The emergence of new generations of satellite Internet of Things (IoT) networks over the last years and their promise of low-cost and low-power global IoT connectivity is seen by many as the fuel for the global 4th Industrial Revolution (4IR).

With satellite IoT as a key driver for the 4IR, along with advancements in sensor miniaturisation, edge and cloud computing and AI, satellite IoT will enable it to expand globally and to all sectors of society.

No wonder market forecasts are bullish, and expectations for satellite IoT are high. Market research forecasts show strong growth, with satellite IoT subscriber numbers increasing by over 20% annually, from 4.5 million in 2023 to 30 million by 2030.

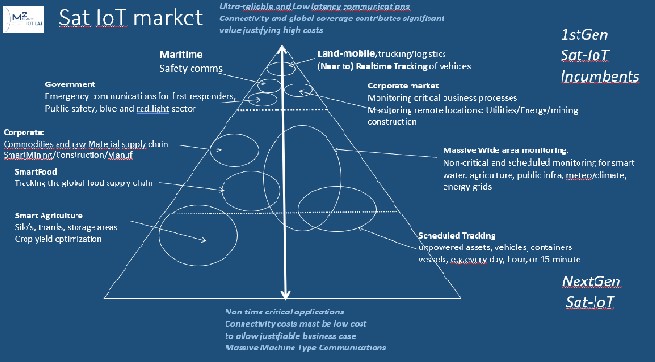

For years, we have seen satellite IoT in market segments like maritime, aero, government, land mobile logistics, or the corporate energy and utility markets, which require critical communications for high-value applications and assets. That market is also growing, but the bulk of the growth in the future is expected to emerge in new and larger market segments, like Environmental Monitoring, Agriculture, or Corporate and Private Asset Management. In these segments, non-critical applications like monitoring require lower-quality services, e.g., in terms of latency, and as such, they perfectly match the features of new generations of satellite IoT networks.

As such, Satellite IoT is expected to be a game changer for global sustainability initiatives. It will enable monitoring of environmental variables (water, air, soil) and provide essential data for climate change adaptation and addressing the UN’s Sustainable Development Goals. This will also benefit the 570 million farmers worldwide who could use better information about their soil condition, local weather conditions, water levels or nutrient distribution over their land, and more to improve their crops and food production.

At M2sat, we focus on new satellite IoT applications for the environmental monitoring market, particularly Hydro Observations. We do this with partners from the hydrological world, like Tahmo.org, which runs a large hydro-met observation network in Africa, providing critical data to national and local governments, hydro dam operators, and weather institutes. This article is written from that perspective.

In this article we will first examine the more than 40 satellite IoT network operators and then discuss market growth and the downstream value chain in those new satellit IoT market segments.

The Evolution of Satellite IoT Networks

Satellite IoT networks have existed for more than 25 years. During the last decade new technology, such as the use of CubeSat-based satellites and the miniaturisation of electronic equipment, combined with lower satellite launch costs and increased data processing power, has disrupted the market.

Satellite IoT networks can be summarised across five key generations:

First Generation: The Incumbents (1990s -Present)

Dominated by major players like Inmarsat, Iridium, Globalstar, and Thuraya, the incumbent networks provide highly reliable IoT services for critical communication in sectors such as government, military, and maritime. They rely on proprietary protocols and own valuable L- and S-band MSS spectrum bands.

Second Generation: Low Power Global Area Networks (2018 - Present):

Triggered by advances in smallsat technology and lower launch costs, about a dozen new start-ups emerged, promising low-cost/low-power services with global coverage. Only about half of these networks offer commercial services today (e.g. Astrocast, Myriota, Head Aerospace).

Third Generation: Piggyback networks (2021 – Present):

Some new operators opted to "piggyback" on existing satellites to provide IoT services. Here, the costs of adding a dedicated IoT payload to satellites stands versus the costs of a dedicated satellite IoT network.

Examples here are Skylo, which works over any "bent pipe" L-band satellite network (e.g., Inmarsat); HiSky, which similarly works with Ku-/Ka-band Geo and LEO satellites; and eSat, which plans to use the L-band-based Thuraya satellites. Future broadband satellite operators like Iridium, Starlink, and OneWeb are also considering adding a dedicated IoT Payload to their constellations.

Fourth Generation: Hybrid terrestrial-satellite networks (2021 – Present)

Some new operators' focus on standardisation led to hybrid networks that integrate terrestrial standards like 5G and LoRaWAN offering seamless connectivity between cellular and satellite services, reducing costs and simplifying deployment for applications.

An early example is Lacuna, which has existed since 2019 and is developing a LoraWan-based satellite IoT network platform with payloads on its own or third-party satellites, like Omnispace and OneWeb.

In 2022, Ireland-based Echostar Mobiel successfully launched its IoT services in Europe based on the LoraWan protocol and using S-band frequencies over the Echostar 21 satellite. Other examples from this generation are Sateliot (Spain), OQ Technology (Luxembourg), and Kineis (France).

Fifth Generation: Direct to Cell (2023 - Present)

The latest generation of satellite IoT features Direct-to-Cell networks, like the Globalstar/Apple and the T-mobile / Starlink combinations, will extend connectivity to standard mobile devices Other initiatives include AST Space Mobile and Lynk, which are in an early development phase and still struggling with funding and licensing.

And what to think of innovative satellite IoT networks using “license-free” ISM spectrum and new satellite technologies, like the PicoSat-based networks under development from Apogea (Italy), Hydra Space (Spain), Innovaspace (Argentina). Or the Ingenu and Totum satellite networks (US) working in the unlicensed 2.4 Ghz spectrum. In March 2024, US-based Hubble Network launched and successfully tested its first two satellites and received signals from a simple 3.5mm Bluetooth chip.

Choosing the right Satellite IoT Network

Investing in developing a global satellite IoT application is expensive and only viable in the long run. Sensors must be connected, modems configured, and data analytics servers and dashboards programmed, not to mention the challenge of lifecycle support for units in the field.

How can service providers, sensor manufacturers, system integrators, IoT solution providers, and new customers choose among more than 40 networks? Each has its own service quality, pricing, coverage, protocols, hardware, and licenses/landing rights, making the market difficult to oversee.

Figure 1: Satellite IoT Pyramid market model (Source M2sat)

Most importantly, the satellite IoT network of choice needs to be future-proof and financially stable. Doubts are especially strong for networks claiming low-cost/low-power connectivity but yet have incomplete constellations. Will they survive and find investment money to complete their constellation?

Of course, as an IoT solution provider, you can choose the safe way and the incumbent networks, but what if your competitor perseveres in innovation and succeeds with a lower-cost network based on next-generation IoT technology?

Satellite IoT Market Expansion

The diversity of networks described above makes the market highly competitive, drives down costs, and promotes technological innovation, which is good news for customers and market segments that previously have not been able to afford satellite connectivity.

The figure below shows how the market will expand from the niche markets for critical communication segments like government, aero, maritime or the utility/energy/mining sectors in the corporate market at the top of the pyramid to the much larger markets for Wide Area Monitoring /Telemetry, Environmental Monitoring, Agriculture and other non-critical corporate applications at the bottom of the pyramid.

Satellite IoT currently focuses on the niche markets at the top of the pyramid, with approximately 4.5 million units. Advancements in 4IR technology and data analytics, combined with lower connectivity costs and power consumption, will expand the market to 30 million units in 2030.

Satellite IoT for Good?

Thanks to satellite IoT, more segments of society than ever will be able to join the 4IR and enjoy its transformative benefits. One major area, and not only in a commercial way, will be climate change adaptation. Current environmental in-situ (on the ground) observation networks are limited to areas with terrestrial (GSM) coverage. Satellite IoT will change that, providing monitoring data from meteo, hydro, air quality, and pollution sensors on a truly global scale.

Or consider what IoT can do for the approximately 570 million farmers worldwide. They can significantly benefit from improved information on the soil moisture, water level, and nutrition distribution in their fields, enhancing their crops and helping feed the world. Satellite IoT has the potential to revolutionise global agriculture, inspiring a new era of productivity and sustainability.

Figure 2. The IoT value chain and application components.

Don’t forget asset tracking either: in the future, every asset, such as a camper, leisure boat, or car, worth more than a couple of thousand Euro/Dollar and that might roam outside terrestrial network coverage will be tracked via satellite.

What are the growth drivers in the new Satellite IoT market segments?

There are two critical factors for growth:

1.Low Cost-of-Ownership of end-to-end satellite IoT applications.

Low Satellite IoT Connectivity cost alone are insufficient to drive market growth, as they are only a minor part of the total IoT application costs. IoT is not a basic data or standard IP connectivity service that you can sell in bulk and compete on price. It is an application-driven business with a complex mix of sensors, connectivity, data processing, and dashboard technologies, all nicely wrapped in an easy-to-install-and-maintain package at a competitive price.

Nearly all satellite IoT application components show strong technological growth with an impact on costs. Sensor technology is developing fast, with sensors becoming smaller and offering more functionality for lower prices; edge processing is reducing sensor data volume and, thus, connectivity costs. And is the true customer value not with the insight generated in the data analytics and displayed on a smart dashboard, using the increased cloud processing power and AI?

Important here are also lifecycle costs. How easy is installing the unit, particularly in remote areas, and how can it be maintained? Having an installer drive up to the unit along the Black Volta River in Ghana for maintenance can be costly.

2. Building a strong value-chain/Eco system for the new market segments

Incumbent satellite IoT networks had 25 years to build their value chains. They are often organised by vertical market segments and with applications based on deep knowledge of the service provider of customer needs and requirements.

Before new markets can be opened up and growth can happen, working application value chains are required for new markets like environmental monitoring or agriculture, with ecosystems and partnerships to provide and integrate sensors, modems, satellite services, application servers, and dashboards into a complete end-to-end application.

As with building satellites, and satellite constellations, this will take investments and time.

Conclusion

The satellite IoT landscape in 2024 shows that the incumbent oligopoly of incumbent satellite IoT networks is still going strong, but new generations of innovative satellite IoT network operators are aiming to offer low-cost/low-power global connectivity to extend and grow the market.

Combined with reduced technology costs, e.g., for sensors, edge computing, and cloud data processing power, satellite IoT will fuel the proliferation of 4IR to new and larger segments of society.

Incumbent satellite IoT operators will benefit from strong growth (15% per year) in the traditional critical communications segments. However, the strongest growth is expected in wide-area monitoring/telemetry segments, such as the environmental monitoring, agriculture, or asset management markets.

For these new markets, two key factors will be critical for growth:

1. the low total Cost-of-Ownership for Satellite IoT applications

2. a strong partner ecosystem of satellite IoT network operators, service providers, system integrators, and solution providers with market knowledge

This means that after a phase in which the satellite IoT market focused on the upstream market (spending hundreds of millions building innovative satellites and launching satellite IoT constellations), the focus and investments now need to shift to the downstream. In the wake of the 4IR, and together with an ecosystem of solution partners, new satellite IoT applications need to be developed to serve the needs not only of customers in the traditional but also those in new market segments. We might change the world by doing so.

A challenge that we gladly will take up.

--------------------------- Hub Urlings was one of the pioneers of Satellite M2M/IOT as Product Manager Inmarsat-C at the famous KPN Station 12. This "small data" satellite service's success, global coverage, and reliability made Inm-C the service of choice for many applications: from sending messages to truck fleet management to pipeline monitoring and bringing back data from all types of sensors. Now, 25 years later, he is still involved in developing a new generation of Satellite-IoT applications. He can be reached at: urlings@m2sat.com

Hub Urlings was one of the pioneers of Satellite M2M/IOT as Product Manager Inmarsat-C at the famous KPN Station 12. This "small data" satellite service's success, global coverage, and reliability made Inm-C the service of choice for many applications: from sending messages to truck fleet management to pipeline monitoring and bringing back data from all types of sensors. Now, 25 years later, he is still involved in developing a new generation of Satellite-IoT applications. He can be reached at: urlings@m2sat.com