Africa: A New Era for Space and Uncertainty for Satcom

By Blaine Curcio

Cairo, Egypt, May 2, 2025--The African continent can often be an afterthought in high-tech, capital-intensive industries such as space and satellite communications, but any way you slice it, the coming decades are going to see strong growth from this region. With a large and growing percentage of the world’s young people, dozens of fast-growing economies, and newly-established space agencies popping up every few months, Africa is a booming frontier market for the global space industry. At the same time, the region’s more well-established satcom sector faces uncertainty, but opportunity, from changing market dynamics.

African Space Agency Headquarters in Cairo, Egypt

All this and more was on display at the NewSpace Africa Conference, which took place at the Egyptian Space City in New Cairo from 21-24 April. Organized by Space in Africa, the African Space Agency (AFSA), and the Egyptian Space Agency (EgSA), the conference brought together 550 attendees from some 60 countries in a celebration of all that is African space. Your correspondent was in attendance for the entire week, so let’s dig in.

The Rise of Africa’s Space Sector

Stemming from growing government interest, the space sector in Africa is undeniably on the rise, and the biggest example during the week took place before the conference even started. On 20 April, Easter Sunday, the gleaming new African Space Agency building was inaugurated. A part of the same massive Egyptian Space City complex that houses EgSA and the new Chinese-built AIT Center, the new AFSA HQ is impressive, with marble floors and high ceilings. Over the coming years, if all goes according to plan, delegates from all over the continent will convene here for joint African space missions and other continent-wide initiatives.

|

|

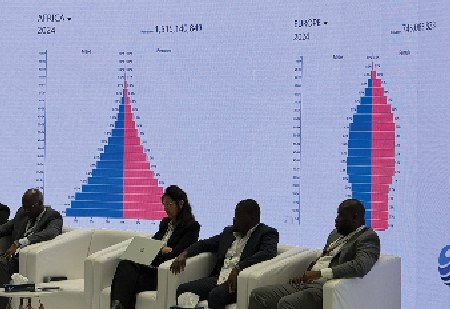

African population pyramid |

And just as well they now have a building, because national space agencies have been popping up like mushrooms across the continent. To name a few:

- Senegal established their own space agency in 2023, and recently signed onto the Chinese International Lunar Research Station (ILRS)

- Ghana is currently drafting the Ghana Space Agency Bill

- Côte D’Ivoire is planning to create a space agency any week now

- And some older agencies are still quite new, with Kenya establishing one in 2017 and Rwanda in 2021.

Most of these new space agencies have similar mandates, typically involving capacity building, knowledge/technology transfer, and economic development. Most of them also emphasize EO projects, with there being plenty of low-hanging fruit in improving agricultural yields, maintaining and defining border regions, and responding to disasters.

And with all these new space agencies popping up, there are unsurprisingly a number of more well-established foreign partners hoping to win business and help develop the continent’s space sector. The most prominent during the NewSpace Africa Conference were the US (with the biggest booth right at the front of the expo area), France, Japan, and the European Union. Also present in a more subtle way was Russia and Turkey, while unsung hero and conference host Egypt was positioning itself front and center as the big brother to the rest of Africa’s space sector.

"...With a large and growing percentage of the world’s young people, dozens of fast-growing economies, and newly- established space agencies popping up every few months, Africa is a booming frontier market for the global space industry..."

Egypt’s Role

With a population of nearly a 100 million people, Africa’s second-largest economy, and a long history of advanced manufacturing, Egypt has emerged as a major power in the region’s space sector. The most obvious example of this, of course, is their hosting the AFSA building at their own Space City, but it extends far beyond this. The entire conference was an advertisement that Egypt is open for business.

During the week, EgSA representatives organized tours around the Space City, where we saw cubesat kits full of all the major subsystems for sale, complete with training modules that teach aspiring satellite engineers the functions of each subsystem, and how to integrate them into a cubesat.

These kits are already being used in a number of Egyptian universities, our tour guides proudly told us as African representatives scribbled notes and practically got their order forms ready.

For heavier-duty stuff, the Space City’s satellite AIT center can build satellites of up to 650kg, and has already integrated a few. And as a reminder to attendees about Egypt’s heritage in such things, EgSA informed us that they have already trained 71 engineers from >20 African countries in a variety of satellite technologies.

Egypt has learned from some of the best, with the country having a lengthy track record of collaboration with the US, and having also co-developed satellites with both China and Germany. They are clearly positioning themselves to be a source of technological knowhow for a fast-growing continent for the long-term future, and this week was basically a coming-out party for that plan.

The Satcom Industry

While not front-and-center, there was plenty of discussion on satcom in Africa during the week. Conference speakers included regional operators Nigcomsat (Nigeria), Angosat (Angola), Nilesat (Egypt), RASCOM (Regional African Satellite Communications Organization), as well as Eutelsat-OneWeb.

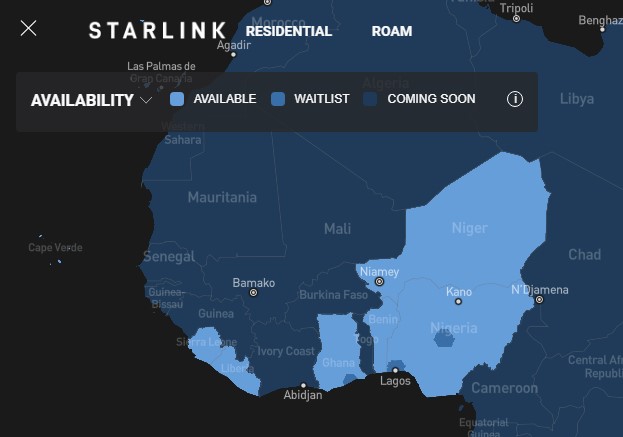

Starlink availability in West Africa, with the darker blue spots in Nigeria, Ghana, and Benin being sold out.

First, despite challenges in the satcom sector, several regional players are looking for new commsats. An official from Nigcomsat noted that they are looking to procure two new satellites this year, while regional satcom operator RASCOM is kicking the tires of several manufacturers for a possible replacement of their ~15 year-old RASCOM QAF-1R satellite. Similarly, Angolan operator Angosat has seen decent fill rates on the recently-launched AngoSat-2, and would consider another comms satellite in the coming years if they can boost fill rates further. These trends are likely to accelerate if the plethora of small GEO manufacturers in the market start to pick up momentum, allowing for country-focused satellites to become an easier financial pill to swallow.

Second, Starlink loomed large, but was on one hand looming large, but on the other hand oddly absent. While companies such as Amazon Kuiper, Eutelsat OneWeb, and ViaSat had prominent speaking roles, no one from Starlink was publicly visible. And while the topic of Starlink came up on a few panels, it was more frequently indirectly alluded to as “non-geo competition” or similar.

This is interesting, because in countries such as Nigeria, Starlink has begun to cause substantial disruption to local service providers. One needs to look no further than the areas around some of Africa’s largest cities—Nairobi, Lagos, Harare, Accra, and others—where Starlink is currently sold out, to understand that the service has a substantial market there, despite high costs relative to purchasing power.

And across the continent, the above-mentioned national satellite projects, many of which have been financed with foreign debt, are looking increasingly outdated compared to the high throughput brought by Starlink and in the future, other NGSOs. It’s too early to tell what the role of Starlink will be in the region, but to paraphrase one of the regional satcom operators during a panel, “Starlink is an existential threat. If countries don’t do the license framework well, you’re going to kill the African market”.

What’s Next for Africa’s Space Sector

After only a handful of days at an African space conference, I am far from an expert on the region. But, with such an action-packed show, I feel like I can make a few predictions, to be taken with a grain of salt. In the near-term, there is clearly going to be continued growth among African space programs, both nationally and continentally. More and more countries are seeing value in developing space capabilities, and they are being presented with more ways to do that.

Emphasis will be placed on capacity building, talent development, technology transfer, and perhaps most important, developing real-world applications that can lead to a return on investment for the precious dollars being spent on space budgets in the region. Low-hanging fruit such as remote sensing for agriculture, border control, and land use monitoring will see the strongest tailwinds, but other areas such as space science and international collaboration on larger missions will also see momentum. Examples of the latter include Senegal’s signing onto the ILRS, and plans for signing on to Artemis.

On the satcom side of things, the picture is a bit murkier. Several regional operators expressed optimism about procuring new satellites, but at the same time, there is clearly the threat (or opportunity) of NGSOs creating complications with that narrative. A few people spoke about a regional NGSO constellation, a sort of African version of IRIS2, though where the billions of required investment would come from is anyone’s guess.

Overall, one thing is for sure: Africa is the world’s fastest-growing region in terms of population, and is likely to play a growing role in the global space sector. A speaker from the South African Space Agency showed a well-known but nonetheless impactful age pyramid of Africa and Europe. Africa’s population is not only twice as large, but it is vastly younger, creating a massive demographic tailwind offering opportunities and challenges for the continent.

In a world where space continues to grow across all regions, Africa is unlikely to be an exception.

----------------------

Blaine Curcio is the Founder of Orbital Gateway Consulting. He’s an expert on the global commercial space and satellite industries He can be reached at: blaine@orbitalgatewayconsulting.com

Blaine Curcio is the Founder of Orbital Gateway Consulting. He’s an expert on the global commercial space and satellite industries He can be reached at: blaine@orbitalgatewayconsulting.com