Declining Demand for Satellite Backhaul?

by NSR

Cambridge, MA, September 20, 2010-In 2010, the UN-HABITAT’s report, State of the World Cities 2010/2011: Bridging the Urban Divide found that the global population has reached its tipping point, a condition where populations are more urban than rural. Today, 50.6% live in urban areas, and the trend is irreversible. Increased urban populations may be taking away a vital market for satellite backhaul.

Since satellite backhaul is really a proposition for rural and underserved areas, population trends initially do not appear to favor satellite solutions over the long term. Looking at the actual projections by the U.N., the good news is that currently, the less urbanized regions of Asia and Africa are expected to reach their respective tipping points in 2023 and 2030, providing healthy prospects for backhaul initiatives over the long term. But the bad news is that South America and Latin America/Caribbean regions are way past their tipping points at 83.7% and 71.7% respectively in 2010.An even more serious finding in the U.N. report is that “the degree of a country’s urbanization is now an indicator of wealth.” So here, we have a declining rural population base and thus a declining addressable market. And what remains of the addressable market is markedly less wealthy compared to their urban counterparts, once again diminishing the market that can be tapped for satellite backhaul offerings.

However, a few things need to be considered before such a dire conclusion can be reached:

Population Growth–The world’s population is still rising such that the addressable market in absolute terms is still quite large.

Population Growth–The world’s population is still rising such that the addressable market in absolute terms is still quite large.

Large Rural Base–The group of countries with the greatest economic prospects is currently known as BRIC (Brazil, Russia, India and China). In examining the move from rural to urban areas, China presents the starkest evidence of this trend. Indeed, China's rural population is estimated to shrink from the current 900 million to 400 million in 30 years. Should satellite backhaul then give up on the China or BRIC markets? Certainly not! The years 2025 and 2030 are many, many years away. A satellite launched in 2010, 2011 or even 2015 can still expect to gain backhaul revenues during its lifetime. In fact, that same satellite can be replaced and still gain healthy revenues within its lifespan. Though declining as a market base, 400 million rural dwellers in China is still a very large market to tap. By comparison, the entire U.S. population is expected to reach 312 million by 2015 and 347 million by 2025. BRIC as well as other countries will continue to provide healthy opportunities despite the urban tipping point.

Wealth, Cost and Disposable Income–In subscribing to wireless services, the cost issue is paramount, whether in rural or urban areas. The U.N. report actually indicated that “if the cost of living was factored in, the prevalence of urban poverty would rise closer to that of rural areas.” So in a sense, there is parity in poverty, which means that there is also parity in wealth, cost and disposable income levels. A wealthier rural population such as China’s 400 million in 30 years presents a very attractive market base to tap.

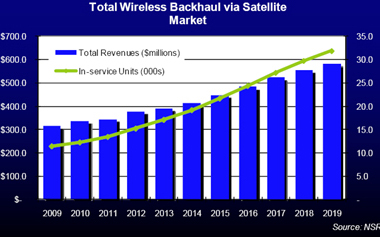

The Bottom Line—Satellite backhaul will continue to grow even with the urban tipping point. Growth will indeed be tempered by urbanization such that steady instead of dynamic growth is expected to take place in the satellite backhaul sector. Cost and ROI considerations in rural areas will be key to satellite’s success.

Information for this article was extracted from NSR's report Wireless Backhaul via Satellite, 4th Edition