Satellite Internet of Things Market

by Elisabeth Tweedie

Los Angeles, Calif., August 27, 2021--There is absolutely no doubt that the Internet of Things (IoT) is a rapidly growing business. Whether we’re consciously aware of it or not, digital transformation is impacting all aspects of daily life. Connected devices are becoming pervasive; from refrigerators that let you know when you’re going to run out of milk, to sensors monitoring the moisture content of soil; from self-driving cars, to tags tracking the movement of containers, across oceans and continents. A recent study from Fortune Business Insights projected that the global IoT market would reach US$ 1,854.76 Billion by 2028, up from US$ 308.97 Billion in 2020, a CAGR of over 25%. NSR is predicting that the total retail market for satellite IoT is also forecast to experience significant growth, reaching around US$ 1.8 billion by 2029, up from around US$ 700 million in 2020.

Growth is coming from many sectors, as companies around the world are looking to IoT to drive greater efficiencies and improve the bottom line through real-time monitoring of thousands of assets, which should lead to better asset utilization, reduced waste, increased output and improved safety. Research commissioned by Microsoft in 2019 and 2020 amongst 3,000 IT professionals in the US, UK, Germany, France, Japan and China bears this out. It showed that 91% of organizations were using some form of IoT, and 90% of them viewed it as “critical to their success.” These figures were relatively consistent across the four segments surveyed: manufacturing, healthcare, retail and energy. The main reasons given for using IoT were: safety and security, optimizing operations, quality assurance and productivity.

Many of the segments served by IoT have been affected by Covid. The impact however, has been mixed. The automotive industry, for example, one of the larger users of IoT, scaled back production, leading to decreased demand. Ironically, now as demand is picking up again, a shortage of chips for the industry is still keeping production low. Conversely, in some other segments, healthcare for example, demand has surged as the pandemic led to greater use of remote patient monitoring. The research conducted by Microsoft showed that one third of decision-makers plan to increase their investment in IoT due to Covid-19, while another 41% say they’ll maintain the same level of commitment.

Several factors have combined to accelerate usage of IoT. Technology advances in semiconductors, increased use of cloud computing, standardization of IPv6, and in some cases government support for research and development (R&D), these have all helped to increase the ubiquity of IoT. However, the fundamental technology necessary for this growth, is communication. 5G, other cellular technologies and WiFi are the obvious choice for many applications, but there are large markets and parts of the world where satellite is the best solution. Maritime and aeronautical applications obviously fall into this category, but there are also many remote areas where there is no reliable cellular coverage, and a need for monitoring and/or tracking; pipelines and cattle for example are critical applications in this segment.

Also, technological advances leading to smaller antennas and cheaper bandwidth, have combined with satellite’s reliability and inherent ability to scale, resulting in satellite’s reach for IoT applications expanding to include other geographies.

Key Segments for Satellite

There are several key segments that are particularly attractive to satellite Service Providers, either because the segment offers particular growth opportunities, or because satellite is the only possible solution, or because it’s a segment already dependent on satellite for other applications, so potentially offering an easier path to entry. We’ll take a brief look at some of these, then consider three key applications in more detail.

Cargo tracking and monitoring for containers and other large items being transported, is a key IoT application. Appropriately tagged cargo is tracked on both sea and land. Obviously, satellite is needed at sea, but given the large distances traveled by some trucks, a satellite-based system offers a ubiquity on land that can’t be achieved with terrestrial systems.

Transport companies also rely on IoT for electronic recording of hours driven, and monitoring of operational devices and events: fluid levels, vibration, and speed for example. Combine these and you have a system for better fleet management, which will facilitate cost-efficiencies and forecasting of vehicle replacement timing. This of course, also applies to heavy machinery, such as agriculture and construction equipment, where information about usage and fuel consumption not only improves asset tracking, but also helps fleet optimization.

Maritime is another key segment. At sea, the equipment on merchant fleets and cruise vessels is being equipped with sensors for performance monitoring, to improve efficiencies and ensure any preventative maintenance needed is carried out at the appropriate time. Oil and gas rigs, in common with ships, are using IoT to monitor the status of equipment and predict, and therefore prevent failures. In the fishing industry, several countries have mandated the use of Vessel Monitoring Systems (VMS), to monitor activity and ensure active reporting of catches.

Mining is another industry where satellite has significant role to play. Many mines are located in remote, inaccessible areas, which rarely justify the deployment of terrestrial networks. Predictive maintenance is a key application for this sector. Additionally, sensors installed around the mines can provide advance warning to help prevent contamination, erosion, flooding and other disasters.

Pipelines carrying oil and gas traverse many thousands of miles in remote geographies. Supervisory control and data acquisition, commonly referred to as SCADA, is a key method of ensuring the integrity and viability of these pipelines. Sensors monitor the flow rate, pressure and the health of valves, motors and pumps to prevent leakage and unforeseen failures.

In many parts of the world, utility companies are turning to smart grids, and satellite enables them to extend this to more rural customers. IoT is an integral part of this, needed to facilitate automation and predictive maintenance. Gaining this level of visibility into their generation and distribution systems can reduce manpower needs, decrease downtime and enable utilities to streamline operations and improve customer satisfaction. For example, in 2017 when Houston was hit by Hurricane Harvey, over 250,000 people lost power. However, thanks to the prior installation of smart meters, CenterPoint Energy, the local utility company, was able to recover and reconnect users quickly, avoiding an estimated 45 million outage minutes.

Agriculture

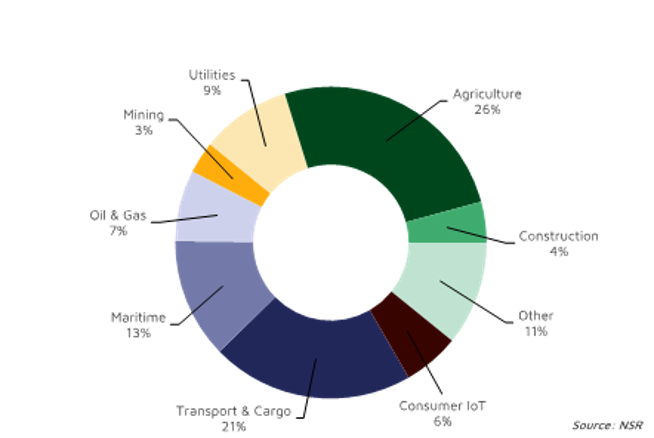

Agriculture is a key segment that has really embraced the use of IoT in recent years. This is particularly true, in regions with vast farms that cover thousands of acres, where it is virtually impossible for farmers to know what goes on in all corners of their land. According to a report on Autonomous Farm equipment by Fact.MR, the global autonomous farm equipment market is projected to reach US$150 Billion by 2031, demonstrating a CAGR of over 10% from its current size. The sheer size of many of these farms, also means that it is highly unlikely that the entire area will be covered by cellular or WiFi. NSR highlights this market as the most significant one for satellite, projecting the number of satellite in-service units grow to over 790,000 in 2029 from 130,000 in 2019. This accounts for 26% of growth in satellite IoT sites during that time period. There are many drivers behind the market for IoT in farming, the main one being the need for increased food production. Factors such as the ability to react instantly to changing weather conditions, insight into crop planting, more precise harvesting and precise and timely data regarding soil, weather and pest conditions all play a role in realizing this goal. To date global take-up has been patchy, according to the report, Europe currently leads the way, with the US and China representing other significant countries.

cover thousands of acres, where it is virtually impossible for farmers to know what goes on in all corners of their land. According to a report on Autonomous Farm equipment by Fact.MR, the global autonomous farm equipment market is projected to reach US$150 Billion by 2031, demonstrating a CAGR of over 10% from its current size. The sheer size of many of these farms, also means that it is highly unlikely that the entire area will be covered by cellular or WiFi. NSR highlights this market as the most significant one for satellite, projecting the number of satellite in-service units grow to over 790,000 in 2029 from 130,000 in 2019. This accounts for 26% of growth in satellite IoT sites during that time period. There are many drivers behind the market for IoT in farming, the main one being the need for increased food production. Factors such as the ability to react instantly to changing weather conditions, insight into crop planting, more precise harvesting and precise and timely data regarding soil, weather and pest conditions all play a role in realizing this goal. To date global take-up has been patchy, according to the report, Europe currently leads the way, with the US and China representing other significant countries.

Precision crop farming uses sensors to capture and transmit a vast array of data including, lighting, temperature, soil condition, humidity, carbon dioxide levels and pest infestations. Together this data enables farmers to detect anomalies and calculate optimum levels of fertilizer, pesticides and water needed, thereby increasing output whilst reducing costs.

Weather stations will update the farmer as to variations in microclimates on their farms. As well as assisting with irrigation needs, this is also used for feeding livestock. Smart irrigation systems control and monitor moisture levels, automatically dispensing water as and when needed. Similarly, sensors monitor the irrigation pipelines for leaks, alerting farmers when repairs are needed. Proactive monitoring can also identify the need for preventative maintenance. In some cases, these alerts will be transmitted directly to equipment manufacturers to trigger delivery of spare parts and onsite repairs.

Disaster Prevention and Mitigation

An exciting development has been the application of IoT for monitoring and prediction and early identification of natural disasters, as well as to aid rescue efforts. Currently, the vast majority of disaster management is reactive. Predictive management is in its infancy, but it’s badly needed and is starting to happen. It is likely to become even more essential in the years ahead, as climate change contributes to increasing the frequency and severity of natural disasters. According to an October 2020 report from the United Nations, in recent years, extreme weather events have dominated the disaster landscape. In the period 2000 to 2019, there were 7,348 major recorded disaster events claiming 1.23 million lives, affecting 4.2 billion people (many on more than one occasion) and resulting in approximately US$2.97 trillion in global economic losses. This is a sharp increase over the previous twenty years. Between 1980 and 1999 there were only 4,212 disasters. According to the report much of the difference is explained by a doubling of climate-related disasters including extreme weather events: from 3,656 climate-related events to 6,681 in the same time periods. Looking at the significant number of climate related disasters recently: major floods in Germany, India, Afghanistan, China, Pakistan and Japan and wildfires in the US, Canada, Turkey, Italy and Greece, to name but a few, it seems inevitable that the number of climate related disasters will continue to rise. It’s therefore easy to understand why there is a great need for early warning, prevention and mitigation systems and solutions that can aid rescue workers. IoT is the key to making this happen.

IoT in the form of multiple strategically located sensors, coupled with the use of the Cloud, and Augmented Intelligence (AI) to make sense of all the data collected, is now being used in many locations around the world to aid in disaster prevention and mitigation. Applications include, tsunami warnings, flooding and wildfire prediction and prevention of collapse of critical infrastructure. Some of these locations are able to employ local terrestrial communications, but many others are in remote areas where satellite is the only solution. One example of this is the Indian National Institute of Ocean Technology (NIOT) which has a network of connected buoys in the Indian Ocean to act as an early warning system for tsunamis, such as the one in 2004, that killed 228,000 people in 14 countries and left two million homeless. The buoys are deployed along the unstable fault line that caused that tsunami. Beneath each buoy is a Bottom Pressure Recorder (BPR). These detect sudden increases in pressure under the sea, which indicate the formation of a tsunami. The BPR communicates to the buoy via an acoustic modem, and the buoys use satellite communications to transmit real-time information to the shore stations, so that local residents can be informed. The buoys are also use to collect other marine information, such as currents, conductivity and temperature.

Forest fires around the world are increasing in both number, size and duration, as global warming continues to create the ideal conditions for them. Current systems for monitoring and early detection primarily rely on observation, often from optical satellites or drones. However, there are several different methods being developed to aid in prediction or very early detection. These include equipping forests with CO2, heat and smoke detectors, to be used in conjunction with drones.

Monitoring Critical Infrastructure

IoT is also starting to play a significant role in the monitoring of critical infrastructure, such as bridges and dams. Failure can occur simply as a result of age. However, in some cases extreme weather will also come into play, particularly with dams, where excessive rainfall can cause build-up not only of water, but also of debris, causing additional stress and strain on the structure itself, which if it’s breached can lead to flooding downstream potentially damaging agricultural land and homes. For example, in 2017, heavy rainfall caused considerable damage to the Spillway of the Oroville Dam in California, necessitating the evacuation of 188,000 people. Installation of sensors on the dam structure, coupled with weather data can help mitigate the chances of a major failure. In the US, 69% of dams are privately owned. Many of the owners don’t have the financial resources to conduct all the necessary inspections and preventative maintenance. IoT has the potential to play an important role in this market. According to the Association of State Dam Safety Officials the average age of dams in the US is 56 years, meaning that many are at an age when structural failure becomes more likely. Appropriately installed sensors on the dams themselves as well as on the gates and hydraulics, can supplement visual inspections to avoid a disaster. One company taking this to heart is Myriota, a smallsat startup company, which earlier this year announced that it is partnering with a sensor company to provide dam operators and owners in Australia, with a dam monitoring solution.

Satellite IoT Market

|

Growth in Satellite M2M/IoT Sites by Application 2019-2029 |

|

As previously mentioned, according to NSR, the total retail market for satellite IoT is forecasted to experience significant growth, reaching around US$ 1.8 billion by 2029, up from around US$ 700 million in 2020. This market is divided between MSS systems, the new LEO systems and traditional GEO systems. MSS operators such as Iridium, Globalstar, and Orbcomm have been in the business for many years and have a well-established base of customers, primarily mobile. However, these systems use different frequencies: L-Band for Iridium and Orbcomm, and S-Band for Globalstar; bandwidth for these frequencies, tends to be more expensive than at Ku or Ka. The smallsat LEO constellations are relatively new entrants to the satellite market and there are many of them including: Kepler Communications, Astrocast, Lacuna, and Kineis.

Given these forecasts it is not surprising that many existing satellite Service Providers are keenly eyeing this market, yet wondering about the best way to enter. The plethora of solutions available make it hard for them to choose. Should they totally change their business model and go with one of the startup constellations, many of which only offer a full turnkey service, and given their numbers, some of which may not be in business in a few years’ time? Should they align themselves with the established L-Band players, or should they stick with a GEO solution, which means minimal change to both their equipment and their business model? Hard decisions to make. For an established VSAT operator this will be a totally new venture, and one that they may prefer to enter slowly, before making a major commitment.

For these Service Providers, ST Engineering iDirect, offers a unique cost-effective, highly scalable and efficient solution that gives Service Providers the key to the IoT market, enabling them to enter it at their own pace. Regardless of whether a Dialog, Evolution or Velocity hub is being used, Service Providers will be able to seamlessly integrate the additional functionality into their existing hub. The solution from ST Engineering iDirect, incorporates an IoT optimized waveform, a cloud-based Network Management System (NMS) from hiSky, and a portfolio of small form-factor IoT terminals with integrated modems and antennas for mobility or fixed use cases. In addition, ST Engineering iDirect makes market entry easy, by offering IoT as a service, with a range of flexible business model options, enabling Service Providers to cautiously enter the market; maybe with just one customer initially. This way it’s possible to minimize the upfront capital investment and steep learning curve usually associated with entry into a new market.

For Dialog, hiSky’s Hub Base Station (HBS) functions as a modulator and demodulator and is paired with a protocol processing server. For Evolution and Velocity hub platforms, IoT waveform enabled universal line cards (ULC) provide simplified integration into a 5IF hub chassis as the IoT modulator and demodulator. Dedicated IoT timing groups are employed on the ULC, and hidden carrier functionality is implemented. This means that the IoT carrier can run under other VSAT outbound carriers on the same hub chassis. hiSky packet processing software is implemented on an integrated gateway server.

The application server is managed through the cloud-based hiSky 360 NMS, allowing Service Providers to configure, operate and monitor the platform and its components.

One of the particularly unique features of ST Engineering iDirect’s solution, is the size of the terminal. No bigger than a laptop and incorporating a flat panel phased-array antenna, in either Ku or Ka-Band for connection to Geostationary satellites. There are two versions.

|

| To read or download a pdf of a MarketBrief report on Satellite Internet of Things Market sponsored by ST Engineering iDirect click here. |

The Dynamic Terminal for Comms-on-the-Pause (COTP) and Comms-on-the-Move (COTM) and a fixed terminal for fully outdoor applications. In the fixed version the terminal is mounted on poles or buildings. It supports Power-over-Ethernet (PoE) as well as solar power. This terminal provides several wireless connectivity options: Wifi and Bluetooth Low Energy (BLE) for phones, tablets and sensors, and wired options for IoT devices and sensor gateways such as LoRaWAN (Long Range Wide Area Network). It’s intended for deployment in extremely remote areas for use in mining, pipelines and other energy verticals, as well as for agriculture and other remote sensor backhaul applications. The dynamic terminal incorporates an integrated phased-array antenna for automatic satellite acquisition and tracking and fast beam switching, incorporating polarization and frequency switching. The antenna design is tightly integrated with the satellite modem into a single unit featuring Ethernet, WiFi, Serial and Bluetooth interfaces and optimized for low power consumption.

Different IoT market segments have different requirements in terms of bandwidth. Low data rate events-based usage such as smart meters, asset tracking and remote monitoring, these applications tend to generate small data bursts of bandwidth, up to 30Kbps, for a total usage of perhaps 1-2MB per month. Other events-based applications such as SCADA, industrial control and maritime vessel management systems, tend to have a higher throughput, maybe 10-100Kbps and a total usage of up to 25MB per month, and at the high end, demand based or continuous throughput usage will be much higher, 10-500Kbps leading to hundreds of MBs per month total usage. IoT backhaul is one classic example of this, other use cases include surveillance and telematics for heavy equipment. The IoT solution from ST Engineering iDirect can handle all of these. ST Engineering iDirect’s Dialog, Evolution or Velocity platforms, is ideal for IoT aggregation, whereby data from multiple sensors connect to a single device or endpoint, which then connects to the satellite.

So, for a Service Provider looking to enter the IoT market, but who is reluctant to completely change its business model, equally unenthusiastic about the idea of needing omnidirectional or tracking antennas, and also very reluctant to commit to a new operator who may not even be around in a few years-time; sticking with a GEO solution and a well-established, trusted partner makes perfect business sense. For these Service Providers, the solution from ST Engineering iDirect, is the ideal choice.

--------------------------------------------

Elisabeth Tweedie has over 20 years experience at the cutting edge of new commmunications entertainment technologies. She is the founder and President of Definitive Direction (www.definitivedirection.com>), a consultancy that focuses on researching and evaluating the long-term potential for new ventures, initiating their development, and identifying and developing appropriate alliances. During her 10 years at Hughes Electronics, she worked on every acquisition and new business that the company considered during her time there. She can be reached at etweedie@definitivedirection.com

Elisabeth Tweedie has over 20 years experience at the cutting edge of new commmunications entertainment technologies. She is the founder and President of Definitive Direction (www.definitivedirection.com>), a consultancy that focuses on researching and evaluating the long-term potential for new ventures, initiating their development, and identifying and developing appropriate alliances. During her 10 years at Hughes Electronics, she worked on every acquisition and new business that the company considered during her time there. She can be reached at etweedie@definitivedirection.com