MarketBrief Report on Comms On The Move Market

by Virgil Labrador, Editor-in-Chief

Los Angeles, Calif., February 5, 2021--Communications On The Move or COTM is one of the key applications of satellite technology that provides key services for various sectors. COTM refers to vehicles and other moving conveyances such as ships, trains, etc. equipped with a satellite dish able to establish communication with a satellite network and maintain communications while the vehicle is moving. COTM has vital applications for first responders, disaster recovery, emergency preparedness, remote access, Satellite News Gathering (SNG) in key verticals such as enterprise, broadcast, government/military, maritime, utilities, oil & gas, mining, among others.

The basic principle of COTM is that equipment is fitted with an antenna that can establish communication without the need to stop or pause. COTM and Satcom-on-the-Move (SOTM) are sometimes used interchangeably in the satellite industry. COTM is not to be confused with Communication on the Pause (COTP) which requires that the satellite equipment be stationary to function.

COTM on the move historical started with L-Band satellite providers such as Inmarsat, Globalstar and Iridium providing voice and low bandwidth data (128 Kbps up to 1 Mbps) connectivity worldwide. Today, new innovative technologies are coming to market that will dramatically change COTM and COTP services.

Innovation Solutions

In the last ten years the development of high-powered Ku- and Ka-band satellites flat panel antenna (FPA) solutions initially for the security and defense market has significantly enhanced the effectiveness of COTM solutions by providing higher bandwidth and greater flexibility.

FPAs are now in the commerical market with the with various companies providing or developing FPAs for COTM and COTP solutions such as Kymeta™, C-COM Satellite Systems, ThinKom Solutions, NXTCOMM, Isotropic Systems, AvL Technologies among others.

“FPAs is probably one of the most significant breakthroughs in the satellite industry in the past decade. It is exciting to see this technology originating as far back as 1950s finally coming to fruition in our time. These electronically steered antennas pave the way towards commercial non-geostationary satellite orbit (NGSO) constellations, which is another exciting development,”said Maxim Usatov, Chief Technical Officer and Founder of BusinessCom.

Kymeta™ launched in the 4th quarter of 2020 its second generation FPA, the Kymeta™ u8 electronically steered satellite antenna platform and Kymeta Connect™, a unique offering that makes satellite and cellular hybrid connectivity as easy to purchase as a mobile plan. The u8 is a comprehensive connectivity solution that enables trusted, secure communications on the go with a host of new innovative features. The new terminal provides a complete connectivity solution for on-the-go communications when and where you need it. The Kymeta™ u8 covers the full Ku-band and it designed to be LEO upgradeable. It also supports MEO and GEO satellite constellations.

“The Kymeta™ u8 portfolio is the only land-based solution of its kind that fully supports always-on broadband communications over both satellite and cellular while mobile. This core feature which allows you to connect to a satellite while on the move, combined with our back-end support suite of services, Kymeta Connect, results in a seamless customer experience and a product that no other satellite antenna company offers today,” said Bill Marks, Chief Strategy Officer (CSO) of Kymeta™.

Key Drivers

One of the key drivers for COTM and COTP solutions is the increasing demand for mobile broadband connectivity, which has accelerated as a result of the global COVID-19 pandemic. “The global demand for mobile broadband connectivity continues to grow, driven by the insatiable consumption of data as well as the growth in new Internet of Things (IoT) applications. Cellular networks alone will not provide the seamless coverage needed to satisfy always-on communications on the move. The combination of satellite and cellular technologies deployed across a variety of different uses cases will be a solution to that growing demand in only a matter of time. There remains a growing demand for mobile connectivity that cannot be met by the cellular industry alone. This demand creates a market for new satellite products and services that can only be met through innovation,” said Kymeta’s Bill Marks.

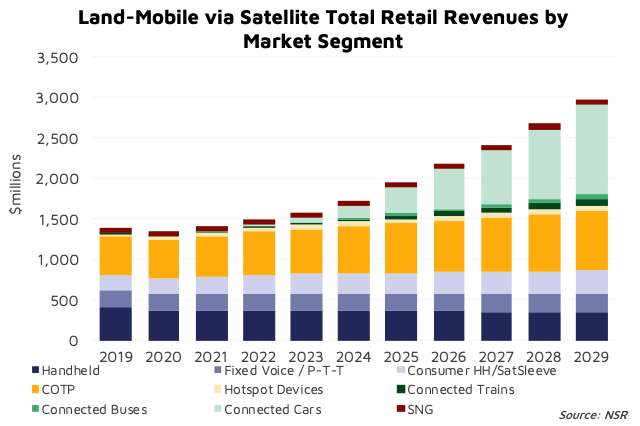

A recent report by NSR entitled “Land Mobile via Satellite, 8th Edition” revealed that the satcom land mobile market continues to have a strong future, with over 750,000 new in-service units coming over the next decade, across nine distinct applications. Many of these units will trend towards higher ARPU levels with enhanced revenue prospects, despite a near-term COVID-19 revenue dip. Connected vehicles play a major role in long term growth, as broadband overtakes narrowband demand across all land mobile applications, according to NSR.

future, with over 750,000 new in-service units coming over the next decade, across nine distinct applications. Many of these units will trend towards higher ARPU levels with enhanced revenue prospects, despite a near-term COVID-19 revenue dip. Connected vehicles play a major role in long term growth, as broadband overtakes narrowband demand across all land mobile applications, according to NSR.

The report found that total revenues in the Land Mobile market will increase from US$ 1.39 billion in 2019 to US$ 2.98 billion in 2029, a growth rate of 7.9% across the decade, despite moderate COVID-19 impacts in the short term.

“As the connectivity marketplace becomes more competitive, the operators are becoming increasingly demanding. Commercial and military customers alike are looking for higher speeds and more competitive rates for bandwidth. The way to consume this data is changing as well and that puts constraints on the operators’ networks, as different platforms require new antenna types or ways to purchase connectivity. Some can evolve their networks and expand their capabilities, looking ahead to 5G, and some are going to struggle, requiring even more innovation on the ground segment. Much of this evolution will drive Research and Development and innovation over the next five years. Another expected demand is standardization in the industry which is long overdue. The cellular industry went through this a decade ago and it is time for Satcom to make real strides in that direction as well,” said Kymeta’s CSO Bill Marks.

“Longer-term, NSR sees accelerated revenue growth driven by a fundamental shift from narrowband applications and towards broadband as a share of revenues” said Alan Crisp, NSR senior analyst and report author. “Greater COTP usage, and the growth of connected vehicle markets, all point to additional life being injected into land mobile. Inmarsat Land Xpress, Iridium Certus, LEO-HTS constellations and more all contribute to new revenue opportunities over MSS narrowband data and voice usage,” he added.

Another key driver for COTM and COTP is the influx of the new Low Earth Orbit (LEO) and Medium Earth Orbit (MEO) constellations that are deploying at full speed in this decade. Thousands of LEO and MEOs are coming online in the next few years from the likes of SpaceX’s Starlink, Amazon’s Kuiper and OneWeb, among others. The Non-GEO satellite systems has the potential to bring the COTM to the mass market.

Although not without its challenges, the Non-CEO constellations provide a unique advantage over GEO for COTM applications. Non-GEO systems ae far closer to earth than GEOs meaning they require less distance to travel, reducing latency and enabling higher data rates.

BusinessCom COTM Solution

One company that is at the forefront of providing innovative COTM service is BusinessCom. Wtih offices and facilities worldwide, BusinessCom’s goal is to make satellite connectivity available to the broadest range of users. The company attributes its success to constant market research and continued investment in new technologies. This knowledge and expertise creates a strong understanding of international and local markets and creates a rich corporate environment that is ideal for creative thinking and innovative solutions.

BusinessCom was one of the first satellite service providers to deliver Deterministic TDMA technology to the Eastern Hemisphere markets which is now a globally accepted reference for business satellite Internet access service.

BusinessCom was one of the first satellite service providers to deliver Deterministic TDMA technology to the Eastern Hemisphere markets which is now a globally accepted reference for business satellite Internet access service.

More recently, BusinessCom has partnered Kymeta™ to work together on programs featuring their advanced FPAs and developing services specifically designed to support this type of platform. FPAs provide low-profile solutions for public transport vehicles like buses, coaches, and trains. Mobile solutions supporting on the move communications are attractive to civilian armored vehicles, recreational vehicles, and truck fleets. Government and Defense clients are interested in COTM services for military vehicles, patrol ships and first responders. FPAs are also of interest to the maritime industry, where environmental conditions are hard on the mechanical parabolic antennas normally used. FPAs are showing up on superyachts, fishing fleets, ferry services and even smaller pleasure craft. Wherever a lightweight, easily deployable antenna is needed for fixed applications such as mining and construction, offshore platforms, or alternative energy installations, an FPA may be the best solution.

“BusinessCom has adapted its capabilities with the goal of delivering the most high-performance COTM service available on the market today. We have paused and asked ourselves—can on-the-move services offer enterprise-grade reliability with unlimited data? We asked ourselves what had to be done to make this happen. I believe we have achieved this quite successfully. Unlike our competitors offering best-effort connectivity with data caps, BusinessCom offers its COTM service with fully unlimited bandwidth and an enterprise-grade SLA. At our price point we believe we are delivering exceptional value to users seeking for on-the-move connectivity for intensive use, such as high-definition streaming and high-volume data transfers. For many user applications our unlimited COTM service, billed at a flat monthly fee, provides typically 2-3 times better OpEx than other services billed on a per-GB (or per-MB) basis, and the users don’t have to worry about reaching hard data caps. The solution is especially effective if you consider a fleet of vehicles or sea vessels sharing the same bandwidth pool, offering unprecedented capability, at the cost lower than competition,” said BusinessCom’s CTO and Founder Maxim Usatov.

BusinessCom’s COTM services enable guaranteed quality satellite private networking, delivering broadband IP throughput to air, sea and land vehicles in motion. BusinessCom’s services provide broadband service to a single or a group of mobile terminals operating within wide geographical coverage zone, typically a wide Ku-band beam on a geostationary satellite. This allows to inter-connect an array of mobile enterprise, government and defense assets, as well as deploy new points of presence rapidly whenever needed. Key features include:

- Unlimited data volume

- High-throughput IP service for land, sea and air

- CIR bandwidth service with SLA

- Bi-directional QoS

- Available on multiple Ku-band satellites

- Guaranteed audio, video and data streaming

- Link encryption and security

- 24/7 NOC technical support

- Fully accelerated VPN

BusinessCom’s COTM service is a unique blend of tried and trusted technology, mixed with thoughtful and sometimes radical design. The service can be provided in managed private network and VNO modes and is compatible with parabolic and flat panel COTM terminals from a variety of manufacturers, including Kymeta™, General Dynamics, L3 and others. The user link power budget and satellite transponder operation are custom tailored to a particular customer’s IP throughput, geographical coverage and link availability requirements. Downlink capabilities often exceed tens of Mbps, with guaranteed network availability and without any limits on data volumes.

More information on BusinessCom and its services can be found at the website at www.bcsatellite.net

Conclusion

Prospects for COTM market are indeed very promising in this decade. The global COVID-19 pandemic has not slowed down growth but actually has increased demand for various applications requiring mobile communications solutions.

----------------------------------------

Virgil Labrador is the Editor-in-Chief of Los Angeles, California-based Satellite Markets and Research which publishes a web portal on the satellite industry www.satellitemarkets.com, the monthly Satellite Executive Briefing magazine and occasional industry reports called MarketBriefs. Virgil is one of the few trade journalists who has a proven track record working in the commercial satellite industry. He worked as a senior executive for a teleport in Singapore, the Asia Broadcast Center, then-owned by the US broadcasting company CBS. He has co-authored two books on the history of satellite communications and satellite technology. He holds a Master’s in Communications Management from the University of Southern California (USC). He can be reached at virgil@satellitemarkets.com

Virgil Labrador is the Editor-in-Chief of Los Angeles, California-based Satellite Markets and Research which publishes a web portal on the satellite industry www.satellitemarkets.com, the monthly Satellite Executive Briefing magazine and occasional industry reports called MarketBriefs. Virgil is one of the few trade journalists who has a proven track record working in the commercial satellite industry. He worked as a senior executive for a teleport in Singapore, the Asia Broadcast Center, then-owned by the US broadcasting company CBS. He has co-authored two books on the history of satellite communications and satellite technology. He holds a Master’s in Communications Management from the University of Southern California (USC). He can be reached at virgil@satellitemarkets.com