Executive Roundtable: Satellite Comms on the Move Market

Los Angeles, Calif., March 5, 2021--The Satellite Markets and Research invited key companies providing satellite Comms on the Move (COTM) solutions to participate in a virtual roundtable on the current status and prospects in the global COTM market. The companies and their respective executives that agreed to participate in the virtual roundtable include Krystal Dredge, Marketing Director-AVL Technologies; Leslie Klein, President and CEO-C-COM Satellite Systems; Brian Billman, VP Product Development-Isotropic Systems; Bill Marks, Chief Strategy Officer, Kymeta; Stephen Newell, Chief Commercial Officer, NXTCOMM; and Bill Milroy, Chairman and CTO-ThinKom Solutions. Follows are exceprts of the virtual roundtable discusssion:

Satellite Markets and Reserach (SMR): Please describe your portfolio of antennas for communications on the move (COTM) applications for the broadcast, defense and commercial markets?

AvL: AvL Technologies specializes in communications on the pause (COTP) antennas for defense, broadcast and commercial markets that operate with GEO and MEO constellations. For these markets we make transportable (vehicle-mount and case-based) antennas ranging in size from 60cm to 4.6m. We also make fixed antennas as large as 5.0m. AvL Technologies has flat panel antennas now in development that will operate with communications on the move (COTM) applications.

C-COM: Presently C-COM only offers COTP (Communication on the Pause) in Ku-, Ka-, X- and C-band products (on the pause). We are developing a Ka-band Phased Array electronically steered antenna which is in its final stages of pattern testing and will be satellite tested in early 2021 over Ka-band LEO and GEO satellites both as stationary and on the move. The same modular technology will also be applied to small antenna arrays using our 2x2 and 4x4 (256) to be used for IoT on the move and on the pause applications.

|

|

| Isotropic antenna |

ISOTROPIC: We are developing a range of high-performance terminals using our patented optical beamforming technology. Our first products will be ruggedized Ka-Band mobility terminals that are capable of forming multiple full performance beams from a single terminal. They cover the full commercial and military frequency bands, are full duplex, can support any polarization (circular or linear), and are capable of wide instantaneous bandwidths to support spread spectrum waveforms.

KYMETA: Kymeta’s connectivity solutions provide revolutionary mobile connectivity on satellite and hybrid satellite-cellular networks to customers around the world. Our next generation connectivity solutions are centered around the Kymeta™ u8 electronically steered satellite antenna platform and Kymeta Connect™, a unique offering that makes satellite and cellular hybrid connectivity as easy to purchase as a mobile plan. The u8 is the comprehensive connectivity solution that enables trusted, secure communications on the go with a host of new innovative features. The new terminal provides a complete connectivity solution for on-the-go communications when and where you need it. Redesigned with our revolutionary software-defined, electronic beam steering technology, the u8 terminal is low profile, mounting easily on vehicles and vessels. Our u8 terminals and u8 GO portable terminals deliver connectivity in a single integrated platform.

The Kymeta u8 portfolio is the only land-based solution of its kind that fully supports always-on broadband communications over both satellite and cellular while mobile. This core feature which allows you to connect to a satellite while on the move, combined with our back-end support suite of services, Kymeta Connect, results in a seamless customer experience and a product that no other satellite antenna company offers today.

|

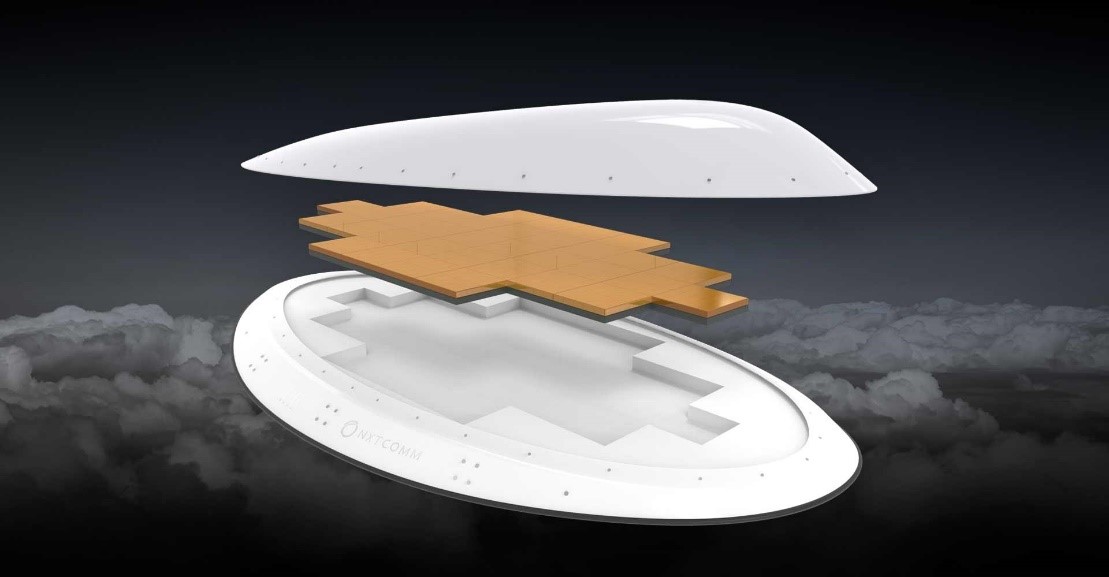

| NXTCOMM’s Flat Panel Antenna concept with radome |

NXTCOMM: We offer modular and scalable electronically scanned phased array antennas. NXTCOMM’s flat-panel satellite antenna solution is initially targeted at defense and aerospace applications. Examples include commercial aero-connectivity, drone ISR applications and comms-on-the-move for Special Forces, which are most in need of portability, low-profile stealth, broadband capacity and high-level operational performance. Our antenna is based on the fragmented aperture technology that has only been previously deployed on U.S. military platforms. NXTCOMM’s core undertaking is to transform money-is-no-object military development and bring that capability to the broader aerospace and defense satellite communications markets using well established manufacturing technologies. Typical antennas on aircraft today are mechanically steered and roughly 10 to 16 inches high, which means they fit under a fairly large radome that sits on top of the commercial aircraft. In contrast, NXTCOMM’s antennas are less than one inch tall, are electronically steered and have no moving parts. Within the defense market,

NXTCOMM’s antenna product line is designed for flexibility, with the ability to go from platform to platform – whether it be a vehicle-mounted or manpack solution. Because the antennas use an advanced silicon-based chipset and a novel combining network, NXTCOMM can manufacture its arrays on a single printed circuit board. Designed to be modular and conformal, NXTCOMM antennas can scale up or down based on the application. For example, an antenna could fit on the roof of a Humvee and deliver secure network for warfighters everywhere they are, easily transitioning from a Humvee to fixed site to a fast-moving watercraft. The base antenna measures about an inch thick, is completely electronically controlled, and, because it has no moving parts, provides high reliability.

THINKOM: Our range of low-profile mobile satellite antennas encompass phased-array solutions from C- to W-band (3-96 GHz) for aeronautical, marine and land applications in defense and commercial markets. Our patented VICTS (Variable Inclination Continuous Transverse Stub) technology combines the technical benefits of mechanically steered and electronically scanned antennas, without their limitations. VICTS antennas provide spectral efficiencies 2x to 8x higher than other phased arrays, as well as higher reliability, lower prime power demand and the unique ability to scan down to very low elevation angles (<10 degrees).

ThinKom is probably best known for our very strong position in the commercial aviation in-flight connectivity (IFC) segment. Our proven Ku3030 flat-panel aero antennas, privately labeled by Gogo (2Ku), are operational on more than 1,550 aircraft with over 20 million accrued operational hours. They have achieved a reliability record of better than 100,000 hours MTBF.

In fact, our first Ku3030, installed on an Aeromexico aircraft in 2015, is still flying today and has never been removed or serviced. Because of their extremely low power dissipation, VICTS antennas provide gate-to-gate connectivity even under high ambient temperatures with full solar loading.

Our Ka-band aero antennas, now in full production, were recently chosen by Inmarsat for their new GX Aviation inflight broadband services,

|

| ThinKom ThinAir® Ka2517 |

including the GX+ North American IFC service to be provided jointly by Inmarsat and Hughes Network Systems. We have started delivering Ka2517s for large-scale deployments on commercial aviation fleets. On the defense side, our Ka2517s are currently flying on a fleet of U.S. government aircraft with the industry’s highest performance and reliability requirements.

Our ground-based COTM antenna business is also growing. We currently offer a range of X-, Ku-, Ka- and Q-band phased arrays for vehicle-mounted, man-portable and fixed solutions, working through partnerships with system integrators and prime contractors. Our COTM antennas are extremely flexible, can work with almost any modem or network and are the most efficient in terms of network bandwidth/satellite-capacity of terminals in their class.

We recently won a contract to supply ThinSat® 300 terminals for testing and evaluation for a major U.S. Department of Defense tactical armored command-post-vehicle program with a requirement for future LEO, MEO and GEO interoperability.

We’re also moving into the maritime COTM segment, having recently won a contract from the Defense Innovation Unit to test and evaluate a Ka2517 to meet U.S. Navy requirements for a low-risk COTS solution for deployment on a DDG-1000 Zumwalt-class destroyer. Our VICTS technology provides uncompromising emission controls to meet the stringent requirements for precision sidelobe control and grating lobe suppression – key factors on a modern naval ship.

SMR: Do you have any new products specifically for the new constellations of Non-GEO satellites (LEO and MEO)?

AvL: AvL Technologies has produced a family of tracking antennas for SES’ O3b MEO network for many years, and is developing new products

|

|

| AvL 85cm transportable tracking antenna for MEO systems |

for SES and O3b. AvL also has new X/Y tracking antennas in development that will work with many LEO networks, and these antennas are on schedule to launch in 2021.

C-COM: Not yet. We are about 12 months away from releasing a commercial Ka-band Phased Array conformal flat panel COTM antenna for LEO/GEO and MEO constellations.

ISOTROPIC: Yes, all of our products will be able to switch between LEO, MEO, and GEO satellites but that’s just the tip of the iceberg! Our terminals can connect to multiple satellites at different orbits simultaneously while maintaining full performance on each link. Not only does this multiply the maximum throughput available within the footprint of a single antenna but it allows the user to dynamically route traffic across multiple communication pathways depending on their priorities. For example, they can route latency sensitive traffic over a LEO satellite while simultaneously receiving a multicast stream from a GEO satellite. The combinations and use cases unlocked by this capability are endless.

KYMETA: The Kymeta u8 covers the full Ku-band and it designed to be LEO upgradeable. It also supports MEO and GEO satellite constellations.

NXTCOMM: Yes, our core flat panel antenna is ideal for next-generation, non-GEO constellations. NXTCOMM’s antenna solutions are satellite orbit-agnostic, meaning they will work over GEO and NGSO (LEO, MEO or HEO) satellites. NXTCOMM offers a turn-key solution complete with all required hardware or integration with existing connectivity hardware.

THINKOM: Our VICTS antennas are ready now for operation on current and future LEO, MEO and HEO satellite constellations as well as GEO HTS. Over the last 18 months, we have conducted successful live tests of our commercial off-the-shelf antennas across multiple commercial and military frequency bands on a wide range of GEO and NGSO satellites.

In all cases, ThinKom antennas met or exceeded all test parameters, including spectral efficiency, data throughput rates, beam agility, switching speeds, ASI interference, low-angle tracking and inter- and intra-constellation roaming. Inter-satellite handoffs—between LEOs and between LEOs and GEOs—were completed in less than one second. The live on-air testbeds included OneWeb, Telesat LEO 1, Inmarsat Global Xpress and SES GEO and O3b MEO satellites. We will continue our testing program on other current and emerging NGSO constellation in the coming months.

SMR: Do you have a Flat Panel Antenna in development or available now or in the future?

AvL: AvL Technologies has flat panel antennas now in development that will operate with communications on the move (COTM) applications. Some of the product development is with SBIR funding and collaboration with the U.S. Air Force.

|

|

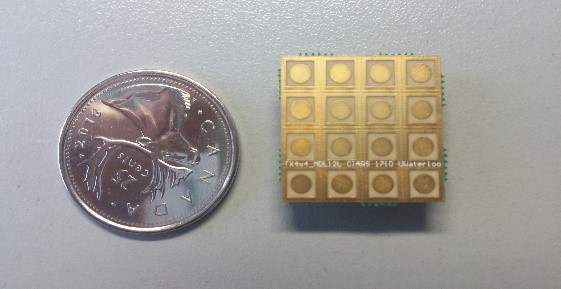

| C-COM’s phased array antena concept. The concept is based on modules that are small, but contain everything—the antenna, plus the electronic circuit, parts of the control circuitry, and local memory. |

C-COM: Not yet. We are about 12 months away from releasing a commercial Ka-band Phased Array conformal flat panel COTM antenna for LEO/GEO and MEO constellations.

C-COM in partnership with the University of Waterloo, tested its Ka-band Phased Array modules using the company’s patented phase shifter technology in summer of 2018. The concept is based on modules that are small, but contain everything — the antenna, plus the electronic circuit, parts of the control circuitry, and local memory.

ISOTROPIC: Our first products will be planar and low profile. We also have the ability to conform our optical beamforming modules to a curved surface. This facilitates designs that maximize performance while minimizing profile which is invaluable for platforms such as aircraft that can save OPEX by reducing drag and fuel consumption while still enjoying a high performance multibeam antenna.

NXTCOMM: Yes. NXTCOMM only makes flat panel antennas. Our antenna combines a fragmented aperture with an active phased array architecture. Traditional active antennas have been known to be very power hungry and require exotic cooling. These two unwanted features are significantly decreased in NXTCOMM’s design. By making our antenna more efficient at the RF layer, we make it more efficient to manufacture. Our foundational subarray design (25 cm x 25 cm) is modular and scalable to any form factor. Each subarray is built on a single printed circuit board.

THINKOM: Our VICTS conformal antennas—available today—are only 2 to 4 inches in height and can be mounted in a low-profile radome enclosure or cavity-mounted, sub-flush to the skin of an aircraft, or discretely mounted on a vehicle or marine vessel.

SMR: What vertical markets are you focusing your COTM products?

AvL: AvL’s COTM products are being developed for defense market applications, and will be applicable for some commercial markets.

C-COM: Initially for terrestrial applications, but we look forward to working with Aero and Maritime as well as Internet of Things (IoT) integrators interested in providing solutions using these modular phased array flat panel antennas into those verticals.

ISOTROPIC: While our first products will be focused on land mobility and maritime applications, the unique modularity of our optical beamforming technology allows us to create derivative products that will meet the needs of a wide range of users across commercial, government, fixed, mobility, land, sea, and air markets.

KYMETA: We are focused on government and military, public safety, and commercial markets today. As our solutions become more widely adopted, we will expand to additional markets. We believe that our solutions can improve the everyday lives of public safety workers, government and military agencies as well as make a power impact on connectivity for businesses, farmers, industrial workers and more. Integrated and seamless connectivity is no longer tied to a specific location and helps workers access information reliably no matter how remote their job site is. Kymeta’s solutions are built for these users who demand simple yet reliable access to information in any location or condition

NXTCOMM: We ae focused predominantly on two key vertical markets: Aerospace and Defense. For the commercial Aerospace, NXTCOMM’s AeroMax® antenna delivers a high-performing inflight connectivity solution to transform the passenger experience. Our antenna solution allows airlines to deliver enhanced passenger internet, monitor system health, provision services and unlock ancillary revenue streams across their fleet. For the Defense market, NXTCOMM Defense antennas and antenna systems solve the mobile connectivity needs of warfighters with modular solutions that scale up or down to fit mobile vehicles, drones and watercraft. Our low-profile, multi-satellite, multimission solutions meet our military where it is today: on the move, portable and in stealth mode.

THINKOM: As stated earlier, ThinKom has enjoyed great success in the commercial and government aviation markets. This will continue to be a productive market for us, building upon our track record of proven performance and reliability. We see ample room for further growth in market share here, as new Ka-band services come into operation.

Our consistent year-on-year success in the land COTM market positions us strongly for greater penetration of these segments, as the new NGSO networks become commercially viable. We will focus more attention on government and security COTM markets, leveraging strategic partnerships with third-party integrators and contractors. We foresee increasing demand for terminals with multi-orbit capability at lower price points, giving partners and end-users a flexible choice of service offerings in Ku-, Ka-, X- and other frequency bands.

Late last year, we conducted successful over-the-air tests of a pair of 17-inch active diameter K/Q-band phased-array antennas communicating through an Advanced Extremely High Frequency (AEHF) satellite. The tests verified that the VICTS antenna meets or exceeds all performance metrics for operating effectively with the frequency-hopping waveform of the protected communications satellite network.

This will open the door to a potentially new market segment for our VICTS technology in military Protected Tactical Waveform (PTW) applications on aero, naval and land-mobile platforms.

We’re also continuing an active R&D effort aimed at adapting our core technology for enterprise and consumer applications.

SMR: What are the key trends that you see in the COTM market?

AvL: The COTM market always has been driven by application, and this is expected to continue. COTM is widely used in commercial air and rail travel, and the next large market is automotive. What remains to be seen is how satellite COTM will fare with the rollout of terrestrial 5G. At AvL we expect satellite COTM to have significant inroads for defense vehicles and applications, but not large commercial or consumer markets. Satellite COTM will be beneficial for some niche commercial markets, such as farming and fleet management.

C-COM: We believe that the right product at the right price using multiple of the many new constellations being launched, will make it possible to deliver COTM to a large number of potential customers world wide. Over the next 10 years it is expected that 1250+ satellites will be launched every year so there will be a lot of opportunities to deliver mobility to those who will need it.

ISOTROPIC: What has been adequate in the legacy GEO-centric satellite ecosystem will not be sufficient for long. With the upcoming LEO, MEO, and HEO constellations users will have more options of how to route their traffic than ever before. They won’t be satisfied with archaic single link limitations and will demand the ability to dynamically route traffic based on latency, throughput, resiliency, security level, or even cost.

KYMETA: The global demand for mobile broadband connectivity continues to grow, driven by the insatiable consumption of data as well as the growth in new IoT applications. Cellular networks alone will not provide the seamless coverage needed to satisfy always-on communications on the move. The combination of satellite and cellular technologies deployed across a variety of different uses cases will be a solution to that growing demand in only a matter of time. There remains a growing demand for mobile connectivity that cannot be met by the cellular industry alone. This demand creates a market for new satellite products and services that can only be met through innovation.

As the connectivity marketplace becomes more competitive, the operators are becoming increasingly demanding. Commercial and military customers alike are looking for higher speeds and more competitive rates for bandwidth. The way to consume this data is changing as well and that puts constraints on the operators’ networks, as different platforms require new antenna types or ways to purchase connectivity. Some can evolve their networks and expand their capabilities, looking ahead to 5G, and some are going to struggle, requiring even more innovation on the ground segment. Much of this evolution will drive R&D innovation over the next five years. Another expected demand is standardization in the industry which is long overdue. The cellular industry went through this a decade ago and it is time for Satcom to make real strides in that direction as well.

NXTCOMM: Across all mobility markets, we are seeing the need for cheaper, faster connectivity, more broadband capacity, and a faster, more nimble ground infrastructure that can operate over GEO, LEO and MEO. And, everyone wants a better user experience. Some specific trends in our key COTM markets include:

Commercial Aero: The #1 connectivity problem facing airlines is the disconnect between the passengers’ expectation of what internet service on board should be like, and the current capabilities of the whole satellite sector to deliver. As airlines resume flights post-Covid, they need to offer affordable and differentiated services such as allowing passengers to easily connect and stream content while in the air for free. Unfortunately, that’s not possible with the slow internet speeds and costly equipment on today’s aircraft. The issue is with the limitations of today’s airborne antennas that we seek to enhance in the future with lower cost terminals able to deliver a better internet experience over LEO satellites.

Defense: Today’s mobile forces face an operating environment requiring more capacity and instantaneous reach. This need for more capacity, agility, and interoperability from their ground infrastructure can only be unlocked by electronically steered antennas that operate over LEO constellations.

THINKOM: On the commercial side, the COTM market will be shaped by both market and technology drivers. First will be the incredible surge in capacity (and competition) as the new NGSO satellite networks proliferate. Even if only a small percentage of the proposed LEO and MEO satellite constellations are actually deployed, they have the potential to be a major market disruptor.

The new generation of HTS GEO satellites will also contribute to the increased capacity. This means the ideal COTM satellite antenna will be a truly integrated solution with the ability to switch rapidly between beams, satellites and constellations, providing seamless global horizon-to-horizon connectivity. Other considerations for antennas will include footprint, heat dissipation, sidelobe suppression and—of course—cost. Antennas should also be modem- and network-agnostic.

For Ka-band systems, careful attention will be needed to meet international regulatory requirements, including ITU Article 22, which restricts NGSO terminal interference with GEO satellites, as well as the new WRC-19 ESIM rules to protect terrestrial 5G networks operating in Ka-band from interference emitted by satellite terminals. I’m happy to say that our VICTS antennas (already) meet these requirements.

Military users are looking for embedded and low-observable phased-array antennas with no visible radome. This has proven difficult in the past due to power, thermal loading, reliability, size and cost limitations.

The military is pushing into the Q-, V- and E-bands to enable fiber-like throughput via satellite in coming years. We also see considerable potential for VICTS in protected comms, which employ techniques and waveforms that are difficult to detect, intercept and/or jam. ThinKom’s phased arrays, based on a unique beam-stabilized feed architecture, supports frequency hopping and spread-spectrum waveform applications.

Finally, in the land COTM environment, there will always be the challenges associated with intermittent or even lengthy blockages, and reacquisition times and network lock optimization software algorithms will be essential for stable land mobility comms.

SMR: Anything else you would like to add?

C-COM: The next 3-5 years will be very exciting for the satellite industry and we are pleased to be able to be part of the solution providers delivering new technology which will make it possible for millions of new customers to get high speed broadband Internet access while on the move even in areas where no terrestrial infrastructure exists.

ISOTROPIC: A host of ambitious new satellite constellations from SpaceX, OneWeb, Amazon, SES and Telesat are currently being deployed to support COTM, but none of them will reach their full potential without equally innovative ground infrastructure. Our unique technology has cracked the connectivity code for unprecedented communications capabilities virtually anywhere and 2021 will be a year of important milestones as we complete critical trials of our high-performance terminals with Government and tech partners in the U.S. and Europe.

|

| Kymeta u8 terminal |

KYMETA: Kymeta’s next generation solutions are leading the industry in a number of ways. The first is that we are changing the way that connectivity and mobile data is consumed and purchased by our industry. Kymeta Connect offers hybrid satellite-cellular connectivity services with an all-inclusive hardware connectivity and services monthly subscription starting at $999, the lowest in the industry. The solution requires no upfront fees and makes broadband connectivity as easy to purchase as a wireless connectivity plan.

Second the Kymeta u8 terminal is the world’s only commercially available flat-panel electronically steered antenna built specifically for mobility and designed for the needs of the most demanding customers and beyond (DoD, emergency responder, rail, bus, commercial, etc.). The u8 is the world’s first lightweight, low-profile, flat panel, cost-effective and self-configurable solution that uses metamaterials and holographic beamforming technology. The industry has desired this type of solution for years and the lack there of has been a major roadblock for mobile broadband customers, who are unable to seamlessly access mobile satellite and terrestrial services while on the move.

The technological innovation and development happening at Kymeta right now will evolve connectivity innovation around the world and what the future of global connectivity looks like. These developments are crucial toward not only accomplishing our company mission of completing the connectivity fabric but helping narrow the global digital divide. Kymeta next-generation solutions are positioned to bridge that gap.

NXTCOMM: We believe 2021 will be the year Electronically Steered Antennas come into their own. We are working to revolutionize high-performance flat panel antennas to provide mobile connectivity users, including operators, a path to greater satellite flexibility.

THINKOM: We’re often asked how our VICTS antennas stand up when compared to the electronically steered antennas (ESAs) being developed. Let me just make a few comments on that subject. The fact is that despite many years and a staggering amount of investment, no affordable ESAs appear market ready; and independent of price, they face considerable technical challenges, such as high-power requirements, thermal dissipation, spectral efficiency, low-elevation-angle performance, and interference protection to meet international regulatory standards. Our VICTS antennas, which are commercially available now, have been field-proven to overcome all of these challenges.