How Can Cube-sats Find Their Niche in the Satellite-Iot Market?

by Hub Urlings

Finding the right niche

Introduction:

Breakthroughs in cubesats and small sat technology have led to a lot of speculation on the impact it will have on the space industry in general and on specific markets like IoT in particular. Is it really going to be so disruptive that the old space GEO systems will become replaced by new space constellations of LEO satellites? Or will it just expand the existing satellite markets opening up new markets? In this article we will have a closer look at these questions, especially as we are now at the verge of a new era as a number of new cubesat base IoT systems will be launched in 4Q2018.

Is Satellite IoT really complementary to Terrestrial IoT networks?

Satellite networks always have been providing telecom services that are complementary to those provided by terrestrial networks. Judging how much market room there is for satellite in addition to terrestrial networks has always been a key element in the business planning for new satellite networks. Sometimes things can go wrong with this, as we know from Iridium that in its initial business plan did not really see the rapid expansion of GSM in particular in densely populated areas around the world.

Comparable to the effect of the extension of terrestrial GSM networks on the satphone market is the use of satellite based IoT systems as an extension of the terrestrial IoT Networks. The development of terrestrial IoT networks like LORA and Sigfox (also called LPWAN low power wide area networks) and IoT in cellular networks like NB-IoT at the moment is accelerating. To judge to position of Satellite IoT in this market, let’s have a look at those terrestrial IoT networks more closely.

LORA is a IoT technology platform with a large number of independent eco-system partners. It develops the coverage mainly according to the location where their customers need service. Although classified as a Low Power Wide Area Networks for the moment LORA proves te be ideal for covering a skyscrapers or inustrial plants and providing IoT services in rather small and local areas. Using LORA services becomes more difficult and expensive when the customer requirements include servicing communication nodes spread over a wide geographical area.

Sigfox takes another approach as it sees itself as a network operator, covering large areas with their own base station infrastructure in order to provide services. In densely populated countries like the Netherlands where I come from that works great, for countries like France it is already a challenge, and imagine what it will take for a country like Brasil or Indonesia. The associated network investments will be an impossible barrier to take.

The third and most promising terrestrial IoT development is NB-IOT. At the moment this is rather a standard agreed upon in the cellular operator world with as main pitch: “we-can-just-do-a-simple-base-station-firmware-upgrade-and-deliver-low-power-wide-area-IoT”, and with a coverage in the high density populated areas. For the time being however it is no network to actually deliver the LPWAN connectivity and we will have to see how long it will take upgrading the cellular towers.

With 90% of the population covered by at least a 2G signal (voice and sms), and 70% by 3G (internet access) only 10 % of the world’s population is not covered by terrestrial networks that can offer IoT connectivity. Is it fair to assume that the same distribution will apply to the proliferation of IoT terminals as well?

The majority of unconnected individuals are low income, living in rural regions of Asia and sub Saharan Africa, and make up the majority of the 4.8 billion not yet on the internet.

The main question here Is if this is the same area that is required in terms of coverage when it comes to the distribution of IoT devices? When we look at the worlds surface 90% is not covered by any terrestrial network. Smart home and smart city applications might work via terrestrial IoT networks but what about Environmental monitoring, Smart Agriculture, Energy grids, and assets the travel across the world? Is that the niche for satellite-IoT complementary to terrestrial, or are these new market segments that can be addressed but that will never be serviced by terrestrial services?

Coverage / network types

Is old space satellite IoT challenged by new space Sat-Iot?

Satellite-IoT services are available in all frequency bands ranging from UHF, L-band, S-band, Ku and Ka band and are offered by both fixed and mobile satellite network operators. In this section we focus on the MSS providers like Inmarsat, Iridium, Thuraya or Globalstar that are providing the majority of the M2M and IoT connectivity services to the market and do this already for more than 10 years.

Inm-C was one of the first dedicated M2M services specifically build for the purpose. Starting in the land mobile market because of its high reliability, in a very short time it reached its final destination in the maritime market as the most cost effective solution to fulfill the Global Maritime Distress and Safety requirements for ocean going vessels.

The success of Inm-BGAN in the IoT market was unexpected for a “broadband system” but the fact that is is an IP-based system with data volume based billing made it (after a rather hefty investment in a BGAN terminal) a very suitable connectivity service for IoT applications.

Iridium and Globalstar were designed as a traditional cellular service with the focus on voice but with a small data service along side as well. After it turned out the demand for voice (due to terrestrial network proliferation of GSM in particular in the densely populated areas where the International Business Traveller normally resides) was not as high as planned, attention turned to ‘alternative’ service for data, M2M and IoT. The so called data modems have the feel of the early PSTN modems however, and are rather complex to install, configure and maintain.

A common feature of “old space” satellite IoT services is that they are relatively expensive when compared to terrestrial services not only due to the high connectivity charges but also because of the high cost of ownership taking installation, configuration and maintenance into account.

For high end markets like Government or corporate segments like Energy or Mining that ask for high quality services and for markets with no alternatives like the maritime market this is might be ok, but fact is that there is hardly any growth in this market. Old satellite operators might also question the profitability of their Sat-Iot services, especially when looking at the huge network costs and the fact that the IoT service basically piggy back on the voice or broadband internet revenues of the network.

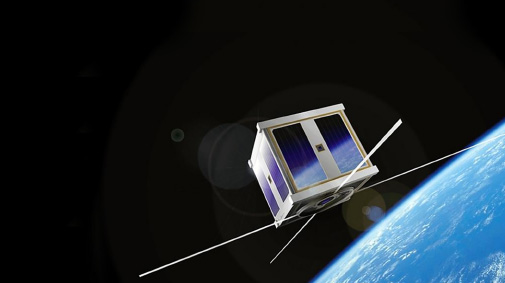

Here come the new space sat-iot operators: the Low Power Global Area Networks!

In the fourth quarter of 2018 a number of new space satellite iot networks will launch their first satellites, and start offering their services. From that moment new space IoT operators will be challenging the dominance of existing old space sat-iot networks with their constellations of cube-sats for IoT connectivity. With fleets of dozens of relatively small satellites the new space challengers can reach cost price levels a magnitude lower than the current sat-iot networks, while at the same time offering global coverage. Important for customers is also the fact that these new sat-IoT constellations are able to work with easy to install, low power IoT devices that can stay in the fieldwithout maintenance for yours thus also lowering the operational cost significantly. For that reason they are called Low Power Global Area Networks.

When we look at IoT research three main requirements for the growth of the IoT market are identified: main requirements are a global service, with low cost of ownership and low power requirements for the field terminal.

It looks like these new space sat-iot providers might just be able to deliver on that. The advent of fleets of small satellites in LEO providing global IoT services have the potential to change the paradigm for satellite IoT, but no one knows exactly how, since no constellation is up yet.

This is going to change in the last quarter of 2018 when a number of new players (Kepler, Hiber, AstroCast, Fleet) will launch their first cubesats into orbit. In a follow up article we will describe them more in detail.

Making cubesat based Sat-IoT a success

The greater question as to who will succeed lies in how much demand their constellations will actually meet/generate.

If you make a comparison with the satellite proposal hype in the end of the 1990’s (e.g the handheld voice systems like Iridium / Globalstar, but also a lot of the satellite broadband systems) the biggest issue was not the technology, but the the fact that the market forecasts were dramatically wrong (FARRAR)

That’s always the challenge for something big and new, and it doesn’t matter whether you are building LEO’s or GEO’s . When you are trying to get into a new market, it’s very difficult to come up with an accurate market forecast.

The new generation of smallsat LEO constellations face similar issues as some of their 1990’s forebears, with as most significant hurdle how to establish credibility that demand will exist at the prices necessary to make the business case work.

In a follow up article we will describe the various cubesat based IoT system more in detail and we will see their vision on the market.

------------------------

Hub Urlings was one of the pioneers of Satellite M2M as Product Manager Inmarsat-C at the famous KPN Station 12. The success of this “small data” satellite service, its global coverage and reliability made that the service was used for a myriad of applications: from sending messages, to truck fleet management, to pipeline monitoring and bringing back data from all types of sensors. At that time satellite was the only type of network that was able to offer global coverage for what we would now call IOT services. Now, 25 years later he is again involved in the development of a new generation of Sat-IOT services. He can be reached at: urlings@m2sat.com