Executive Roundtable: Flat Panel Antennas

by Bernardo Schneiderman

Los Angeles, Calif., Sept. 3, 2019 — Flat Panel Satellite Antennas (FPSAs) are one of the most anticipated technical innovations in the satellite industry for its potential to provide connectivity in mobility applications for aeronautical, terrestrial and maritime applications. However, we have yet to see FPSA take off.

Historically the defense market invested in development of the first models but commercially it is not yet feasible for enterprise and other applications because of high price of the antennas. The push to develop smaller and more economically priced FPSAs is the main target for the last three years with the new wave of High Throughput Satellite (HTS) and new satellite constellations focus in mobility and residential low-cost solutions.

Currently several companies are investing in developing feasible solutions for the market with a few already implemented. NSR report a forecast cumulative FPSA equipment sales to reach approximately US$ 11 billion by 2028. NSR finds aeronautical equipment will drive revenue growth for manufacturers, while fixed broadband applications on Non-GEO satellites will be the main volume market. The complexity of staying connected on the move is expected to keep antenna prices and revenues high over the next decade, with NSR forecasting 94% of all revenues to come from mobile applications. Leading the way will be the increasingly-competitive aeronautical market, well-established government land-mobile vertical, and the fast-growing, high-potential, commercial land-mobile sector.

Satellite Executive Briefing invited executives from the main manufacturers of the Flat Panel Satellite Antennas to participate in a virtual roundtable and we received responses from the following companies: Mustafa Buelbuel, Bus. Development Manager, ALCAN Systems; Bill Awada, Chief Technology Officer, C-COM Satellite Systems; David Helfgott, CEO, Phasor; Bill Milroy, Chairman and CTO, THINKOM. Follows are excerpts of the exchange:

Satellite Executive Briefing (SEB): Give us an update on your Flat Panel Antenna product?

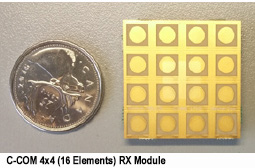

ALCAN Systems: ALCAN Systems is currently at development stage. Thus, there are no products available at the market right now. We expect to launch our first product within the next year.

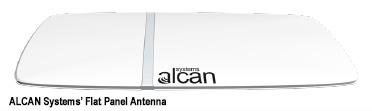

C-COM: C-COM is making good progress on its development for Ka band flat panel Phased Array Antenna. We are at the “Proof-of-concept” stage where the main intelligent 4x4 subarray modules or “building blocks” have been fully tested and are now used to build larger size subarray panels. The 4x4 (16 elements) Tx and Rx modules were used to develop and test a 16x16 subarrays (256 elements) and 32x32 (1024 elements). Our next step is to have a full flat panel antenna made out of 4000 elements for Tx and Rx which is equivalent to a 70cm parabolic antenna. We hope to achieve this objective over next 12 months and then start our commercialization phase.

C-COM: C-COM is making good progress on its development for Ka band flat panel Phased Array Antenna. We are at the “Proof-of-concept” stage where the main intelligent 4x4 subarray modules or “building blocks” have been fully tested and are now used to build larger size subarray panels. The 4x4 (16 elements) Tx and Rx modules were used to develop and test a 16x16 subarrays (256 elements) and 32x32 (1024 elements). Our next step is to have a full flat panel antenna made out of 4000 elements for Tx and Rx which is equivalent to a 70cm parabolic antenna. We hope to achieve this objective over next 12 months and then start our commercialization phase.

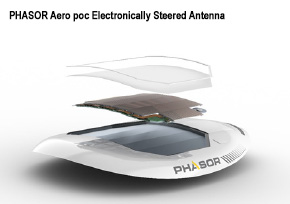

PHASOR: Phasor is working towards commercial introduction of its ‘Release One” technology-based products – (Flat Panel Antenna systems/Electronically Steered Antenna systems). These systems are designed for enterprise-grade SATCOM mobility markets in the commercial Ku band, and are undergoing extensive testing today. We are very far along our “commercialization” process and look to release products early next year, dependent upon the timing of completion of our testbeds. Phasor will release product for maritime and Land-mobility first, followed by aeronautical.

THINKOM: I’ll start with a brief background by way of introduction. ThinKom Solutions, Inc. was founded in 2000 and received our first major U.S. government contract for K/Q-band airborne antennas three years later. In 2011, we developed the first low-profile antenna for high-speed Ka-band and EHF communications on a U.S. military wide-body aircraft. In 2013, Gogo selected our flat-panel antenna for inflight connectivity, and the following year Gogo launched its 2Ku IFC powered by ThinKom’s Ku3030 phased-array antenna. The Ku3030 received FCC blanket worldwide regulatory approval in 2015.

As of this writing, our Ku3030 antennas are operational on over 1,300 aircraft, with more than 10 million cumulative hours of service proving industry-leading reliability, with measured antenna Mean Time Between Failure (MTBF) greater than 100,000 hours.

During the last two years, we have also made substantial progress with our new family of Ka-band aero antennas. The Ka2517, introduced in 2016, has completed DO-160 certification and the antennas are now in service aboard a fleet of U.S. government command and control aircraft, and entering IFC service on commercial aircraft (airlines) in the very near future. Multiple ground and in-flight demo trials have been conducted with the Ka2517 over LEO, MEO and GEO satellite networks with extremely high data throughput.

We are also continuing to build our terrestrial satellite communications business with the same flat-panel phased-array technology. We work with major third-party integrators and prime contractors to supply X-, Ku-, K-, Ka-, and Q-band systems for mobile, man-portable and fixed antenna solutions for military, homeland security, disaster recovery, emergency management, law enforcement and broadcast/media applications.

This year, we unveiled our concept for using our phased-array antenna technology to create a new generation of satellite gateways, replacing the large “dish farms” of cumbersome, heavy parabolic antennas with a compact, reconfigurable “array of arrays.” We are also continuing the product development of fixed user terminals to support the next generation of LEO and MEO satellite broadband services.

SEB: Is your antenna Mechanically-Steered, Electronically-Steered or Hybrid (Mechanical and Electronic - Steered)? Describe what is the main advantage of your solution and what frequencies will the antenna be?

ALCAN Systems: ALCAN Systems is developing a fully electronically steerable flat panel antenna. The main advantage of the technology is the use of liquid crystal within the antenna. This enables us to design a product which has very low costs and is able to perform with low power. The focused frequency bands are Ka and Ku, other bands are possible.

ALCAN Systems: ALCAN Systems is developing a fully electronically steerable flat panel antenna. The main advantage of the technology is the use of liquid crystal within the antenna. This enables us to design a product which has very low costs and is able to perform with low power. The focused frequency bands are Ka and Ku, other bands are possible.

C-COM: We are aiming to develop a fully electronically steered phased array Ka band antenna which can be used to replace the mechanically steered parabolic antenna of 70-75cm. The advantages of the underlaying technology is that its modular which can be scaled to any size of antenna depending on the requirements and applications. It’s also conformal and can follow the shape of the surface it’s intended to operate from. Another big advantage of Phased-array technology is that it allows for multiple beam forming which would be capable to operate seamlessly over traditional GEO and Non-GEO (LEO/MEO) satellites and track multiple satellites at the same time electronically.

PHASOR: Phasor technology is solid-state with no mechanical/moving parts. Phasor’s ESA uses a unique and patented ASIC-based beam-forming technology, and a sophisticated software-defined/controlled systems approach which allows for very high performance, very low profile and a scalable, modular aperture to accommodate aperture sizes of various dimensions.

PHASOR: Phasor technology is solid-state with no mechanical/moving parts. Phasor’s ESA uses a unique and patented ASIC-based beam-forming technology, and a sophisticated software-defined/controlled systems approach which allows for very high performance, very low profile and a scalable, modular aperture to accommodate aperture sizes of various dimensions.

THINKOM: Our underpinning patented phased array technology is called VICTS, which stands for Variable Inclination Continuous Transverse Stub. VICTS delivers all the benefits of conventional mechanical and electronically steered phased array antennas without their well-known drawbacks and limitations. Our technology uniquely provides gap-free pole-to-pole coverage, high beam agility for network flexibility, a low-profile antenna radome producing near-zero drag in flight, low prime power consumption and installation flexibility, as well as the IFC industry’s highest spectral efficiency (2X to 8X higher efficiency than our various competitors.)

Let me just point out that while electronically steered arrays (ESAs) are still not widely available on the market, our VICTS antennas are fully proven with over 5,000 daily commercial flights on 1300+ commercial aircraft today.

SEB: What markets are you planning to address with the FPSA (GEO, MEO or LEO) and what verticals (Defense, Aviation, Maritime, Terrestrial or others)?

ALCAN Systems: ALCAN Systems is planning to address all major satellite markets (GEO, MEO and LEO) as well as the upcoming 5G technology. The planned verticals are enterprise, maritime, landmobile and aviation.

C-COM: C-COM will focus on land mobility markets since we have well established channels and resellers network in different market verticals worldwide. However, the antenna technology can easily be extended to other markets including aviation, marine, defence, space, 5G and many others.

PHASOR: Phasor is focused upon enterprise-grade commercial and government broadband mobility markets where high performance, very low profile and more efficient form-factors are vital. Phasor ESAs will work with satellites in any network configuration, from traditional Geosynchronous regional beam systems (GEOs), to newer High-throughput, spot-beam-based data-centric satellites (GEO HTS), available today. In additional, the same Phasor ESA will also interoperate seamlessly with new Non-Geosynchronous constellations in Low and Medium Earth Orbit (LEOs and MEOs). In this way, the Phasor solution derisks the coming heterogenous SATCOMs market for service providers and end-users alike.

THINKOM: Our VICTS phased-array flat-panel antennas are totally interoperable with LEO, MEO and GEO satellite constellations. We believe that users and providers of satellite connectivity should not be compelled to gamble their futures on an “either-or” compromise choice when it comes to satellite orbits. Our vision for the future is a truly integrated, multi-constellation solution, in which the satellite antennas switch seamlessly back and forth between LEO, MEO and GEO services (and without any performance compromises,) providing truly global pole-to-pole, all-constellation, connectivity. Essentially a best-in-class solution for today... and tomorrow.

THINKOM: Our VICTS phased-array flat-panel antennas are totally interoperable with LEO, MEO and GEO satellite constellations. We believe that users and providers of satellite connectivity should not be compelled to gamble their futures on an “either-or” compromise choice when it comes to satellite orbits. Our vision for the future is a truly integrated, multi-constellation solution, in which the satellite antennas switch seamlessly back and forth between LEO, MEO and GEO services (and without any performance compromises,) providing truly global pole-to-pole, all-constellation, connectivity. Essentially a best-in-class solution for today... and tomorrow.

The key requirements for functioning on LEO or MEO satellites are broad channel bandwidth operation, high efficiency over scan, and high beam agility, to ensure minimal handoff times between setting and rising satellites in the field of view. Our VICTS phased array antennas currently support re-steer times of <800 msec, depending on satellite-to-satellite geometries, which is faster than ping times (delays) associated with applications on GEO systems today. We have conducted successful on-air tests of our Ka2517 antenna on MEO and LEO satellites validating extremely high data-throughput rates and rapid beam agility.

We are currently working under a collaborative agreement to develop a Ka-band enterprise user terminal for Telesat’s planned LEO satellite constellation. Initial tests have already been successfully completed using the Ka2517 on Telesat’s Phase 1 LEO satellite.

SEB: What are your plans in the next few years in regards to use and pricing for mass market/vertical markets?

ALCAN Systems: Our five-year plan consists of the market launch in the enterprise vertical and the extension of our products to other verticals. We aim to provide an enterprise solution for $10,000 and a consumer solution for $1,000.

C-COM: We plan to start the commercialization phase by the end of 2020 targeting commercial Ka-band land mobile applications for GEO, LEO and Cubesat/SmallSat constellations. We hope to see pricing equivalent or less than the cost of our presently manufactured on the pause motorized auto-pointing parabolic antennas with the added benefit of delivering full mobility over LEO/MEO constellations in additions to GEO.

PHASOR: Over the next five years, Phasor will introduce broadband mobility products across all uses cases (sea, air, land) in the enterprise-grade commercial and government SATCOM services markets. This will include several new technology releases and new SATCOM frequencies.

THINKOM: While I cannot comment on specific product development projects in the works, I will briefly identify some of the important themes and trends we believe will shape the future of flat-panel satellite antennas.

The first is the proliferation of LEO and MEO constellations, which has driven us to more flexible “future-proof” designs in which acquisition, tracking, inter-and intra-satellite handoffs and polarization diversity requirements will be of key importance. We are already there with a range of flat-panel phased arrays that have been successfully demonstrated across LEO, MEO and GEO platforms.

The second is frequency coverage. We foresee a continued push into higher frequencies for satellite communications, including Q-, E- and even W-bands. We’ve already built and tested VICTS antennas as high as W-band with excellent results.

The third is in the area of production scalability. Our antennas are uniquely well suited to commoditized production materials. We will soon announce some significant “breakthroughs” in terms of size, performance and market pricing for fixed LEO and MEO, full-duplex user terminals that are 40% smaller than traditional dish solutions with 2x to 8x higher efficiency than competing ESAs, without the high-power consumption and poor scan efficiency.

-------------------------------------

Bernardo Schneiderman is the Principal of Telematics Business Consultants. He can be reached at: info@tbc-telematics.com

Bernardo Schneiderman is the Principal of Telematics Business Consultants. He can be reached at: info@tbc-telematics.com