Iridium Reports Net Loss of US$ 7.9 million in 4Q 2020 and Issues Full-Year Guidance 2021

McLean, Va., February 11, 2021–Iridium Communications Inc. (Nasdaq:IRDM) today reported financial results for the fourth quarter of 2020 and issued its full-year 2021 guidance. Net loss was US$ 7.9 million, or $0.06 per diluted share, for the fourth quarter of 2020, as compared to net loss of US$ 107.9 million, or $0.82 per diluted share, for the fourth quarter of 2019.

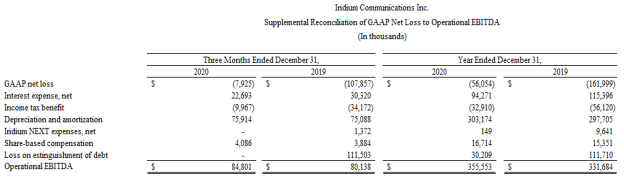

This improvement was primarily the result of debt extinguishment costs associated with Iridium’s refinancing in the fourth quarter of 2019, which did not recur in 2020. Operational EBITDA for the fourth quarter was US$ 84.8 million, as compared to US$ 80.1 million for the prior-year period, representing a year-over-year increase of 6% and an OEBITDA margin of 58%. OEBITDA primarily benefitted from increased commercial service revenue and engineering and support work with the U.S. government.

Iridium reported fourth-quarter total revenue of US$ 146.5 million, which consisted of US$ 116.9 million of service revenue and US$ 29.6 million of revenue related to equipment sales and engineering and support projects. Total revenue increased 5% versus the comparable period of 2019, while service revenue grew 3% from the year-ago period. Service revenue, which represents primarily recurring revenue from Iridium’s growing subscriber base, was 80% of total revenue for the fourth quarter of 2020.

The company ended the quarter with 1,476,000 total billable subscribers, which compares to 1,300,000 for the year-ago period and is up from 1,429,000 for the quarter ended September 30, 2020. Total billable subscribers grew 14% year-over-year, driven by growth in commercial IoT and government business.

Full-Year 2020 Iridium Business Highlights

For the full year, Iridium reported net loss of US$ 56.1 million, or $0.42 per diluted share, as compared to net loss of US$ 162.0 million, or US$ 1.33 per diluted share, for 2019. This improvement in net loss resulted from lower debt extinguishment costs and lower interest expense associated with Iridium’s refinancing. The Company reported record total revenue in 2020 of $583.4 million, which was up 4% from the year-ago period. Total revenue included US$ 463.1 million of service revenue and $120.3 million of revenue related to equipment sales and engineering and support projects. OEBITDA for 2020 was US$ 355.6 million, a 7% increase from US$ 331.7 million in the prior year, representing an OEBITDA margin of 61%. Capital expenditures were US$ 38.7 million for the full-year 2020.

“I am incredibly proud of the results Iridium delivered this year in the face of an unprecedented business environment. The resilience of our wholesale business model and double-digit subscriber growth in 2020 are testaments to the strength of our global partner network and the growing demand for Iridium’s safety services and mobility platform,” said Matt Desch, CEO, Iridium.

Commenting on Iridium’s share repurchase authorization and capital priorities, Desch said, “In light of Iridium’s strengthening capital position and continued opportunities for growth, I am happy to announce that our Board of Directors approved the first share repurchase program in the Company’s history. This program authorizes the repurchase of up to US$ 300.0 million of Iridium common stock through December 31, 2022, and demonstrates Iridium’s commitment to long-term value creation through returns of capital to shareholders.”

Fourth-Quarter Iridium Business Highlights

Service – Commercial

Commercial service remained the largest part of Iridium’s business, representing 62% of the Company’s total revenue during the fourth quarter. The Company’s commercial customer base is diverse and includes markets such as maritime, aviation, oil and gas, mining, recreation, forestry, construction, transportation and emergency services. These customers rely on Iridium’s products and services as critical to their daily operations and integral to their communications and business infrastructure.

- Commercial service revenue was US$ 91.1 million, up 3% from last year’s comparable period due primarily to increased revenues from hosted payload and broadband services.

- Commercial voice and data subscribers were down 1% from the year-ago period to 350,000 subscribers, as a result of the COVID-19 pandemic. Commercial voice and data average revenue per user (“ARPU”) was $40 during the fourth quarter, compared to $41 in last year’s comparable period.

- Commercial IoT data subscribers grew 20% from the year-ago period to 962,000 customers, driven by continued strength in consumer personal communications and tracking devices. Commercial IoT data ARPU was $8.90 in the fourth quarter, compared to $10.50 in last year’s comparable period. The decrease in ARPU resulted from reduced usage in aviation, as well as the effect of the increased proportion of personal communications subscribers within IoT, who typically utilize lower ARPU plans.

- Commercial broadband revenue was $9.6 million, up 18% from $8.1 million in the year-ago period. This rise was primarily attributable to increasing activations of Iridium Certus® broadband service. Commercial broadband ARPU was $277 during the fourth quarter, compared to $253 in last year’s comparable period, reflecting an increasing mix of Iridium Certus® broadband subscribers.

- Iridium’s commercial business ended the quarter with 1,324,000 billable subscribers, which compares to 1,165,000 for the prior-year quarter and is up from 1,287,000 for the quarter ended September 30, 2020. IoT data subscribers represented 73% of billable commercial subscribers at the end of the quarter, an increase from 69% at the end of the prior-year period.

- Hosted payload and other data service revenue was US$ 14.4 million in the fourth quarter compared to US$ 12.1 million in the prior-year period, which was primarily due to increased Aireon data service fees related to a contractual step-up.

Service – U.S. Government

Iridium’s voice and data solutions improve situational awareness for military personnel and track critical assets in tough environments around the globe, providing a unique value proposition that is not easily duplicated.

Under Iridium’s Enhanced Mobile Satellite Services contract (the “EMSS Contract”), a seven-year, US$ 738.5 million fixed-price airtime contract with the U.S. Space Force signed in September 2019, Iridium provides specified satellite airtime services, including unlimited global standard and secure voice, paging, fax, Short Burst Data®, Iridium Burst®, RUDICS and Distributed Tactical Communications System services for an unlimited number of Department of Defense and other federal government subscribers. Iridium also provides maintenance and support work for the U.S. government’s dedicated Iridium gateway under two other contracts with the U.S. Space Force. Iridium Certus airtime services are not included under these contracts and may be procured separately for an additional fee.

- Government service revenue was US$ 25.8 million in the fourth quarter and reflected increased revenue from a contractual step up in the EMSS Contract on September 15, 2020.

- Iridium’s U.S. government business ended the quarter with 152,000 subscribers, which compares to 135,000 for the prior-year quarter and is up from 142,000 for the quarter ended September 30, 2020. Government voice and data subscribers increased 9% from the year-ago period to 62,000 as of December 31, 2020. Government IoT data subscribers increased 15% year-over-year and represented 59% of government subscribers at year-end.

Equipment

- Equipment revenue was US$ 18.9 million during the fourth quarter, up 11% from the prior-year period.

- In 2021, the Company expects equipment sales in line with 2020 levels.

Engineering & Support

- Engineering and support revenue was US$ 10.7 million during the fourth quarter, up 30% from the prior-year quarter, primarily due to the episodic nature of contract work for the U.S. government.

Capital expenditures were US$ 9.4 million for the fourth quarter, including $0.9 million in capitalized interest. The company ended the fourth quarter with gross debt of US$ 1.64 billion and a cash, cash equivalents and marketable securities balance of US$ 244.7 million, for a net debt balance of US$ 1.4 billion.

Other Events

On January 20, 2021, the company completed a repricing of its Term Loan. This action improved the annual rate of the facility and will produce annual interest expense savings of over $16.0 million per year.

Most recently, the company announced that its Board of Directors had authorized a new a buyback program that allows for the purchase of up to $300.0 million of Iridium common stock through December 31, 2022. Repurchases of the Company's common stock under the program may occur from time to time in the open market.

2021 Outlook

The company issued its full-year 2021 outlook and reiterated other elements of long-term guidance:

- Total service revenue growth of approximately 3% for full-year 2021.

- Full-year 2021 OEBITDA between US$ 365 million and US$ 375 million. OEBITDA for 2020 was US$ 355.6 million.

- Negligible cash taxes in 2021. Cash taxes are expected to be negligible through approximately 2023.

- Net leverage of below 3.5 times OEBITDA at the end of 2022, assuming US$ 300.0 million in share repurchases. Net leverage was 3.9 times OEBITDA at December 31, 2020.