Eutelsat Reports Full-Year 2020-21 Results

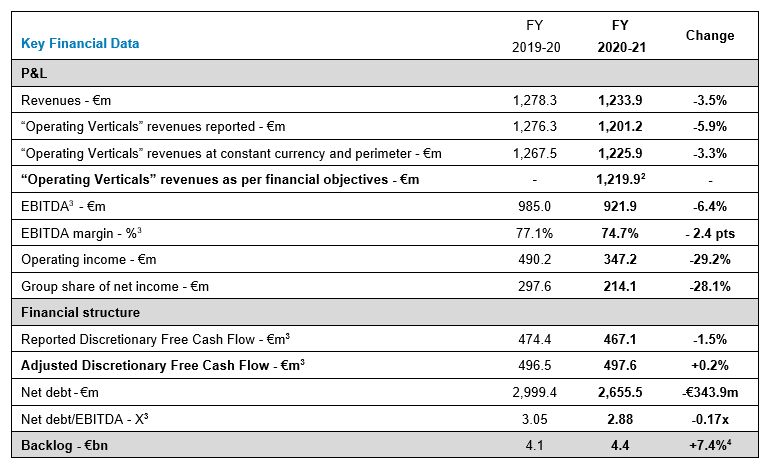

Paris, France, August 2, 2021--The Board of Directors of Eutelsat Communications (ISIN: FR0010221234 - Euronext Paris: ETL), chaired by Dominique D’Hinnin, announced the financial results for the year ended June 30 2021. Highlights of the results include:

- Operating Verticals revenues at the top end of expected range

- Further high level of Free Cash Flow generation

- Topline to grow from FY 2022-23 with an acceleration in FY 2023-24

- Adjusted Discretionary Free Cash Flow objective for FY 2021-22 raised by €30m; growth from FY 2022-23

- Recommending 5% dividend increase to €0.93[1] per share

|

|

Rodolphe Belmer, Chief Executive Officer of Eutelsat Communications, said: “FY 2020-21 was a solid year with revenues at the high end of our upwardly revised guidance, record high cash generation and a further reduction in our Net Debt / EBITDA ratio. Major commercial highlights included, in Broadcast, the Sky Italia renewal, reflecting the long-term relevance of satellite in Europe and two hosted payloads in Government Services. The year was a turning point for our Connectivity business, in particular Fixed Broadband, with notably the entry into service of EUTELSAT KONNECT as well as major wholesale agreements with Telcos, Orange and TIM, for capacity on both EUTELSAT KONNECT and EUTELSAT KONNECT VHTS. Finally, Eutelsat accomplished a major strategic move, gaining a foothold in the LEO segment through its investment in OneWeb. OneWeb represents an additional growth engine for our Connectivity businesses with strong potential for co-operation thanks to complementarity of resources and assets."

"Looking ahead, Operating Verticals revenues for FY 2021-22 are expected between €1,110 and €1,150 million. They will subsequently return to growth from FY 2022-23 with an acceleration in FY 2023-24 on the back of the entry into service of incremental assets with substantial firm precommitments. Our Adjusted Discretionary Free Cash Flow objective for FY 2021-22 is raised by €30m with growth from FY 2022-23. We are also renewing our commitment to strong shareholder returns with a recommended dividend of €0.93, up 5%,” he added.