Satellite Connectivity for the Energy Market

|

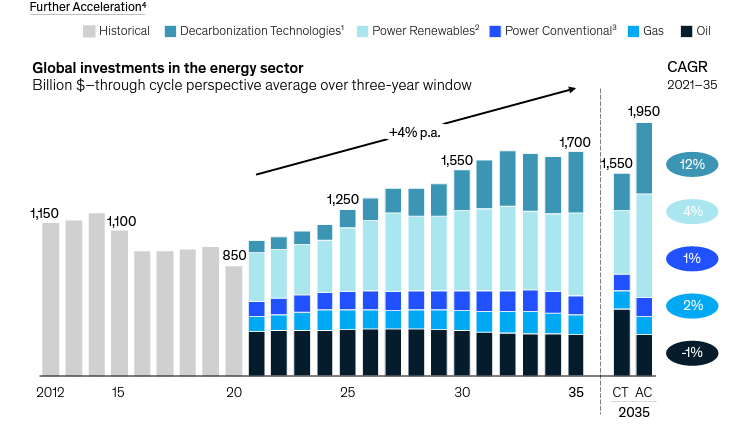

| Global investments in the energy sector will continue to grow at CAGR of 4%through 2035 according to McKinsey & Co. |

The importance of good connectivity was also emphasized by McKinsey in a study carried out in 2020. The study estimated that “advanced connectivity to optimize drilling and production throughput and improve maintenance and field operations could add up to US$250 Billion of value to the industry’s upstream operations by 2030 .” It was estimated that between US$160-180 Billion could be realized with the existing infrastructure and an additional US$70 Billion could be unlocked with by non-geostationary satellites (NGSO) and 5G. Furthermore, McKinsey estimated that “offshore operators can reduce costs, including operational and capital expenditures by 20-25% per barrel by relying on connectivity to deploy digital tools and analytics.”

“green” energy sources. Just last year, Germany announced a goal to source 100% of the country’s energy from renewable sources by 2035. Whilst this may be one of the most ambitious plans announced to date, virtually every country in the world, is trying to reduce dependence on fossil fuels.

“green” energy sources. Just last year, Germany announced a goal to source 100% of the country’s energy from renewable sources by 2035. Whilst this may be one of the most ambitious plans announced to date, virtually every country in the world, is trying to reduce dependence on fossil fuels.Related Article:

Read the full MarketBrief report on the Energy Market sponsored by ST Engineering iDirect

Read the full MarketBrief report on the Energy Market sponsored by ST Engineering iDirect

--------------------------------------------

Elisabeth Tweedie has over 20 years experience at the cutting edge of new communications entertainment technologies. She is the founder and President of Definitive Direction (www.definitivedirection.com), a consultancy that focuses on researching and evaluating the long-term potential for new ventures, initiating their development, and identifying and developing appropriate alliances. During her 10 years at Hughes Electronics, she worked on every acquisition and new business that the company considered during her time there. She can be reached at etweedie@definitivedirection.com

Elisabeth Tweedie has over 20 years experience at the cutting edge of new communications entertainment technologies. She is the founder and President of Definitive Direction (www.definitivedirection.com), a consultancy that focuses on researching and evaluating the long-term potential for new ventures, initiating their development, and identifying and developing appropriate alliances. During her 10 years at Hughes Electronics, she worked on every acquisition and new business that the company considered during her time there. She can be reached at etweedie@definitivedirection.com