The Asia-Pacific Satellite Market

by Omkar Nikam

Strasbourg, France, July 5, 2021--In the recent years, the Asia-Pacific region has become a bright spot for connectivity solutions. One of the reasons is its huge population, which represents approximately 60% of the humanity (4.6 billion people as of 2020).

India is one of the biggest consumers of satellite content and has made significant progress in the past few years to unlock its full potential of the video market. Though DTH is very popular in India, companies like Reliance JIO are now becoming the competitor in the broadcasting segment due to their low-cost services.

Over the past several decades, Asia Pacific has been one of the major drivers of global economic growth, and this is expected to continue moving forward. There are several factors that play a crucial role in the Asian market that makes it a huge opportunity for Direct-to-home (DTH) operators such as the rural community who don’t have access to the terrestrial TV network and other is the limited channel services via cable network.

One of the major factors is the rollout of the DTH services in the most demanding regions. Many of the developing Asian countries have numerous remote sites, where people are unable to access television services.

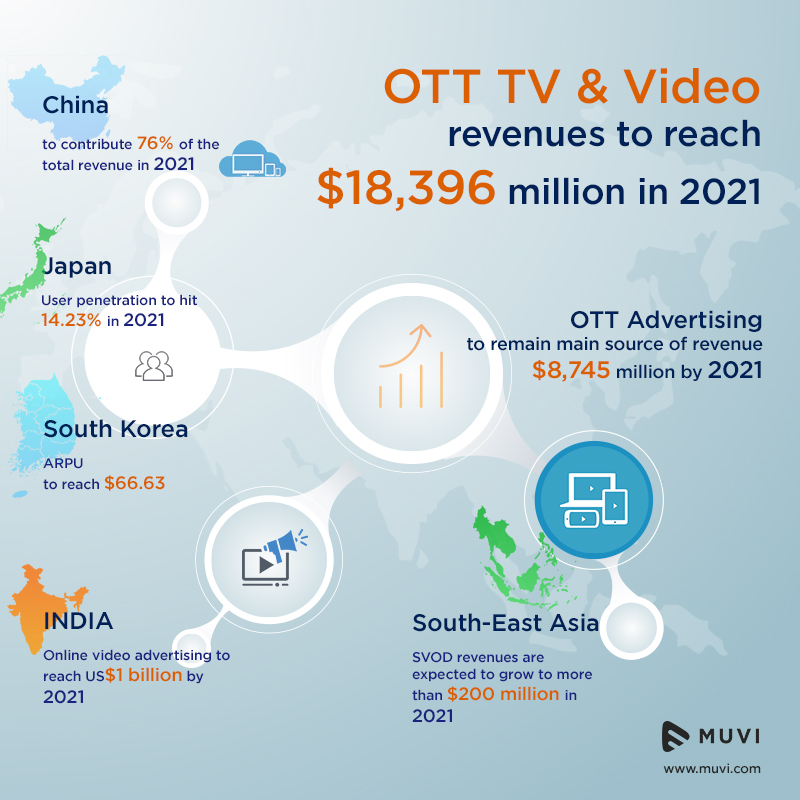

Considering the developing nations and their ability to adopt new technologies, China and India are the ones contributing to the rapid transformation of Asia. China is currently one of the biggest consumers of IPTV, though has a very limited satellite broadcast market that is dominated by China Satcom. On the other hand, India’s media and entertainment industry are flooding with numerous regional Over-the-top (OTT) platforms. In terms of developed nations, Singapore is the first country in Asia to become fully digital for video content delivery from January 2019. While Australia, South Korea and New Zealand are covering 80% of their regions for delivering video content via digital mode. Asia’s huge diversity in culture gives the OTT players strong benefit to target the regional audience. In the near future, increasing demand of such regional OTT platforms might lead to the decline of traditional TV consumers in the near future. Nevertheless, Asia Pacific remains the major hotspot for satellite companies. Simultaneously, it is also the only biggest continent of the world to consume huge amount of Free-to-air (FTA), DTH, and Digital Terrestrial Television (DTT) content.

transformation of Asia. China is currently one of the biggest consumers of IPTV, though has a very limited satellite broadcast market that is dominated by China Satcom. On the other hand, India’s media and entertainment industry are flooding with numerous regional Over-the-top (OTT) platforms. In terms of developed nations, Singapore is the first country in Asia to become fully digital for video content delivery from January 2019. While Australia, South Korea and New Zealand are covering 80% of their regions for delivering video content via digital mode. Asia’s huge diversity in culture gives the OTT players strong benefit to target the regional audience. In the near future, increasing demand of such regional OTT platforms might lead to the decline of traditional TV consumers in the near future. Nevertheless, Asia Pacific remains the major hotspot for satellite companies. Simultaneously, it is also the only biggest continent of the world to consume huge amount of Free-to-air (FTA), DTH, and Digital Terrestrial Television (DTT) content.

Market Outlook

For almost four decades, the Asian satellite broadcasting market has grown consistently. It has also reshaped itself in time with the evolving technologies in the media and entertainment industry. India tops in the list of DTH market, while Australia, Indonesia, New Zealand, Philippines, and Sri Lanka, are also some of the biggest consumers of satellite video content.

The growth in subscriber base is not the only strong asset for the DTH companies, as video on demand (VOD) services are rising, Average Revenue Per User (ARPU) is something that plays a crucial role in the combined revenues of the DTH companies. As many companies in Asia are trying to offer huge amount of content in lower prices, the ARPU eventually falls as there is still a considerable gap between the consumer demand and the tailored service offering. According to a 2021 report published by Media Partners Asia (MPA), Asia Pacific pay-TV subs will grow at a CAGR of 1% between 2020-25 to reach more than 715 million by 2025, representing 63% penetration. According S&P Global, Australia had highest DTH Average Revenue Per User (ARPU) in Asia at USD 66 per month and India register lowest ARPU at USD 4 per month.

OTT is slowly becoming popular in Asia, and it is mainly due to its wide variety of the content as well as its tailored design for the regional audience. DTH operators should make the use of huge international and national HD, UHD, and 4K video content to segregate it as per the needs of the subscribers in the specific region. This will lead to the rise in VOD, which will in-turn increase ARPU regardless of the monthly packages that a subscriber is paying as per the standard rates.

Singtel, Thaicom, Measat, Intelsat, and SES are some of the prominent satellite operators in Asia, with each having several DTH content broadcasting on their fleets. Currently there are more 100 million active pay satellite TV subscribers in Asia. FTA content is also very much popular in Asia Pacific. On the other hand, Dish TV, Tata Sky, Airtel, Independent TV and MNC Vision are the dominant DTH companies in Asia. Though companies like Dish TV alone have combined 20 Million subscriber bases in India and Sri Lanka, Sky Perfect JSAT and KT SAT DTH platforms tops the HD content services in South Korea and Japan.

Market Transformation from Satellite Broadcasting to Satellite Broadband

The OTT and IPTV trend of in the Asian video market will not create a significant amount of loss for satellite operators, as most of the population still consumes traditional TV content rather than OTT or IPTV. As of 2020, Asia has more than 600 million Pay TV subscribers. This massive number of subscribers certainly will take some time to adapt to OTT and IPTV solutions. But companies like SES, have already started tapping the IPTV market by utilizing HTS capacity to feed content into cable head-ends. This allows the broadcaster to distribute content by using a local operator’s IP network. Also, companies like Astro Malaysia are trying to establish themselves in the OTT market on the basis of regional content broadcasting.

As broadband solutions are rapidly gaining momentum in the Pacific region, companies like Kacific, a Singapore-based broadband satellite operator, are expanding their next-generation broadband solutions across several countries. Christian Patouraux, CEO Kacific, recently menionted in one of the APSCC Webinars that “The later months of 2020 has accelerated the demand in the satellite industry. And it is highly possible that pandemic will leave with strong demand in the connectivity segment as many people are preferring to work from home.” With growth in satellite broadband demand, maritime and In-flight Connectivity (IFC) will also help drive demand in the Asia Pacific region. Though pandemic has temporarily halted the growth these markets, in the post-pandemic world, maritime and IFC are also the growth hotspot for the satellite companies in the Pacific region.

Post-COVID Opportunities

While the pandemic can be seen as both an opportunity and challenge, it is by far safe to say that given the huge population, the Asia Pacific region has the potential to amplify the demand satellite broadband services. Aligning the upcoming race of low earth orbit (LEO) satellite internet, the Pacific will soon be a competitive region with companies like SpaceX and CurvaNet at the forefront of the LEO satellite services segment.

Taking a closer from another angle of integrating new technologies, cloud services can also be a major game changer in the video market. Especially in Asia, where most of the developing nations prefer economically viable solutions, cloud adoption can reduce the cost for the content producers and distributors. The migration of services from traditional to the cloud will provide higher reliability for end-to-end video delivery solutions. And the transition from multicast to Adaptive Bit Rate (ABR) video delivery will reduce the cost across the whole video supply chain. This transformation will take some time due to the lack of appropriate infrastructure in Asian countries. But in a decade or so, satellite broadcasters can take a huge pie out of the cloud market. Simultaneously, satellite operators and service providers should take advantage of HTS and VHTS technology to open the doors for HD, UHD, and 4K content in Asia.

--------------------------

Omkar Nikam is an independent space and satellite consultant based in Strasbourg, France. He has eight years of experience in technology and business consulting. He is also the EMEA correspondent for Satellite Markets & Research, USA. Omkar specializes in market research, analysis, and consulting services for several space and satellite market verticals. He can be reached at: www.oknikam.eu

Omkar Nikam is an independent space and satellite consultant based in Strasbourg, France. He has eight years of experience in technology and business consulting. He is also the EMEA correspondent for Satellite Markets & Research, USA. Omkar specializes in market research, analysis, and consulting services for several space and satellite market verticals. He can be reached at: www.oknikam.eu