Comcast Still Dominates the Western European Pay TV, Now Primarily OTT

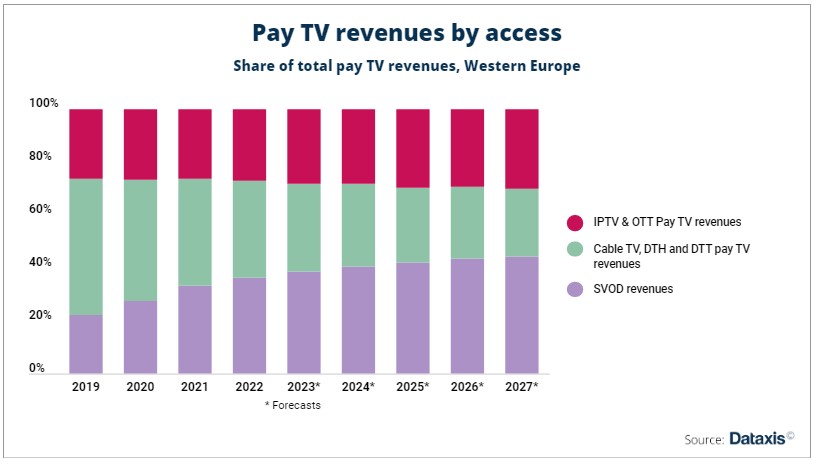

Berlin, Germany, March 20, 2023 - At Q3 2022, OTT pay TV and IPTV offers crossed the 50% penetration of pay TV subscriptions mark in Western Europe, highlighting the continuous progression of OTT services and its adoption by telecom operators according to new research from Dataxis.

Traditional premium satellite intensify their shift towards OTT

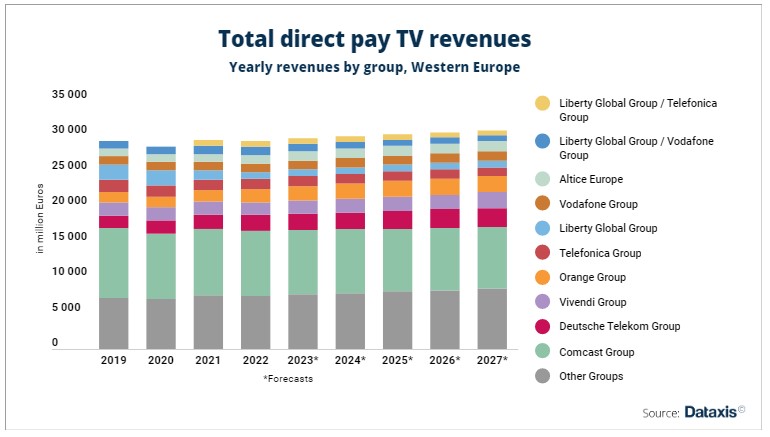

Comcast still dominates the Western European pay TV market in terms of income: it generated around 31% of total revenues through the Sky and Now TV brands in the past year. The group has been making a strategic shift from satellite to OTT distribution for several years with its brand Now TV available in the UK, Ireland, Italy and in the DACH region, and in 2021, it entered the Smart TV market with the Sky Glass TV set. Meanwhile, the group has also increasingly positioned itself as an aggregator of the OTT world: Sky currently has 33 active partnerships with third party OTT platforms in Western Europe, offered as add-ons or in hard bundles.

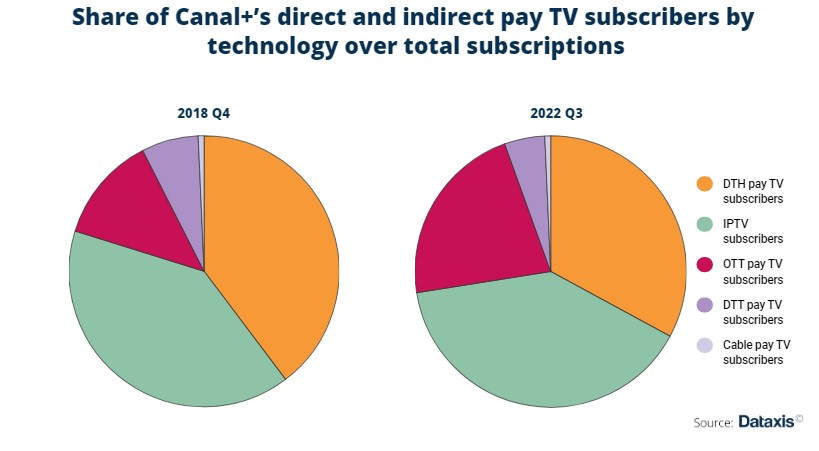

Likewise, the other major Western European premium satellite player, Canal+, also embraced OTT with offers in France, the Netherlands, Belgium, Austria and Poland. The OTT offer has grown significantly: in four years, their number of subscribers was almost multiplied by 2.5. The Canal+ Group continued its expansion with the launch of Canal+ First in Austria in early 2022, and is strengthening its content offering through the acquisition of SPI International in March 2022, and the expected takeover of OCS in France.

Direct-to-consumer OTT now accounts for close to 60% of paying video in Western Europe

On the other hand, Europe's second largest pay TV operator in revenue, Deutsche Telekom, is seeing its growth driven by a shift towards IPTV. The group gained almost 18% of IPTV subscribers between 2020 and 2022 and reached over 3.2 million subscribers through this access, 73% of its total subscriber base at Q3 2022. With the acceleration of fiber deployment in Germany, the group's revenues should continue to grow in the future, with a yearly growth rate around 4% between 2023 and 2027, as reported in Dataxis forecasts. Similarly, the French incumbent Orange invested massively in IPTV in its native market, supported by a rapid and massive deployment of optical fiber in the country. As a result, the group gained around 1 million IPTV subscribers in France in two years, reaching a total of 7.9 million, which now represents almost all of its subscriber base. Orange's revenue growth is expected to slow down gradually in the coming years due to strong competition in the French market and first signs of market saturation: almost 85% of TV households have a pay TV subscription at the end of 2022.

Overall, historical pay TV operators are increasingly turning away from traditional pay TV offers to IP-based TV distribution: in two years, the number of subscriptions to either IPTV or OTT has grown by almost 18% in Western Europe, while the other accesses have declined by 7.5%. Dataxis expects this trend to accelerate in the future: the number of IPTV/OTT pay TV subscriptions should increase by 22% between 2022 and 2027, and the subscriptions to legacy access should decrease by 13%. With the success of SVOD and AVOD services, operators are trying to adapt to new trends and develop more flexible, richer offers with user friendly and personalized interfaces through IPTV and OTT solutions. They aim at capturing a part of the revenues generated by direct-to-consumer OTT services, which already represent 59% of video revenues in Western Europe. This can be achieved by launching for instance a proprietary platform, like Viaplay Group in the Nordics and its eponymous platform, TV everywhere services like Tele2 Play in Sweden, or by developing partnerships with different OTT platforms. To date, Dataxis reports 346 active partnerships between telecom operators and SVOD platforms in Western Europe, which should continue to increase to reduce complexity for users and facilitate their access to the largest amount of content. To date, Dataxis reports 346 active partnerships between telecom operators and SVOD platforms in Western Europe, aiming at reducing complexity for users and facilitating their access to the largest amount of content. These deals are expected to create the most prevalent content offers model, provided that market fragmentation continues to structure the European OTT market in the coming years.