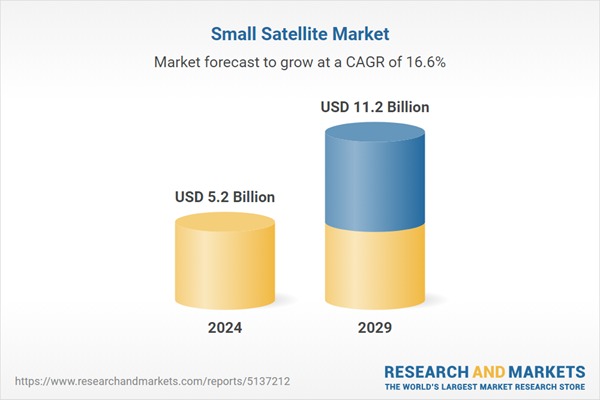

Small Satellite Market Global Forecast to 2029

Dublin, Ireland, November 1, 2024.- The small satellite market is estimated to grow to US$ 11.2 billion by 2029, from US$ 5.2 billion in 2024, at a CAGR of 16.6% from 2024 to 2029. The anticipated number of small satellite launches from 2024 is expected to increase by around 1442 from 3220 units to reach 4,662 units in 2029 accoridng to new research from Research and Markets.

|

This surge has been stimulated by increasing demand for commercial satellites boosting the launching of small satellites. They are widely accepted since they are affordable, have short developing periods and can serve various purposes such as telecommunication, earth observation, etc. The growing need for small satellites is fueled by technology advancements like innovative production methods, lighter materials and artificial intelligence integration. Such improvements make it easier to build advanced capable satellites which can do difficult tasks that were limited to larger ones in the past. Furthermore, greater miniaturization focus as well as high performance small devices construction facilitate design of more effective spacecrafts.

Government & Defence segment by end use is expected to hold the second highest market share in 2024.

Based on end use, the small satellite market is categorized into commercial, government & defence, and dual use. The government & defence segment having second highest market share of 9.1%. The government and defense segment of the small satellite market is driven by the critical need for enhanced communication, surveillance, and reconnaissance capabilities. Increasing geopolitical tensions and the necessity for stepped forward national safety features are key elements propelling the adoption of small satellites.

Earth observation & remote sensing segment by application is estimated to hold the second highest market share in 2024.

Based on application, the market is further segmented into communication, earth observation, scientific research, technology and others. The Earth observation & remote sensing segment having second highest market share of 30.8%. Key players in the industry are actively working on developing advanced high resolution earth observation satellites to take advantage of new opportunities in this market. Advancements in satellite imaging technologies and data analysis capabilities have enabled small satellites to offer valuable insights for climate research, resource management and government policy making. Public-private partnerships and investments from businesses also significantly drive this segment’s growth thereby enhancing affordability and accessibility of Earth observation services.

Asia Pacific is expected to hold the second highest market share in 2024.

The small satellite industry in Asia Pacific is booming, with more money flowing in from both established and up-and-coming space countries. New companies focusing on small satellite tech are popping up all over the region. These new organizations bring new ideas making the whole market stronger and more exciting. This growth is prompted by the need for better communication infrastructure particularly in remote and rural areas, as well as growing government’s focus on managing disasters and environmental monitoring through satellite technology. In addition to that, the region has a strong collaboration between the countries and private companies that have improved innovation leading to deployment capabilities thus making Asia Pacific one of the dynamic players in global small satellite industry.

The break-up of the profile of primary participants in the small satellite market:

- By Company Type: Tier 1 - 35%, Tier 2 - 45%, and Tier 3 - 20%

- By Designation: C Level - 35%, Director Level - 25%, Others - 40%

- By Region: North America - 20%, Europe - 25%, Asia Pacific - 35%, Middle East - 10%, and Rest of the World - 10%

SpaceX (US), Lockheed Martin Corporation (US), Airbus Defence and Space (Germany), Northrop Grumman (US), L3Harris Technologies, Inc. (US). These key players offer connectivity applicable to various sectors and have well-equipped and strong distribution networks across North America, Europe, Asia Pacific, the Middle East, Africa, and Rest of the World.

Research Coverage:

In terms of Mass, the small satellite market is divided into small, micro, mini, nano, and cube. The end use segment of the small satellite market is commercial, government & defence and dual use.

The frequency-based segmentation includes L- Band, S-Band, C-Band, X-Band, Ku-Band, Ka-Band, Q/V/E- Band, HF/VHF/UHF-Band, and Laser/Optical.

Based on application, communication, earth observation, scientific research, technology, and others. The orbit segment is divided into LEO, MO, GEO, and other orbits.

This report segments the small satellite market across five key regions: North America, Europe, Asia Pacific, the Middle East, Africa and Rest of the World along with their respective key countries. The report's scope includes in-depth information on significant factors, such as drivers, restraints, challenges, and opportunities that influence the growth of the small satellite market.

A comprehensive analysis of major industry players has been conducted to provide insights into their business profiles, solutions, and services. This analysis also covers key aspects like agreements, collaborations, new product launches, contracts, expansions, acquisitions, and partnerships associated with the small satellite market.

For more information go to: https://www.researchandmarkets.com/report/small-satellite