Is 2021 the Year Smallsat IoT Takes Off?

by Hub Urlings

Amsterdam, the Netherlands, April 6, 2021--Will 2021 be the year that a new generation of smallsat Internet of Things (IoT) networks take off? Smallsats offer ubiquitous low-cost and low power connectivity for the global IoT industry. If it is up to some of the new operators, it sure will be, as the launch activities in the first quarter of 2021 demonstrate.

When the SpaceX Transporter-1 rideshare mission shot up in January 2021 to put 133 small-sats into a sun-synchronous orbit (SSO) this January, four of the most noticeable small satellite IoT systems were on board.

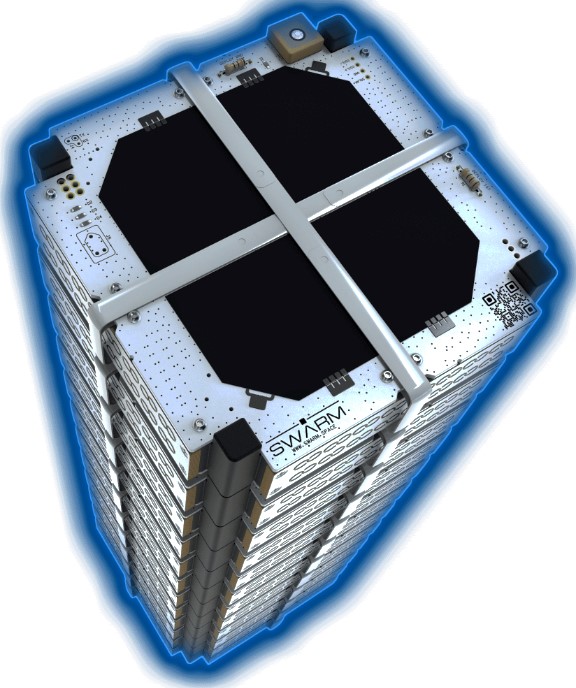

The launcher carried eight Kepler satellites, 36 so-called “space bees” from Swarm, five AstroCast satellites, and the Hiber 4 satellite. With that, it certainly looks like satellite IoT has moved into the new exciting phase: the Constellation Phase, where the commercial services are becoming available to end-users.

In March a second launch by Soyuz-2 that carried small-sats for 3 IoT operators: Hiber and Kepler were again on board carrying the Hiber Three satellite and Kepler 6 and 7, and UK-based Lacuna launched its 5th smallsat.

The day after that Rocketlab from Mahia Launch Complex on New Zealand’s North Island, launched the 7th small satellite for the Australian-based Myriota as well as the Centuari 3, the 5th satellite of Fleet Space Technologies.

With all these launches several satellite IoT constellations are starting to get the shape, and a new type of network emerges, the Low Power Global Area Networks (LPGAN) that operate smallsat-based infrastructures in Low Earth Orbit (LEO). Officially Low Earth Orbit (LEO) is between 350 and 1400 km, but most small-sat IoT systems are between 500 and 600 km above the earth.

From that position, LPGAN networks will be connecting all kinds of sensors via small low-power satellite terminals, and send their data back to the dashboards on customers’ screens. LPGANS provide global coverage, and they come with prices that are a magnitude below current satellite IoT price levels.

Smallsat IoT in LEO

LEO satellites are visible only for a limited period. You can see that by watching the ISS (https://spotthestation.nasa.gov/) or Iridium (https://www.satflare.com/track.asp?q=iridium#MAP) passing in the night sky. In a couple of minutes, the satellite comes up at your horizon, crosses over you, and is gone again. A fundamental principle of small-sats is that the only time the ground terminal can send its data messages up to the satellite is when it is insight. The small-sat will receive the data message, accept it and store it. Then when it passes over a ground station, it will send the message back to earth, and the ground station will deliver it to the final destination, usually the customer data dashboard. The more often a satellite comes over (e.g. with multiple satellites in the constellation) the more messages can be sent and delivered each day.

At the end of 2018 the so-called Small-sat Express, with rockets from SpaceX and the Indian Polar Satellite Launch Vehicle (PSLV), launched the first batch of Pathfinders for the IoT small satellites to test them in space. It took two years for these Pathfinder satellites to get settled and validated.

Now in 2021, we are seeing that satellite IoT has completed the research phase, and with the experience of the last two years under the belt, a better and much-improved generation of IoT satellites being launched.

The list of smallsat IoT start-ups around the world is extensive and diverse. It includes AstroCast (Switzerland), Fleet (Australia), Kepler (Canada), Kineis (France), Lacuna (UK), Myriota (Australia), Swarm (USA), XingYun (China), and Hiber (Netherlands). They have all entered the first round of the smallsat IoT race over the last year. But now it looks that a couple of these players are moving significantly ahead of the pack by launching their (minimum but growing) constellations, and are ready to build out their commercial network and services.

In this article, we’ll have a closer look at the leading LPGAN players moving into their commercial phase, and the IoT services they can provide.

Let's have a look at the small-sat IoT networks that launched their second generation smallsats in the first quarter of 2021 with SpaceX, Soyuz, and Rocketlab:

|

Swarm launched 36 next-generation satellites into their low earth orbit constellation |

|

|

With the launch of 8 new Gen1 satellites on SpaceX Transporter-1 and 2 more on the Once fully operational within the Kepler constellation, the Ku-band-based small-sats will significantly increase the capacity of Kepler’s global data service. Kepler has a hybrid service that already is offering store and forward service for large files, and we are looking forward to the launch of their satellite IoT service. |

|

|

|

|

The fourth operator to launch their smallsats on board the SpaceX rideshare and Soyuz-2 is Hiber. The Hiber Three and Hiber Four satellites operate in UHF and are the first of the in-house build, second-generation 3U Hiber satellites. The new generation Hiber satellites are a new innovative model that is utilizing high-performance green propulsion technology. This will allow Hiber ground engineers to adjust the satellite’s orbit. This ensures that Hiber Three and Four, and its future descendants, avoid collisions and, importantly, de-orbit themselves at the end-of-life. This makes Hiber one of the most sustainable small-sat constellation operators in the world, setting a new standard for responsible small-sat operations. |

|

|

With 5 satellites in space and two more launching in 2021, South Australia-based Fleet Space is building Australia’s particular connectivity challenges have been a major driver in creating new connectivity technologies like nano-sat digital beamforming. Fleet launched its first four satellites in November 2018 when Proxima 1&2 and Centauri 1&2 were launched in three weeks. With the recent launch of Centauri-3 on Rocketlab, Fleet is continuing its work on launching the next batch of its second-generation satellites in 2021. |

We also look at some other aspects of this exciting new phase:

What does it mean to have dozens, hundreds, and in the future even thousands of satellites circling our globe in low earth orbits? How can we track those large number of satellites and keep them physically apart? Not to mention, what we will do when we cannot keep them apart? And what can we and should we do with the potential space debris.

The legal domain also plays an important role in smallsat IoT. Spectrum wars are already underway between terrestrial and space-based operators to get access to the best frequency bands. And then there is a mountain of licensing work, to get access to all the countries in the world, each with their own rules and regulators. Not so much a fight, but operation licenses might be the key differentiator between sat-iot networks.

And, who is going to pay all for all this? Who is going to provide the funding for all that Low Orbit infrastructure? And who are the customers of these new small-sat IoT networks, and are they eager for their global low-cost services?

Welcome to the Constellation Era

The relations between the number of satellites and the service level that can be offered.

Low Earth Orbit mechanics have an impact on customer service levels. Even with only one satellite in LEO, LPGAN networks can provide IoT connectivity starting with a once-per-day service. When the constellations grow and the number of satellites and ground stations goes up. Later with the full constellations in place they can go up to once-per-hour, and increasing to once-per-15-minutes, and offer a similar service level as in terrestrial cellular networks with 100 data messages a day.

How do we get all these small satellites into orbit?

More than 500 start-ups are working to develop a smallsat launcher. After all, these small satellites only have to go up to 500 or 600 km. You can reach that orbit by launching from a plane as some systems like Virgin and Dawn Aerospace are aiming for.

At the moment of writing, nearly all small launcher start-ups are still in the development phase, while we see that the big boys like PSLV, SpaceX, and Soyuz are providing rideshare missions that can bring up more than 100 satellites with one launch. We see smaller launchers and start-ups enter the market, however. Newcomer RocketLab is starting to show a solid track record as well, so the availability of launches around the world is increasing for the LPGAN operators. And no, we will not go into the development of smallsat launchers in Europe here. We keep that for another time!

Another important development in the launch market is the availability of transport vehicles to place the small-sats in the proper orbit. Onboard the SpaceX Transporter 1 in January was an additional rocket stage: D-orbit, that can bring satellites, after they are released from the main launch rocket, exactly into the orbit they need to be. As the launchers mainly go to sun-synchronous orbits (SSO), D-Orbit can help to spread the constellation in other orbits around the globe.

RocketLab took this one step further and integrated the so-called Kick Stage a powerful extra stage on Rocket Lab’s Electron launch vehicle, designed to circularize the orbits of smallsats, taking them exactly where they need to go

Welcome to the LEO Sphere

Space is increasingly becoming a new commercial exploitation zone. Established commercial satellite operators such as SES, Thuraya, Asiasat, Inmarsat continue to grow their space “real estate” in Geostationary orbit and Medium Earth Orbit but now are also looking at Low Earth Orbit (LEO) systems. Existing LEO operators like Iridium and Globalstar are already there.

With at least 10 smallsat IoT providers planning constellations of dozens to hundreds of satellites each, there will most likely be to 1000 small-sats for IoT alone in the LEO sphere within the next few years.

Add to that the growing number of earth observation satellites, scientific and governmental satellites and we see that the whole LEO sphere becomes rather populated, mainly by commercial small-sats.

And then we did not even take into account the vast numbers of satellites required by broadband constellations like OneWeb, Amazon’s Kuiper project, or SpaceX.

Some speak of the industrialization of the LEO sphere.

How to Manage all these Small Satellites?

To manage these LEO constellations we need a large number of ground stations. Where most of the pathfinder satellites were in polar orbit, we could do with ground stations at the very north or very south.

A leading ground-station provider here is Norway-based KSAT (http://www.ksat.no) with stations close to the North and South Pole. But with the growth of the constellations, and to increase the service level at all locations on the world we need other orbits and more ground stations.

How can we track and distinguish all these satellites? Traditionally the US Air Force tracked all satellites, but nowadays also commercial parties like LeoLabs (http://leolabs.space) are offering tracking services to satellite operators, regulators, and insurance companies.

To do this Leolabs operates a network of ground-based phased array radars to tracking thousands of objects in LEO, switching from one object to the next every millisecond. Have a look at what is happening in the LEO sphere at https://platform.leolabs.space/visualization

What about Space Debris?

The number of objects in LEO orbit is steadily increasing, and good tracking does help to keep sight of what is happening. But good tracking is not enough as, with exception of Hiber, the current IoT small-sats do not have propulsion and just drift around the earth, and are unable to do anything even when the radar warns there might be a collision.

This situation leads to discussions in the industry and their governing bodies on Space Traffic Management (STM) and Space Environment Management (SEM). Governments, space agencies, and insurance companies are starting to revamp global policies as the public and professional con-cern for space debris, and potential impact or damages, increases, and propulsion may soon be mandated. Recently FCC advised on having propulsion on board that can help to avoid collisions and also help to de-orbit the small-sat in a managed way.

What about Radio Regulations, Spectrum, and Interference?

With the growing number of constellations, can we separate them in terms of radio frequencies? Not only in space, but some of them are also in terrestrial frequency bands. Who will handle the interference? The ITU? National Telecom Authorities? Regulations regarding the use of different frequency bands are a patchwork build-up in the last 50 years. Increasingly we see the spectrum wars where one type of network (cellular) operators try, to conquer spectrum from other networks (e.g. C-band spectrum from satellite operators).

New satellite IoT networks have to comply with the regulatory framework they are in and try to do that with a wide range of strategies: apply and reserve your own global frequency band (e.g. in UHF), move to an “open” frequency band like VHF and UHF ISM band, use a “readily available” frequency (e.g. in KU-band).

On a national level, the situation is also challenging. Individual satellite IoT operators will have to manage the agreements necessary to operate in all the individual countries around the world, all with their respective Radio Spectrum Management and licenses.

What will LPGAN networks bring to the market?

LPGAN services are typically store-and-forward messaging services, used to send small data packages from sensors back to the dashboards at the customer side. The message size is fairly limited. Subject to the specific service the message will be around 20-120 bytes, large enough to contain the data input coming from sensors.

The new satellite IoT systems can send data regularly depending on the size of their constellation. This can range from once per day when you have to say one or two satellites, once-per-hour if you have about 12 satellites, and later - when you have a couple of dozen satellites - to once-per-15 minute, equal to 100 messages per day as also used in terrestrial IoT networks.

The name Low Power Global Area Network (LPGAN) is derived from the three main promises fact that small-sat IoT systems have for their customers when it comes to sensor data messaging services: a) They provide global coverage b) For low-cost IoT and c) With Low power IoT devices.

LPGAN Offering a New Type of Service for New Product-market Combinations

Existing satellite IoT services from Iridium or Inmarsat provide near real-time connectivity providing critical communication for niche markets like maritime (e.g. for the Global Maritime Distress and Safety System), government, or trucking and logistics market tracking trucks, trailers, heavy machinery or cargo as they move around the world. Connectivity pricing and engineering costs are relatively expensive, which limits the market, but for the niche markets, these costs are justified by the fact this is critical communication.

Many applications in the market however are non-critical and do not require the high service quality as provided by the existing operators, and could do with one or several messages a day. Think of applications to monitor water-levels, air quality, weather data, ground humidity, etc.

That is where LPGAN comes in providing a new type of global IoT connectivity with a low-cost store and forward service, using low-power devices for their transmissions. These features open up new product and market combinations, in particular for monitoring applications and wide area telemetry.

As such the service looks very similar to terrestrial Low Power Wide Area Networks (LPWAN) such as Lora, Sigfox, and NB-IoT that are currently the carriers of the IoT disruption. The one big difference that LPGAN offers is that their services are deployed on a global basis.

From the niche markets served by existing satellite IoT operators, the introduction of LPGAN will allow the satellite IoT market to expand to a lot of other markets segment and customers.

LPGAN with its global connectivity will bring the benefits of IoT, which we know from terrestrial networks to the whole earth. Streamlined corporate operations, more efficient resource utilization, lower costs, better logistics and supply chain management, improved security benefits will now become available on a truly global scale.

Who is Going to Benefit from this New Generation of Small IoT Satellites and their Services?

The whole market from the existing niche markets like government, logistics, and maritime, as well as service providers, NGOs, and – not forgetting - producers and manufacturers in the developing and emerging world will benefit from low-cost IoT connectivity. Satellite IoT will develop from a rather expensive service for niches like the maritime, government, and trucking market, to a low-cost service that in the end will be able to serve the 500 million farmers around the world helping them to improve their yields and bringing their crops to the market in an accountable and efficient way.

Most promising is also the big wide area telemetry market in particular in the public sector. Think of applications like public infrastructure monitoring, climate measurements, weather stations, water management, soil management, natural disaster management, healthcare, and wellbeing (monitoring Covid, Ebola, Zika, measles, etc.). The call for more government investments in these areas is getting stronger and stronger. But the necessary data-gathering infrastructure is not yet in place. An example is C02 emissions levels. Although there are international agreements to bring those down, there is no proper measurement infrastructure in place. Instead of being measured Co2 emissions, at least at a national level, are estimated.

To build up the infrastructure our smart society needs also outside cellular coverage, to monitor air pollution, groundwater levels, local weather conditions, climate change, nutrient content in agricultural areas, LPGAN will play an important role. Together with the new generation of sensors, the increased power of data analytics, and the lower prices of electronic components and circuits, the low-cost connectivity of LPGAN will be the main driver for the development of global sensor networks in the private but mainly also in the public sector. Organizations in the public sectors can benefit very much from new possibilities for wide-area telemetry, and for that will be an important new satellite IoT market.

While the price point and product availability will initially be a brake on the global rollout of the LPGAN, it is expected within the next two years both these issues will have become academic. Communications that allow to globally improve quality of life and have detailed knowledge for health, trade, and wellbeing will become essential to industries, governments, and people.

Satellite IoT, up to the Third Round

With the satellite IoT networks in space, the development of the market becomes another story. With LPGAN systems operational, the efforts will have to move to the marketing and distribution of satellite IoT equipment. Many satellite IoT operators need large volumes of subscriptions to pay back the investments for their satellite IoT constellations. Who is going to sell and install all these units with customers? New models for sales, distribution, installation, and maintenance of satellite IoT units are necessary.

Not to speak of the many potential new customers that are not aware yet of the possibilities that IoT can bring to their organizations, which includes governments and industrials (mining, fishing, energy) as well as farmers and NGOs. The satellite IoT value chain is very fragmented consisting of sensor manufacturers, satellite IoT connectivity providers (which one out of the many systems?), data marketplaces and data analytics companies, dashboard visualization companies.

After launching and validating the technical part of their networks in round two, satellite IoT operators now face a new challenge, something we will come back to in a follow-up article.

Conclusion

With the launches of IoT small-sats with SpaceX, Soyuz-2, and Rocketlab in the first quarter, the year 2021 made a good start. It looks that 2021 will become the year where small satellite-based IoT networks come to the market with their low-cost and low-power-based solutions for IoT. With so many IoT small-sats in space, the establishment of Low Power Global Area Networks is a main technological achievement that ushers in a new era for the global IoT sector – one where data from devices is accessible anywhere on the planet securely and affordably.

Market researchers tell us that based on this there will be a strong expansion from the current market (millions) served by Inmarsat, Iridium, and Globalstar up to the market with tens of millions of sat-iot units serving customers in all kind of vertical markets.

To make this happen, the next phase is mainly a commercial challenge. With the technical infrastructure in LEO, now the commercial infrastructure becomes a priority. The establishment of end-to-end IoT solutions and value chains required to build up the large forecasted subscriber base for satellite IoT requires a more earthly skillset. Let’s see how this develops.

---------------------------------

Hub Urlings was one of the pioneers of Satellite M2M as Product Manager Inmarsat-C at the famous KPN Station 12. The success of this “small data” satellite service, its global coverage and reliability made that the service was used for a myriad of applications: from sending messages, to truck fleet management, to pipeline monitoring and bringing back data from all types of sensors. At that time satellite was the only type of network that was able to offer global coverage for what we would now call IOT services. Now, 25 years later he is again involved in the development of a new generation of smallsat based Sat-IoT services as ESA Innovation Manager at Hiber.global. To meet the complexity of the sat-IoT value chain he developed the SatIoTlab.eu as an education and co-creation platform for global sat-IoT applications. He can be reached at urlings@m2sat.com

Hub Urlings was one of the pioneers of Satellite M2M as Product Manager Inmarsat-C at the famous KPN Station 12. The success of this “small data” satellite service, its global coverage and reliability made that the service was used for a myriad of applications: from sending messages, to truck fleet management, to pipeline monitoring and bringing back data from all types of sensors. At that time satellite was the only type of network that was able to offer global coverage for what we would now call IOT services. Now, 25 years later he is again involved in the development of a new generation of smallsat based Sat-IoT services as ESA Innovation Manager at Hiber.global. To meet the complexity of the sat-IoT value chain he developed the SatIoTlab.eu as an education and co-creation platform for global sat-IoT applications. He can be reached at urlings@m2sat.com

which already had 36 “space bees” in space, doubling the size of their previous network to 72. With the Swarm network being live for commercial services they can now start serving customers.

which already had 36 “space bees” in space, doubling the size of their previous network to 72. With the Swarm network being live for commercial services they can now start serving customers.  Soyuz-2 Kepler has expanded its active constellation to 15 satellites in total.

Soyuz-2 Kepler has expanded its active constellation to 15 satellites in total. gone live offering commercial two-way communications to customers.

gone live offering commercial two-way communications to customers.

a constellation of 140 small satellites in Low Earth Orbit.

a constellation of 140 small satellites in Low Earth Orbit.