Constellation Watch: China’s Incubating Answer to Starlink

by Blaine Curcio

Hong Kong, December 4, 2020--Many things have happened in the satcom industry in 2020. We as an industry have responded to Covid with a flurry of webinars, virtual conferences, LinkedIn posts, and an endless variety of podcasts. Meanwhile, satellite operators have been evolving, with 5G spectrum reallocation moving full steam ahead in some markets (including my home market of Hong Kong, one of the world’s leading assassins of C-band for satellite).

In the more medium-term, the months after the NDRC announcement saw no less than 3 funding rounds highlighting satellite internet as “new infrastructure” as a major opportunity. Most notably, Galaxy Space is building a “superfactory” in Nantong City, Jiangsu Province, aiming to address broadband LEO constellations with a manufacturing output of 300-500 satellites per year. Noteworthily, Galaxy Space also completed a round of funding in November 2020, at which time the company specifically mentioned a goal of bringing the gap between China and the west in terms of smallsat mass manufacturing down to 2 years (the company also officially became a unicorn during that funding round, with a valuation of RMB 8 billion).

In the more medium-term, the months after the NDRC announcement saw no less than 3 funding rounds highlighting satellite internet as “new infrastructure” as a major opportunity. Most notably, Galaxy Space is building a “superfactory” in Nantong City, Jiangsu Province, aiming to address broadband LEO constellations with a manufacturing output of 300-500 satellites per year. Noteworthily, Galaxy Space also completed a round of funding in November 2020, at which time the company specifically mentioned a goal of bringing the gap between China and the west in terms of smallsat mass manufacturing down to 2 years (the company also officially became a unicorn during that funding round, with a valuation of RMB 8 billion).

|

|

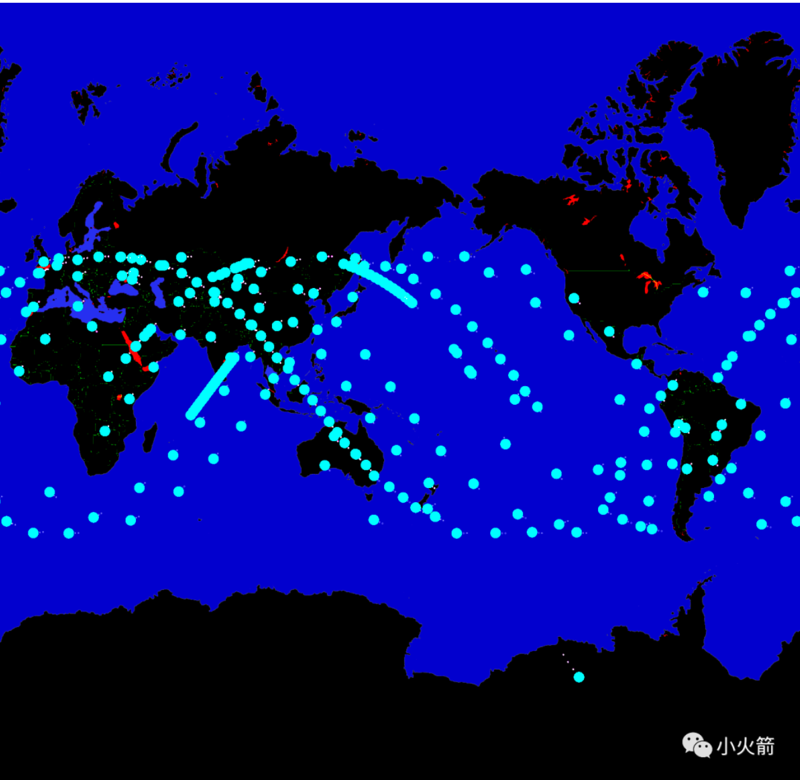

Artist’s rendition of China’s GW Constellation Source: Small Rocket, Toronto, Canada. |

narrowband constellation. China’s LEO broadband constellation plans have fallen into two broad categories—those spearheaded by state-owned enterprises (SOEs), and those spearheaded by private/commercial companies. Broadly speaking, I believe that the former are much more likely to come to fruition as planned, insofar as LEO broadband constellations are basically ISPs from space—two industries that are very sensitive and usually state-controlled in China.

Blaine Curcio is the Founder of Orbital Gateway Consulting. He’s an expert on the commercial space and satellite industries with a focus on the Asia-Pacific region. He can be reached at: blaine@orbitalgatewayconsulting.com