UAVs Moving Satellite Markets Upwards

With about 24 more MQ-9 Reapers budgeted for 2011, the Air Force is acquiring more pilotless aircraft than combat units, while the Army is planning to procure 26 more Predators than it currently has. The manufacturer of these, San Diego-based General Atomics, will see a 60% increase in revenues next year with these orders, but more interesting is that concurrent UAV flights are expected to reach 65, up from 37 today.

What this means for satellite operators is simply a 75% increase in potential clients to serve. The U.S. Secretary of States, Robert M. Gates, recently shifted the focus of the U.S. Military machine towards more nimble and flexible forces, able to deploy at many sites simultaneously. Following this logic, the use of UAVs to complement other means of observation for in-theater operations and tactical use is set to expand significantly in the years ahead.

What this means for satellite operators is simply a 75% increase in potential clients to serve. The U.S. Secretary of States, Robert M. Gates, recently shifted the focus of the U.S. Military machine towards more nimble and flexible forces, able to deploy at many sites simultaneously. Following this logic, the use of UAVs to complement other means of observation for in-theater operations and tactical use is set to expand significantly in the years ahead.

He was quoted as saying: "We will continue to see significant growth [in drone use] for some years into the future, even as the wars in Iraq and Afghanistan eventually wind down."

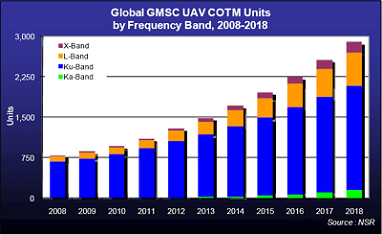

This echoes the conclusion of NSR’s recent Government and Military Satellite Communications, 6th Edition report on the overall COTM market, and more specifically on UAVs. With an expanded role in border control, drug interdiction and disaster management, NSR believes that their positive influence has broadened their appeal and further grew its uses not just in military circles but also with civilian government users, thereby benefitting the satellite equipment and service providers.

For the satcom world, the fact that troops are more dispersed than ever but continue to require fast turnaround to serve battlefield mission planners has put more stringent requirements on availability and reliability of satellite capacity. But with expanded coverage and with UAVs flying longer routes more often and over areas where line-of-sight communications is not relevant, satellite communications is often the only option for both narrowband and broadband links for Predators and the Reaper.

As such, NSR forecasts that in the next ten years, revenues from satellite equipment and services for the UAV market will show a double-digit growth rate to reach levels that are representative of a high-end bandwidth usage service that characterizes these unique vehicles. In other words, large amounts of satellite capacity are necessary for each UAV to relay in real-time video imagery shot at 60,000 feet in far-flung areas of the world back to central command where decisions are often made and then relayed back to troops in the area of conflict. As UAVs are now becoming an integral part of warfighting and peacekeeping missions, the units flown are more relevant than ever, and in particular the large Predator and GlobalHawk, which today number around 300 active or waiting to be flown units.

For both in-theater and tactical-level roles, it is still by all accounts a small addressable market, but as technology advances in various bands, many possibilities are opening up not just for the established Ku-band market but for smaller beyond-line-of-sight (BLOS) hardware using MSS commercial satellites.

What best exemplifies the newfound longevity of the UAV market is certainly the statement made by Mr. Gates in April 2009 in recommending this new budget direction:

"[We will field] 50 Predator-class unmanned aerial vehicle orbits by FY11...this capability will be permanently funded in the base budget."

This was quite a departure from previous UAV spending that was often funded in the U.S. by supplemental budgets (i.e. unplanned) and was a strong commitment to UAVs, which were still questioned by Air Force pilots in the not too distant past.

Thus, the budget proposal of the Pentagon is not really a big surprise but more of a logical, concrete, palpable and calculated commitment to have more UAVs fly...and propel satellite capacity demand upward.

Information for this article was extractedfrom the NSR report entitled: Government & Military Satellite Communications, 6th Edition