The Asia-Pacific Small Satellite Market

by Virgil Labrador, Editor-in-Chief

Los Angeles, Calif., June 2, 2023--The Asia-Pacific (APAC) satellite market is the largest market for satellite services in the world. Extending from the Middle East at the Eurasia border to the vast Pacific ocean, it is not a homogenous market but also the most fragmented market of all the regions in the world. Leading research companies estimate that the APAC market can comprise up to 60 percent of the world's market for satellite services.

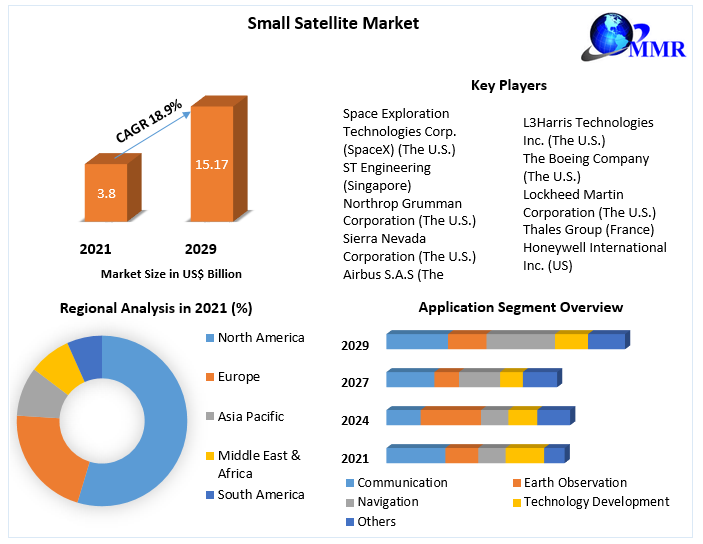

So it's no surprise that with the explosion of Low Earth Orbit (LEO) constellations in the last few years, small satellite manufacturers are eying the APAC market. A recent study by Research and Markets projected that the APAC small satellite market will grow from US$ 888.57 million in 2022 to US$ 4.2 Billion by 2028; at a CAGR of 29.6% from 2022 to 2028.

So it's no surprise that with the explosion of Low Earth Orbit (LEO) constellations in the last few years, small satellite manufacturers are eying the APAC market. A recent study by Research and Markets projected that the APAC small satellite market will grow from US$ 888.57 million in 2022 to US$ 4.2 Billion by 2028; at a CAGR of 29.6% from 2022 to 2028.

The increase in space investments in countries in China, Japan, India, and Australia, among others, is anticipated to drive the development and launch of small satellites in the region, according to the report.

Many companies are entering the small satellite market, owing to the diversification of applications for small satellites. Many startups are utilizing small satellites for telecommunication, space-based Internet of Things (IoT), weather prediction, track assets, military surveillance, etc.

Key Market Trends

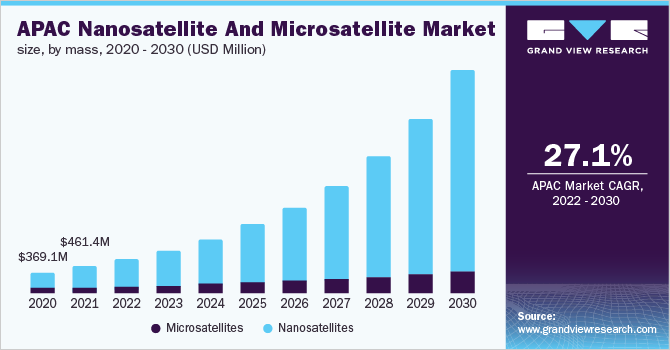

The nanosatellite segment of the small satellite market accounted for the highest share in the market, and it is anticipated to continue its dominance over the market during the forecast period. The growth of the segment is mainly due to the increasing programs of nanosatellites in the region. Nanosatellites are widely deployed for earth observation and satellite communication applications. Various countries, like China, Japan, and India, among others, have been launching new nanosatellites. In order to increase its nanosatellite constellation to 50 satellites, in February 2019, Myriota partnered with Tyvak Nano-Satellite Systems Inc. to develop and launch multiple satellites, in 2019. These satellites will be used to provide direct-to-satellite Internet of Things (IoT) connectivity to its customers. Similarly, NanoAvionics was selected for manufacturing a 12U nano-satellite bus for the Singaporean research mission “Cathode-Less Micro Propulsion Satellite” (CaLeMPSat). Such missions are anticipated to accelerate the demand for nanosatellites in the near future.

The nanosatellite segment of the small satellite market accounted for the highest share in the market, and it is anticipated to continue its dominance over the market during the forecast period. The growth of the segment is mainly due to the increasing programs of nanosatellites in the region. Nanosatellites are widely deployed for earth observation and satellite communication applications. Various countries, like China, Japan, and India, among others, have been launching new nanosatellites. In order to increase its nanosatellite constellation to 50 satellites, in February 2019, Myriota partnered with Tyvak Nano-Satellite Systems Inc. to develop and launch multiple satellites, in 2019. These satellites will be used to provide direct-to-satellite Internet of Things (IoT) connectivity to its customers. Similarly, NanoAvionics was selected for manufacturing a 12U nano-satellite bus for the Singaporean research mission “Cathode-Less Micro Propulsion Satellite” (CaLeMPSat). Such missions are anticipated to accelerate the demand for nanosatellites in the near future.

China accounted for the highest Market Share in the Asia-Pacific Small Satellite Market in 2019 according to Resarch and Markets.

China is investing heavily in the space-based capabilities, and according to the China National Space Administration, the country intends to launch about 100 satellites by 2025 and transform itself into a world-leading space power by 2045. The country launched approximately 40 nanosatellites during the 2018-2019 period. Various companies are investing in the development of small satellites to increase their satellite-based services. GalaxySpace, a communication satellite manufacturer, announced to invest about US$ 700 million to launch a constellation of small satellites, mainly to provide global 5G communications, for the airline and maritime industries, emergency, and disaster responders, etc. China launched a new remote sensing satellite as a part of Jilin-1 satellite constellation in November 2019 for commercial applications, like geological disaster prevention, harvest assessment, and resource surveys. The government plans to launch 60 satellites by 2020 and 137 by 2030. Such long-term plans are anticipated to propel the demand for small satellites in the country.

Competitive Landscape

Some of the key players in the APAC small satellite market include the Indian Space Research Organization, Beijing Commsat Technology

Development Co., Ltd., Spacety, NanoAvionics, and Thales Group. Spacety is one of the major companies that provide 10, 20 to 50 kg, and 200 kg small satellite platforms to governments, research institutes, universities, and commercial companies. The company is currently developing MiniSar, a synthetic-aperture radar (SAR) satellite, scheduled to be launched by the third quarter of 2020. There are many players in the market, including several universities, government agencies, and the militaries, which are launching their own satellites, thereby increasing the competition in the market. Also, the growth in satellite-based services in the region is propelling the partnership of service providers and the satellite manufacturers in the region, which is anticipated to increase the share and presence of the satellite manufacturers in the market.

Development Co., Ltd., Spacety, NanoAvionics, and Thales Group. Spacety is one of the major companies that provide 10, 20 to 50 kg, and 200 kg small satellite platforms to governments, research institutes, universities, and commercial companies. The company is currently developing MiniSar, a synthetic-aperture radar (SAR) satellite, scheduled to be launched by the third quarter of 2020. There are many players in the market, including several universities, government agencies, and the militaries, which are launching their own satellites, thereby increasing the competition in the market. Also, the growth in satellite-based services in the region is propelling the partnership of service providers and the satellite manufacturers in the region, which is anticipated to increase the share and presence of the satellite manufacturers in the market.

The government sector in the APAC is one of the key drivers not jjust in the small satellite market but in the satellite market as a whole. NSR/Analysys Mason Senior Director Jose del Rosario says the demand for broadband access in the region is a key driver, with as much as half of Asia's population of over 4.5 Billion with no or access to broadband services. Goverments of many countries in the region like in Indonesia, Malaysia, among others are spearheading broadband projects aimed at acheiving universal access.

Small satellites can be highly useful in military applications due to their short development time, low cost, and assembly line manufacturing processes. according to a report by Business Market Insights. In November 2021, the Indian Air Force Research Laboratory Space Vehicles Directorate announced that they had signed a contract with Tyvak Nano-Satellite Systems for experimenting in very low Earth orbit. Tyvak was awarded US$ 8.4 million for the satellite launch project and is projected to launch in 2024. Also, in July 2022, the Indian Army announced that they wanted a small satellite for training its signals officers. For this, the army issued a request for information (RFI) to the Indian companies to design and develop the communication satellite.

Conclusion

Technological advances have made small satellite more capable and easier to design and build. There are a lso very promisijng market segments like IoT, Earth Observation, Enterprise, Government applications that are well-suited for smallsats. The entry level costs are reachable for the average entrepreneur and while this may lead to innovations in design and capabilities, it also brings increased competition. It will be intersting to see how all this will shake out in the coming years.

----------------------------------------

Virgil Labrador is the Editor-in-Chief of Los Angeles, California-based Satellite Markets and Research which publishes a web portal on the satellite industry www.satellitemarkets.com, the monthly Satellite Executive Briefing magazine and occasional industry reports called MarketBriefs. Virgil is one of the few trade journalists who has a proven track record working in the commercial satellite industry. He worked as a senior executive for a teleport in Singapore, the Asia Broadcast Center, then-owned by the US broadcasting company CBS. He has co-authored two books on the history of satellite communications and satellite technology. He holds a Master’s in Communications Management from the University of Southern California (USC). He can be reached at virgil@satellitemarkets.com

Virgil Labrador is the Editor-in-Chief of Los Angeles, California-based Satellite Markets and Research which publishes a web portal on the satellite industry www.satellitemarkets.com, the monthly Satellite Executive Briefing magazine and occasional industry reports called MarketBriefs. Virgil is one of the few trade journalists who has a proven track record working in the commercial satellite industry. He worked as a senior executive for a teleport in Singapore, the Asia Broadcast Center, then-owned by the US broadcasting company CBS. He has co-authored two books on the history of satellite communications and satellite technology. He holds a Master’s in Communications Management from the University of Southern California (USC). He can be reached at virgil@satellitemarkets.com