The satellite market is one that constantly continues to change and evolve as new technologies emerge, price points change, new markets open up and new alliances are struck. However, there is another independent variable that at times, and this is one of those times, can have a dramatic effect on the overall market; and that is geopolitical tensions.

Space is an increasingly important element in global defense and security. There are three key factors driving this growth.

- Firstly, space itself is becoming a potential war zone as the technology exists, not only to closely monitor other satellites, but also to destroy them.

- Secondly, ground operations are progressively becoming more reliant on information delivered from space. This could be ground surveillance information, relayed from earth observation (EO) satellites and drones, or communications originating elsewhere in the theater of war; and

- Thirdly, nationalism is coming to the fore. Many countries now want to have their own independent space assets, particularly when it comes to national defense.

Military Space and Ground Systems play a critical role in modern defense, ensuring secure, resilient, and real-time connectivity across all domains—land, sea, air, space, and cyberspace. These systems support a wide range of military applications, improving command capabilities, intelligence gathering, and battlefield coordination.

Key Applications of Military Satellite Systems include:

- Command and Control (C2) - Enables continuous, secure communication, allowing commanders to direct operations and receive intelligence anywhere.

- Early Warning & Missile Defense Supports missile detection, tracking, and early alerts, enhancing defense response strategies.

- Intelligence, Surveillance & Reconnaissance (ISR) – Ensures real-time data transmission from reconnaissance satellites to ground command centers for threat analysis and decision-making.

- Secure & Resilient Communications – Provides encrypted, jam-resistant networks, with systems like AEHF satellites ensuring functionality in nuclear or electronic warfare scenarios.

- Global Force Connectivity – Links deployed forces, fleets, aircraft, and remote bases, enabling seamless joint and coalition operations.

- Resilience Against Threats – Designed to withstand cyberattacks, jamming, and anti-satellite (ASAT) threats, ensuring mission continuity.

- Space-Based PNT (Positioning, Navigation & Timing) – Supports accurate signal distribution for navigation and precision-guided munitions.

Taking all these factors into account, it is hardly surprising that in its first Space Defense and Security report, Novaspace (a merger between Euroconsult and SpaceTec Partners) is forecasting that the global launch rate for defense and dual use (defense and commercial) satellites will grow by 160% in the ten years to 2034. A record 107 defense and dual use satellites, were launched in 2023, a massive 40% increase from the previous year. Well over one-third of these (44) were US satellites.

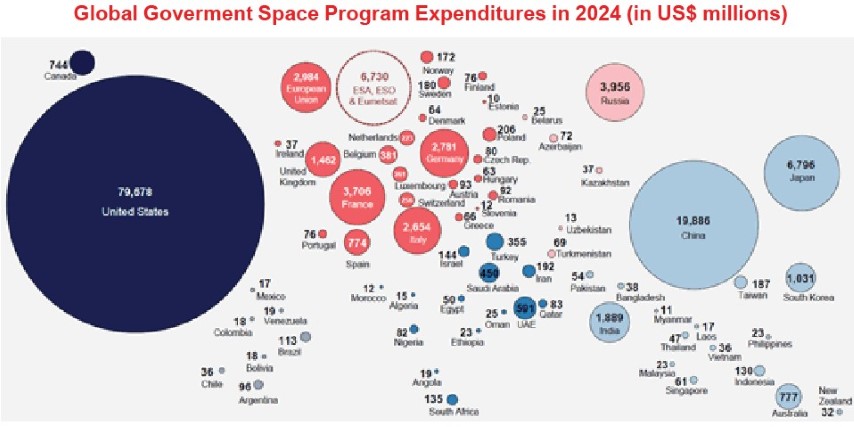

In the same report, it estimated that in 2023 worldwide government expenditures in space defense and security reached a record US$58.4 billion. As would be expected, the bulk of this expenditure US$38.9 billion) came from the US, followed by China (US$8.8 billion), Russia (US$2.6 billion) and France (US$1.3 billion). Three other countries, the UK, Germany and Japan and the European Union funneled over US$500 million each into defense and security.

|

|

Globally, US$40.2 billion of the US$58.4 billion was contracted to industry to supply four key segments of the value chain. These are: manufacturing and launch of defense and dual use satellites (US$24 billion), operations (US$10.2 billion), user terminals for SATCOM and positioning, navigation and timing (PNT) (US$3.3 billion), and managed and value-added services (VAS) (US$ 2.7 billion).

The US DoD

The US Department of Defense (DoD) as the organization with the largest budget for expenditure on space related defense is now focused on integrating commercial space solutions into the national security framework in two main areas. Defense missions are classified into three main groups, with only one of them being largely reserved for government entities. These groups are:

1. Government Primary Mission Areas. These areas require the majority of the functions to be handled by government-operated systems. In particular the core capabilities must remain separate and distinct from commercial offerings. Mission areas currently classified under this category include:

- Combat Power Projection

- Command and Control (C2) i including Nuclear Command, Control and Communications (NC3)

- Electronic Warfare (EW)

- Nuclear Detonation (NUDET)

- Missile Warning (MW)

- Positioning, Navigation and Timing (PNT)

2. Hybrid Mission Areas. In this category both government and commercial entities can contribute, so this has beome a significant area for commercial players, as DoD leverages both to enhance operational effectiveness. Included in this area, are:

- Cyberspace Operations

- Satellite Communications

- Spacecraft Operations

- Intelligence, Surveillance and Reconnaissance (ISR)

- Space Domain Awareness (SDA)

- Electromagnetic Spectrum (EM) Operations

3. Mission Areas primarily served by Commercial Entities with only a few functions requiring direct government involvement. In other words, these are mature solutions that have met military standards for mission assurance. The Space Access Mobility and Logistic (SAML) mission falls into this category. Several emerging commercial services may well be included in this category in the future, In Space Servicing, Assembly and Manufacturing (ISAM) for example.

The DoD is continuously evaluating these categories, with the objective of integrating commercial advancements where possible, with the aim to enhance the resilience, agility and effectiveness of national security space operations.

Last May, in a testimony before the Senate Armed Services subcommittee, John D. Hill Deputy Assistant Secretary of Defense for Space and Missile Defense outlined the key investment areas relating to space in the DoD’s budget request for 2025. Included US$33.7 billion for space programs were US$2.4 billion for launch capabilities, US$1.5 billion for more resilient PNT, US$4.2 billion for more protected satellite communications, US$4.7 billion to develop new missile warning and tracking architectures and US$12.3 billion for other capabilities aimed at increasing the resiliency of existing DoD space architectures.

The highlights of last year’s DoD’s Commercial Space Integration Strategy were also presented during the same session. Four priorities have been identified to achieve this integration.

- Outlining DoD’s requirements to in contracts and other agreements to enure that commercial solutions are available when needed.

- The integration of commercial solutions into defense architecture during peace time, including planning, training and routine operations to ensure warfighters can seamlessly utilize these solutions during crises or conflict.

- Protecting and defending against threats to U.S. national security space assets (in space or on the ground) and commercial space capabilities where appropriate.

- DOD to use its full range of financial, contractual and policy tools to support the development of new, commercial space solutions that have the potential to support the joint force.

Also at the presentation was General Michael A. Guetlein, Vice-Chief of Space Operations for the Space Force, he commented: “Space has never been more critical to the security of our nation, and the success or failure of the joint forces depends heavily upon the capabilities that we present.”

Military satellite equipment must meet Size, Weight and Power (SWAP) specifications as well as ease of use and portability in the battlefield. (Photo courtesy of the US Marine Corp System Command)

The new administration has recently ordered the DOD to cut its 2026 total budget request by approximately $50 billion, so that the money can be allocated to “new priorities.” At this point it is not clear where those cuts will come from, but what is clear is that the “Iron Dome for America” intended to shield the US from hypersonic and ballistic missile attacks, is excluded from the cuts. This program relies heavily on space assets. So it would appear reasonable to assume that space will continue to be a major priority for defense.

Key Requirements

Given the increasing emphasis on the use of commercial partners for the DoD, and other defense departments, it’s worthwhile to considering some of the key features and services that are, and will be needed. As regional and global geo-political tensions increase, military operations are becoming increasingly complex, encompassing dispersed communications, multi-orbit, multi-frequency networks, enhanced cybersecurity protocols as well as standardized equipment to support mission-critical operations and mitigate interception, jamming and interference, whether intentional or not.

High service level agreements (SLAs) are a necessity, these can be achieved by creating networks composed of military and commercial satellites, in different orbits and using different frequencies. Obviously, the hardware must be ruggedized and designed to operate seamlessly in all environments: maritime, aeronautical and land (fixed and mobile). Equipment providers must also be able to respond quickly to requests and be capable of providing rapid installation wherever needed. Size, weight and power (SWAP) must also be taken into consideration when equipment will be used on the move (OTM) or on the pause (OTP).

Capacity is obviously a critical factor. Military customers may need to accurately transmit encrypted video, and tactical plans at short notice. Therefore, advanced quality of service settings, which can dynamically adjust traffic prioritization across multiple satellites, orbits and frequencies and terrestrial networks, are a necessity.

Accurate network sizing is needed to ensure maximum performance and efficiency. This includes the ability to rapidly upgrade, troubleshoot and maintain the network, as well as ensuring that non-technical military personnel are able to reconfigure the settings as and when needed.

One of the key trends in ground operations is virtualization: the transition of hubs and modems from hardware to software. This is even more important for military communications than it is for commercial operations. Being able to remotely perform software upgrades, that may add support for additional waveforms and security protocols, as and when needed is a major advantage. Advanced modems already incorporate frequency-hopping, spread-spectrum and interference mitigation algorithms and advanced anti-jamming techniques along with intercept detection to enhance security. As updates and upgrades become available, being able to apply them remotely and immediately serves to enhance troop security.

“...One of the key trends in ground operations is virtualization: the transition of hubs and modems from hardware to software. This is even more important for military communications than it is for commercial operations...”

Zero Trust Architecture (ZTA) and end-to-end encryption are both important for defense communications. ZTA verifies every network request before granting access. In addition military networks are utilizing Advanced Electronic Signature (AES) 256 encryption and Post Quantum Cryptography (PQC), to ensure secure data transmissions. Quantum Key Distribution is also being explored to enhance encryption resilience against future quantum computing threats.

The advent of low earth orbit (LEO) constellations, has been accompanied by significant improvements in antenna technology. Electronically steered phased array antennas, autonomous tracking systems and ruggedized deployable antennas are all now used in tactical operations.

Flat panel electronically steered antennas (ESAs) are replacing parabolic antennas as they provide rapid beam forming and multi-beam connectivity, a key requirement to ensure network redundancy. AI-powered tracking systems enhance ground terminals’ ability to auto-align with moving satellites, reducing downtime and increasing reliability and optimizing signal quality to compensate for atmospheric changes.

This accelerated growth, and increasing emphasis on commercial involvement in the defense and government marketplace, makes it a good time for key players to focus on these sectors. Orbital Connect is one of those players, already highly successful in the commercial satcom market the company is now turning its attention to government and defense and the US DoD in particular.

Orbital Connect

Orbital Connect is an authorized distributor and connectivity services provider, with a whole host of major clients, including: Aerospace Corporation, FMC Globalsat, Globecast Americas, Telspazio, Mitre Corporation, Raytheon, Northrup Grumman, and L3 Harris from the commercial sector. In the government and education sectors, it has an equally impressive client list, including: the US House of Representatives, the US Antarctic Program, the US Agency for Global Media, the United Nations, the University of San Diego and Ohio University.

It has a similarly impressive roster of over 40 vendors and partners in the satellite, broadcasting and telecom sectors that it works with. This enables Orbital Connect to choose from over 5,000 products when designing a system for its clients. Customers can therefore be confident that whatever solution is offered to them, it will be the most suitable for their particular situation and precisely tailored to their needs.

In the last year Orbital Connect has made significant strides to expand its capabilities and offerings on the service side of the business. As an authorized Partner with iDirect, Orbital Connect has expended its resale agreement including Canada where it has addressed the contribution and distribution needs of broadcasters and Canadian government agencies, looking to supply them with the latest modulators and professional modems and hubs such as Evolution, Velocity, Dialog incorporating all standards including IP over satellite.

In 2024 the company also expanded its relationship with Speedcast and is now an authorized indirect reseller of Starlink and offers Maritime, and Land high speed connectivity . This agreement enables Orbital Connect to be able to offer services including uplink/downlink, teleport hosting, and turnaround services through their Teleport Facilities. Agreements with Verizon and AT&T mean that 4G and 5G services can also be supplied and integrated into satellite connectivity, as well as fixed terrestrial service. Essentially through this agreement, Orbital Connect is able to access and offer the full capabilities of Speedcast, including OneWeb service.

In addition, Orbital Connect has agreements with Intelsat, Inmarsat/Viasat, Worldlink Martime Communications, IABG teleports and Globalstar. Other vendors and partners include: MediaKind, Norsat, Terrasat, Kymeta, Cobham, Intellian, Paradigm, Comtech, Novelsat, Sat-lite Technologies, Satcube, SatService, RF Design and many more.

Services and Defense

Having created relationships with many of the A list industry players, Orbital Connect is now turning its attention to services and the defense market in particular.

“...This accelerated growth, and increasing emphasis on commercial involvement in the defense and government marketplace, makes it a good time for key players to focus on these sectors...”

It has taken a very structured approach to the defense market, working for over a year with experienced consultants in this area to ready itself to obtain GSA certification as an approved vendor. The company expects to receive this in the next few months. It has also created a separate specialist; experienced sales force for this sector. Working with the US government is very different to working with the commercial sector. This sales force is focusing on building good relationships with procurement officers to understand their needs and ensure that they understand the capabilities and experience of Orbital Connect. Naturally this sales force is also searching for suitable tenders and opportunities.

Orbital Connect has also expanded its product line to include a broad range of ruggedized terminals that comply with DoD standards and enable different customizations in specific customers’ requirements as well. It can also supply modems incorporating enhanced security including AES-256, FIPS-140 and TRANSEC.

------------------------ Elisabeth Tweedie is Associate Editor of the Satellite Executive Briefing and has over 20 years experience at the cutting edge of new commmunications entertainment technologies. She is the founder and President of Definitive Direction (www.definitivedirection.com), a consultancy that focuses on researching and evaluating the long-term potential for new ventures, initiating their development, and identifying and developing appropriate alliances. She can be reached at: etweedie@definitivedirection.

Elisabeth Tweedie is Associate Editor of the Satellite Executive Briefing and has over 20 years experience at the cutting edge of new commmunications entertainment technologies. She is the founder and President of Definitive Direction (www.definitivedirection.com), a consultancy that focuses on researching and evaluating the long-term potential for new ventures, initiating their development, and identifying and developing appropriate alliances. She can be reached at: etweedie@definitivedirection.