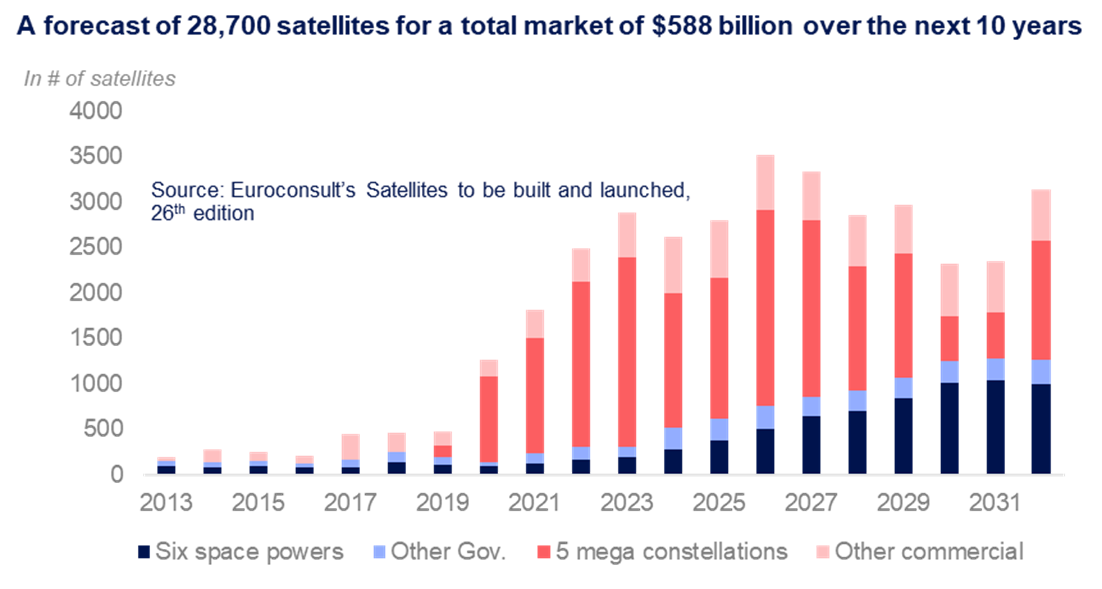

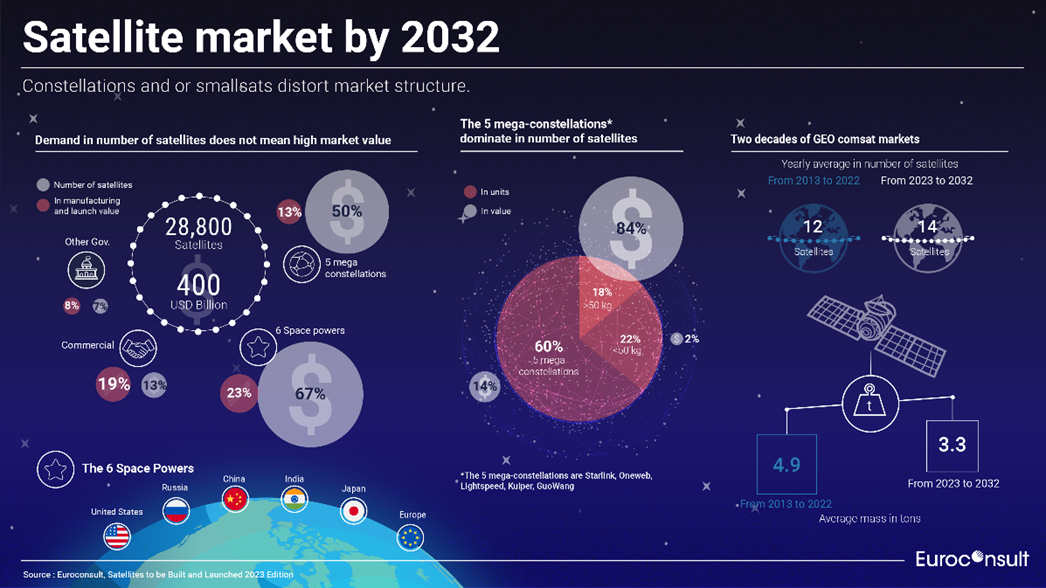

Euroconsult announced the release of its highly anticipated 26th edition flagship report, "Satellites to be Built and Launched. This edition forecasts an average of over 2,800 satellites launched annually – equivalent to 8 satellites per day and totaling a mass of 4 tons - between 2023 and 2032. The report sheds light on the long-term dynamic of the satellite market, emphasizing sustained demand, the concentration of NGSO constellations, and the seismic shifts caused by a handful of mega constellations, with a particular focus on the short-term bottleneck faced by established vendors.

Commercial NGSO constellations, known for their size and advanced capabilities, are reshaping the manufacturing and deployment of satellites to deliver global connectivity. They dominate the industry by concentrating 65% of satellites demand yet contribute only 18% to the manufacturing and launch value, averaging US$ 10.5 billion yearly. In comparison,GEO comsat will average US$ 3.4 billion. Euroconsult forecasts moderate increase in GEO comsat demand, surpassing the levels of the past decade, with an average of 14 orders annually by 2032. However, these are for smaller satellites, resulting in a reduced market value. This shift reflects the decline in broadcasting business and a transition toward the expanding broadband business, emphasizing the need for scalable solutions.

The report also reveals a robust and sustained demand for satellites from legacy customers. Civil and defense government operators alone hold three quarters of the US$ 58 billion manufacturing and launch market yearly average value. The six-leading space-faring governments or organizations alone (U.S, China, Russia, Japan, India, and European governments, EU and ESA) will account for two-third % of the total satellite manufacturing and launch demand in value. Hence, readers are advised to go beyond raw numbers and look at market value to get an accurate picture of the market.

Maxime Puteaux, Space Industry Practice Leader at Euroconsult and editor of the report stated: “The increasing concentrated demands for satellites by a handful of new customers, coupled with high pressure on their cost structures and internalized supply chains, is reshaping market dynamics and placing vendors’ margins under pressure.” He added “The scarcity of launches and the dependency of Western launch customers on SpaceX create a market concentration which will have long term effect on the industry.”

An intriguing aspect covered in the report is the short-term bottleneck faced by established vendors, poised to introduce next-generation launchers. The challenges in this transitional phase are explored in-depth, providing stakeholders with crucial insights into the lasting impact on the market and downstream effects. The report addresses the outstanding performance of SpaceX and its de facto monopoly, given that competitors’ next generation launchers are about to become operational. The implications of this dominance are analyzed, offering a comprehensive understanding of how industry dynamics are shaped by this major player.

The “Satellites to be Built & Launched” report includes a reviewed and refined pricing model for manufacturing and launch prices. Notably, it considers inflation-driven cost and price increases already witnessed in the manufacturing and launch industries, as well as prices anticipated in coming years. The Euroconsult report incorporates new content to provide decision-makers with key knowledge in this area, as along with a reviewed and up-to-date forecast that accounts for the economic situation and ongoing tensions over the supply chain and changing macro-economic environment.

Satellites to be built and launched forecast relies on a thorough satellite demand through an assessment of downstream markets, satellite operators’ strategy and maturity and new players or needs to arise in the future. As the long-term future of satellite demand does not result from the sum of the projects currently known (through satellite backlogs and launch planning), Euroconsult applies various discount factors to them depending on their credibility. Therefore, all constellation-related figures presented were derived from Euroconsult’s assumptions and do not necessarily reflect the views of operators.

This year, a new premium option has been added: Software Defined Satellites Market Insight (also available for standalone purchase), offering a deep dive on software defined satcom payload also known as “flexsat”. This add-on focuses on payload specifications and technology requirements, providing up-to-date tracking of vendors’ offering and customers’ fit and orders. It delves into market drivers, challenges and features a dedicated forecast in GEO and NGSO.

The “Satellites to be Built & Launched” 2023 report is now available on Euroconsult’s digital platform in Standard and Premium versions, offering Euroconsult’s pioneering and unfettered data access and readability. A free extract can be downloaded.

About the Report

“Satellites to be Built & Launched” is the go-to report for any player throughout the satellite value chain, ranging from manufacturers to launch brokers and space agencies, or for those looking for detailed insight into this exciting and fast-developing market. Appreciated by over 85 major players in 2023, the new report provides critical intelligence with as-yet unrivalled levels of precision.

The updated report comes with an option to access premium features line-by-line data on every satellite to be built and launched within the next 10 years, raising the bar once again for the granular and easy to use data access Euroconsult is known for.

About Euroconsult

The Euroconsult Group is the leading global strategy consulting and market intelligence firm specialized in the space sector and satellite enabled verticals. Privately owned and fully independent, we have over thirty years of experience providing first-class strategic consulting, developing comprehensive market intelligence programs, organizing executive-level annual summits and training programs for the satellite industry. We accompany private companies and government entities in strategic decision making, providing end-to-end consulting services, from project strategy definition to implementation, bringing data-led perspectives on the most critical issues. We help our clients understand their business environment and provide them with the tools they need to make informed decisions and develop their business. The Euroconsult Group is trusted by 1200 clients in over 50 countries and is headquartered in France, with offices in the U.S., Canada, Japan, Singapore, and Australia. http://www.euroconsult-ec.com/