Direct-To-Satellite Communications to Generate $9 Billion in Airtime Revenues for Operators in 2030: Kaleido Intelligence

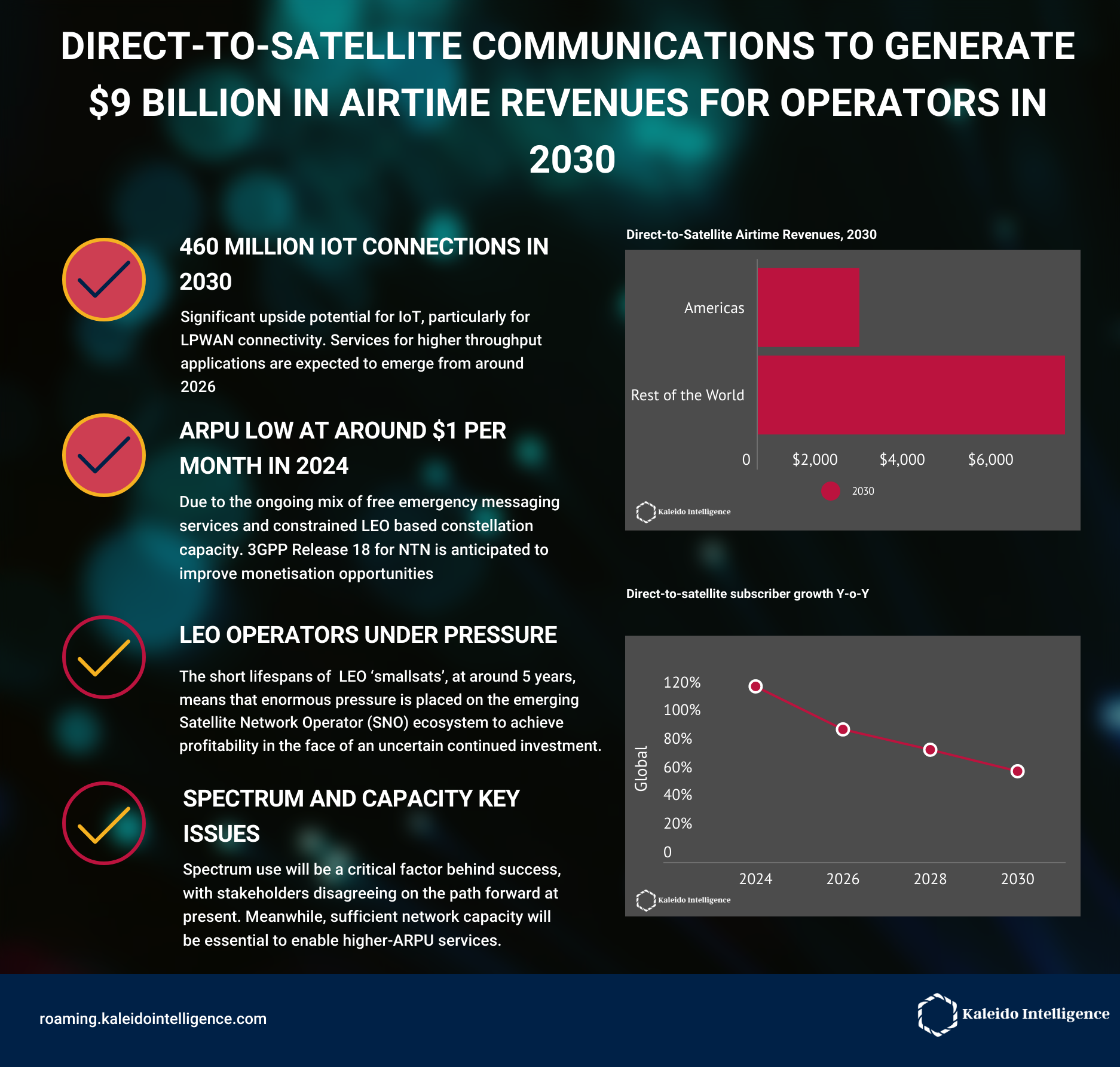

London, UK. February 22, 2023-- A new report from Kaleido Intelligence, a leading connectivity market intelligence and consulting firm, has found that direct-to-satellite connectivity, where unmodified cellular smartphones and IoT devices leverage satellite communications networks, will see revenues for connectivity services reach over US$ 9 billion annually in 2030.

Satcom (Satellite communications) services promise to enable the ‘everything, everywhere’ vision for cellular connectivity, serving as a failover for terrestrial coverage ‘not spots’.

Kaleido anticipates significant potential for IoT initiatives, forecasting over 460 million connections by 2030, although it notes that the path towards market traction is fraught with challenges.

See the full research details here

Cellular-Satellite Communications Market is Now Ripe for Growth

The research, Cellular-Satellite Communications: Opportunities & Outlook 2023-2030, highlighted that the market is moving from proprietary solutions based on bulky, expensive hardware and high-cost airtime services towards services that are able to connect to unmodified cellular devices, signalling a new era for Satcoms.

Chipset makers such as Qualcomm, MediaTek and Sony Semiconductor are supporting this new architecture. Meanwhile, the 3GPP has started the path towards integrated cellular and satellite communications networks, following the finalisation of the NTN (Non-Terrestrial Networks) standard as part of 5G Release 17 last summer. Standardisation and hardware ecosystem support means that the market is now ripe for growth.

Economics and Capacity Critical to Success

At this stage of the market, large ecosystem barriers remain in place. The high-cost nature of launching and maintaining satellites in orbit inherently raises airtime costs for customers, and whether pricing models can be offered that prove sustainable remains under question. Meanwhile, approaches towards spectrum use remain divided at a regulatory level and commercial level, with capacity ultimately likely to remain constrained for the foreseeable future. In turn, this will limit available bandwidth and the scope of overall service potential.

Steffen Sorrell, Chief of Research at Kaleido, commented: “Using existing GEO-based capacity looks the most sustainable way forward for LPWAN IoT connectivity, but few providers have opted for this path. Meanwhile, the relatively low data rates offered by NTN-NR will ultimately mean that the revenue opportunity will remain constrained until at least 2030. Further industry consolidation is inevitable as the market positions itself.”