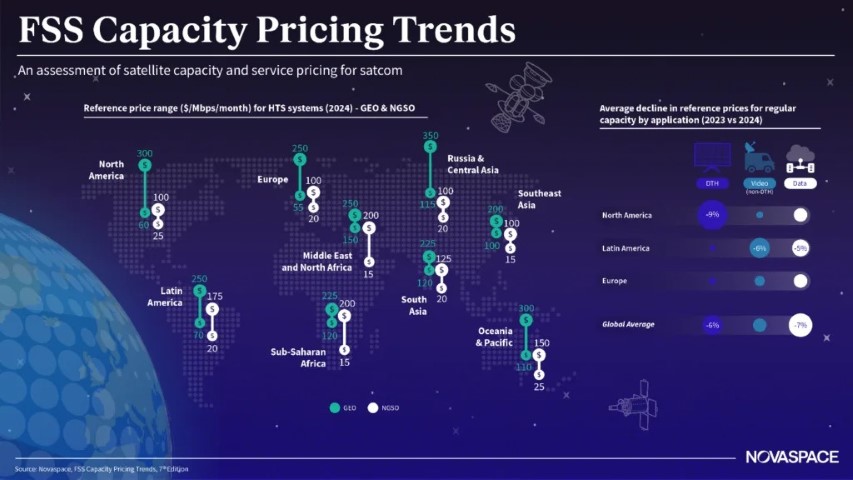

Space consulting and market intelligence firm Novaspace has released the 7th edition of its FSS Capacity Pricing Trends report, analyzing the shift in satellite capacity pricing as the industry moves from scarcity to abundance. As new-generation satellites drive down costs, traditional wholesale leasing models are under increasing pressure. Operators are responding by adopting value-based pricing and innovative service models to remain competitive. Falling cost structures are reshaping pricing strategies across the sector. Starlink has led the push for lower $/GB pricing, reaching approximately US$ 0.20 per month for consumer broadband in most regions. Meanwhile, other operators are introducing competing plans, intensifying market competition. “The shift from ‘scarcity’ to ‘abundance’ of capacity supply is pushing operators to embrace value-driven pricing strategies,” said Grace Khanuja, Senior Consultant at Novaspace.

The cost base of satellite capacity is projected to fall below US$ 1 per Mbps per month over the next two to three years. While video pricing for traditional infrastructure remains relatively stable, data application pricing is seeing greater declines due to the rise of NGSO systems. The report also highlights a growing shift toward best-effort services over committed information rate (CIR)-based offerings, varying by industry segment.

New use cases, particularly in mobility and agriculture, are emerging as satellite operators explore new revenue streams. Starlink’s expansion into land mobility services at economical price points demonstrates how operators are adapting to changing demand patterns. The ability to deliver affordable, flexible connectivity is becoming a critical competitive factor in the evolving FSS landscape.

About the Report

The Novaspace FSS Capacity Pricing Trends report provides a comprehensive analysis of satellite capacity pricing across regions, applications, and infrastructure. It examines evolving pricing dynamics amid technological advancements and increasing capacity from next-generation satellites.

The report evaluates pricing shifts over the past 12–18 months, offering a “best-fit” price range and standard reference levels for different regions and applications. It also assesses the cost base of satellite capacity, particularly for GEO and NGSO-HTS systems, factoring in new platforms like Starlink v3 and Amazon Kuiper.

With over 2,500 capacity contracts and 2,800 broadband service plans analyzed, the report delivers detailed pricing benchmarks. It includes a deep dive into service pricing by application, a Starlink pricing database, and business case simulations to determine break-even pricing for sustainable operations.

The latest edition expands mobility service pricing coverage, refines GEO and NGSO-HTS capacity pricing distinctions, and updates cost-based analyses for emerging satellite constellations. Classic and premium editions offer varying levels of historical pricing data, regional insights, and a rich database of satellite broadband plans.

FSS Capacity Pricing Trends

Novaspace report highlights evolving pricing models amid growing supply and cost-efficient capacity