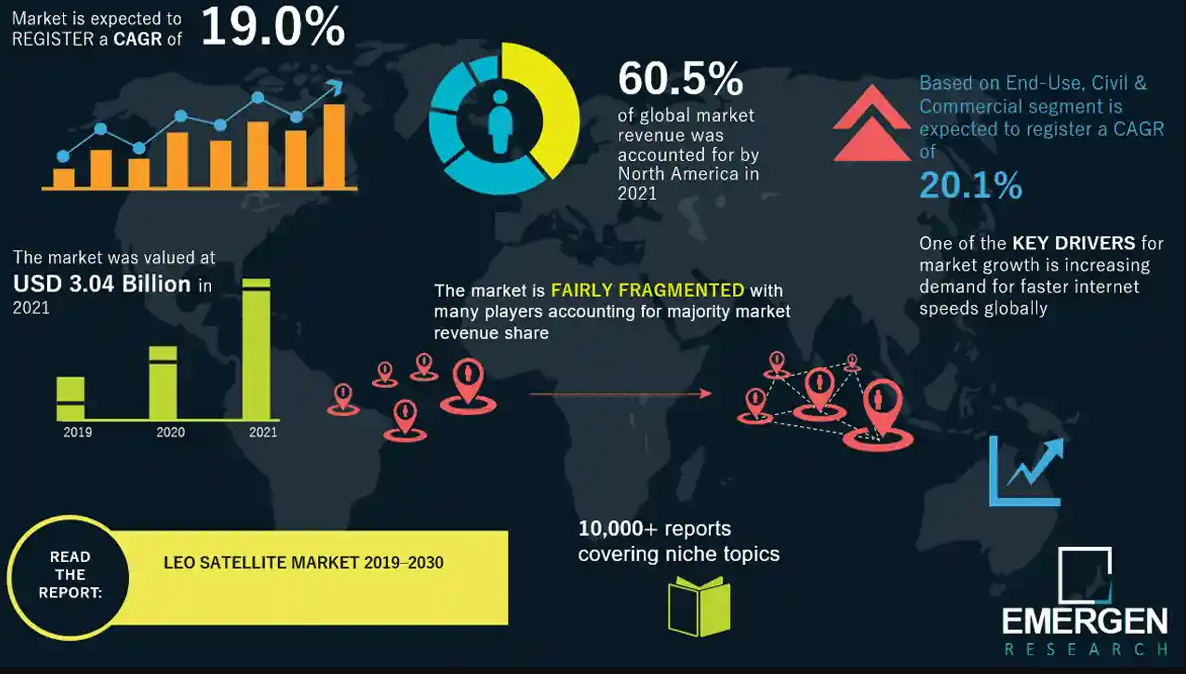

The LEO Satellites Market

Of these companies, one of the the most important one to watch is Project Kuiper. So far nothing has been launched, but last year 83 launch contracts were signed. This is one of the largest ever commercial procurements of launch services; an ambitious statement from a company that has a zero track record in space. However, that company is Amazon, so financial resources are not the limiting factor that many new entrants have to contend with. It is also necessary to launch half of the 3,236 planned satellites by July 2026, in order to comply with the FCC deadline. In line with that contract, Amazon also acquired a new 172,000 square foot facility in Kirkland, Washington for satellite production. It is intended to produce 1-3 satellites per day. The customer antennas were designed in-house, reportedly, the components cost around US$ 400. Ultimately, the company says it expects to produce 10 million of these. The first two Kuipersat satellites are scheduled to launch during the first quarter of this year.

At the end of December 54 “mini” second-generation satellites were launched. “Mini” because a full-size second generation satellite needs to be launched on SpaceX’ Starship which isn’t yet available. At the end of 2021, users in North America were getting download speeds of over 100Mbps from Starlink, this had been cut in half by the end of last year as the number of subscribers increased; indicating that Starlink really does need those additional satellites if it is to continue grow. This will become increasingly important as Starlink is now entering into agreements to provide commercial service in some sectors; maritime for example.

At the end of December 54 “mini” second-generation satellites were launched. “Mini” because a full-size second generation satellite needs to be launched on SpaceX’ Starship which isn’t yet available. At the end of 2021, users in North America were getting download speeds of over 100Mbps from Starlink, this had been cut in half by the end of last year as the number of subscribers increased; indicating that Starlink really does need those additional satellites if it is to continue grow. This will become increasingly important as Starlink is now entering into agreements to provide commercial service in some sectors; maritime for example.

|

|

One company to watch is Amazon's Project Kuiper--which is a very vertically integrated company with the capacity not only to manufacture satellites but also to launch them and provide ground segment services. The company has procured a dedicated, 172,000-square-foot satellite production facility in Kirkland, Washington. (image courtesy of Project Kuiper). |

OneWeb has five main target markets: carrier and enterprise, government, maritime, aviation and land mobile. Several agreements have been signed to support these markets. For example, working with Intelsat for aviation, airlines will be offered a multi-orbit solution for inflight connectivity. OneWeb is also working with Marlink to offer service to several sectors: including energy, maritime, enterprise and humanitarian sectors. The companies will work together to deploy, test and demonstrate several types of user terminals and connectivity services. OneWeb’s LEO constellation will be integrated into the hybrid network services that Marlink provides to its customers.

Elisabeth Tweedie has over 20 years experience at the cutting edge of new communications entertainment technologies. She is the founder and President of Definitive Direction (www.definitivedirection.com), a consultancy that focuses on researching and evaluating the long-term potential for new ventures, initiating their development, and identifying and developing appropriate alliances. During her 10 years at Hughes Electronics, she worked on every acquisition and new business that the company considered during her time there. She can be reached at etweedie@definitivedirection.com

Elisabeth Tweedie has over 20 years experience at the cutting edge of new communications entertainment technologies. She is the founder and President of Definitive Direction (www.definitivedirection.com), a consultancy that focuses on researching and evaluating the long-term potential for new ventures, initiating their development, and identifying and developing appropriate alliances. During her 10 years at Hughes Electronics, she worked on every acquisition and new business that the company considered during her time there. She can be reached at etweedie@definitivedirection.com