Euroconsult: Commercial Satellite Ground Segment Aggregate Market to Reach $4-B by 2028

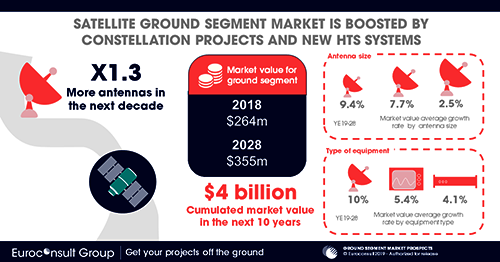

Washington D.C., May 27, 2019 — The commercial satellite ground segment market, including satcom applications, EO applications and user terminals for user applications, is going through significant expansion in terms of both capabilities and demand and will grow from US$ 264 million in 2018 to nearly US$ 360 million in 2028.

According to Euroconsult's latest report, Ground Segment Market Prospects: Part 1, Forecasts to 2028, the aggregated market value in the next decade is expected to achieve US$ 4 billion. The initial Euroconsult report covers only large gateways, while the second part of the report dedicated to user terminals will be published in several months.

2018 has entailed a point of inflextion in the ground segment industry with the preparation of the OneWeb ground network, the launch of additional HTS systems and the need of further ground stations to provide connectivity with EO constellations. After some years of market consolidation in the teleport industry for satcom applications, the number of ground sites is expected to grow from 2019 driven by new installations in emerging regions. In the EO ground segment, the number of ground stations is steadily growing to serve the increasing demand on EO data and value-added services, the report concluded.

2018 has entailed a point of inflextion in the ground segment industry with the preparation of the OneWeb ground network, the launch of additional HTS systems and the need of further ground stations to provide connectivity with EO constellations. After some years of market consolidation in the teleport industry for satcom applications, the number of ground sites is expected to grow from 2019 driven by new installations in emerging regions. In the EO ground segment, the number of ground stations is steadily growing to serve the increasing demand on EO data and value-added services, the report concluded.

"In the last five years, numerous companies have announced new satcom and EO satellite solutions, largelly based on costellation projects but also on large HTS systems, aiming to capture new customers," said Santiago Perez, Senior Consultant at Euroconsult and editor of the report. "Their feasibility and sustainability are usually focused on the space segment, whereas their business cases need to evaluate them as end-to-end systems, including the ground segment that will be required. Their ground segment CAPEX and OPEX is not negligible and will have an impact on the market adoption of these solutions. Finding a sweet spot between space segment performance, ground segment features, along with service provided and price, will be key for the success of new EO and satcom satellite systems."

Each satellite mission, being in constellation or not, might have different communication needs (e.g. modcods, frequency bands, etc.) and so, the rationale for the use of ground segment can vary. The amount of data to download, the regional distribution of end-users, connectivity with ground networks, meteorological constraints, etc,, might also impact the definition and use of the ground segment.

The space sector is pushing for substantially more productive satellite infrastructure and ground segment at a lower cost. This trend is expected to intensify over the next decade, coupled with an increasing push for standardization in satellite manufacturing and ground segment equipment. New technological developments (notably going to SaaS) seek a more productive infrastructure with the aim of making lower cost end-to-end services.

Ground Segment Market Prospects: Part 1, Forecasts to 2028 is the essential tool for business planning and investment decisions in the ground segment industry, covering the different application chains in the ground segment including both satcom and EO applications. Part 2 of the report, to be published later in 2019, is dedicated to user terminals.

Consulting firm Euroconsult specializes in high technology industries, with expertise in the space industry, satellite-based applications and aero connectivity. Privately owned and fully independent, it has over thirty years of experience working with private companies and government entities, helping clients understand business environments and providing them with tools they need to make informed decisions. The company is headquartered in Paris, and has offices in Washington D.C. and Montreal, as well as representatives in Singapore and Tokyo.