New Space Ventures by Elisabeth Tweedie

by Elisabeth Tweedie

Los Angeles, Calif., March 4, 2024--When I started doing research for this article on “new space,” I was spoilt for choice. There are so many relatively new companies, with innovative products and services. Where to begin, and how to choose which to highlight?

Seraphim Capital’s Space Investment summary, seemed a good place to start. Its latest analysis shows that that a total of US$ 6.8 billion was invested in New Space last year, with 127 of those deals occurring during the last quarter. This is the highest number of deals ever recorded in a single quarter. Unsurprisingly given the number of “Moon” stories in the news recently, “Beyond Earth” accounted for 24% of investment and was the only sector showing significant growth from 2022.

Seraphim Capital’s Space Investment summary, seemed a good place to start. Its latest analysis shows that that a total of US$ 6.8 billion was invested in New Space last year, with 127 of those deals occurring during the last quarter. This is the highest number of deals ever recorded in a single quarter. Unsurprisingly given the number of “Moon” stories in the news recently, “Beyond Earth” accounted for 24% of investment and was the only sector showing significant growth from 2022.

Looking ahead, Euroconsult, in its recently published report “Prospects for Space Exploration,” indicates that global government investment in space exploration reached US$ 26 billion in 2023 and is projected to rise to nearly US$ 33 billion by 2032, largely fueled by lunar missions. In addition to national endeavors, there are two major international efforts underway; one led by the (US) National Aeronautics and Space

Administration (NASA) in conjunction with the US Department of State, known as The Artemis Accords, and the other led by China and Russia known as The International Lunar Research Station Cooperation Organization (ILRSCO). 36 countries have now singed The Artemis Accords, including Australia, Canada, France, Germany, India, Israel, Japan, Korea, Luxembourg, Ukraine, UAE, UK and US. There are around 15 national signatories to ILRSCO including, China, Russia, Belarus, Pakistan, Azerbaijan, Venezuela, and South Africa.

"...global government investment in space exploration reached US$26 billion in 2023 and is projected to rise to nearly US$33 billion by 2032, largely fueled by lunar missions..."

Artemis Leads the Way

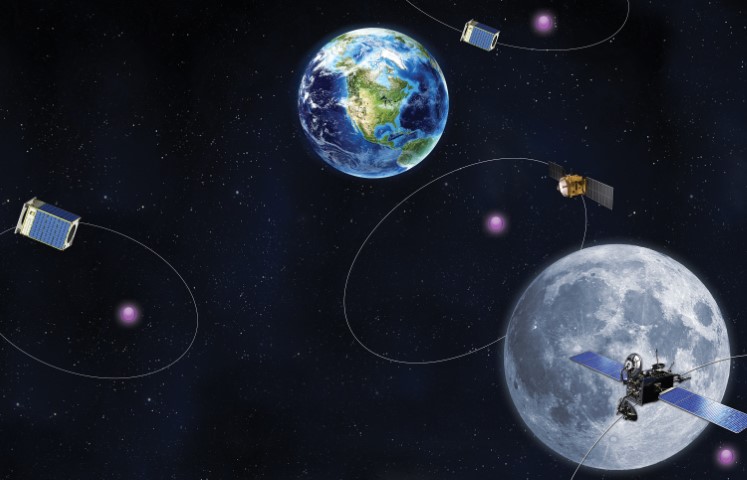

The overall goal of Artemis is to establish a long-term presence at the Moon for science and exploration. There are a few basic tenets including: peaceful exploration of space, transparency, interoperability and timely and safe disposal of debris. Currently, there are three defined Artemis missions. The first took place in 2022 when the unmanned Orion spacecraft orbited the Moon. Artemis II now planned for no earlier than September 2025 will take four astronauts to circle the Moon aboard the Orion spacecraft. Artemis III currently planned for 2026 will land four astronauts at the lunar South Pole. Subsequent missions will establish a base on the Moon and assemble sections of a lunar gateway.

This will be a lunar orbiting space station similar to the ISS, although it is not envisaged that this will serve as a permanent base for crew in the way that the ISS is, more a stopping off point and a location for equipment. Contracts to work on Artemis will come from companies in the signatory countries.

Separately, but in conjunction with Artemis, NASA is also awarding contracts for the Commercial Lunar Payload Services (CLPS). This initiative is to deliver a commercial, end-to-end lunar delivery service. These contracts are only available to US companies. There are currently 14 providers on contract, a mixture of established space giants such as Lockheed Martin and SpaceX and relative newcomers to the industry, such as Astrobotic, Firefly Aerospace and Intuitive Machines. CLPS contracts are indefinite delivery, indefinite quantity contracts, with a cumulative maximum contract value of $2.6 billion through 2028. Being on contract simply establishes the right to bid for the different tasks. The first mission in January of this year, unfortunately was a failure, when a lunar lander from Astrobotic suffered a fuel leak and failed to reach on the Moon. However, as we all know, space is a challenging business and initial failures often lead to future success.

The second CLPS mission landed at the South Pole on the Moon as I’m writing this article. SpaceX launched Intuitive Machines’ Nova-C lander, named Odysseus on February 15th, and it touched down at 6.23pm Eastern Time on February 22nd. Odysseus carried six NASA payloads including a camera to study dust plumes, a Doppler Lidar system, and an RF fuel tank gauge. The Doppler Lidar navigation beacon became particularly important, as this had to be brought into use at the last minute, when Odysseus’ ranging lasers, needed to land the craft failed. It also carried six commercial payloads, these included EagleCam from Embry-Riddle Aeronautics University, intended to be ejected before touchdown in order to capture images of Odysseus landing. After what appeared to be a near perfect, landing within two to three kilometers of the landing site, Odysseus then tipped over. Remarkably, all the scientific instruments on board are on the side facing up, which should allow them to continue to work.

This is the first moon landing of a vehicle developed by a commercial company, and the first lunar landing by an American Spacecraft in 52 years. However, it is not the first recent landing on the Moon. Earlier this year, Japan launched a lander known as Smart Lander for Investigating the Moon (SLIM), which unfortunately landed upside down, meaning its solar arrays were pointing away from the sun. It however, “woke-up” ten days later as the sun shifted and started transmitting images of spectral analysis of the composition of certain rocks on the Moon’s surface. Currently, it’s not known whether it will spring back into life when the sun shifts into the “right” inclination again.

|

|

The successful landing on the moon by Intuitive Machines' Nova-C lander named Odysseus is the first moon landing of a vehicle developed by a commercial company, and the first lunar landing by an American spacecraft in 52 years. (image courtesy of Intuitive Machines) |

Race to the Moon

There were two other Moon landings last year, one by India, its Chandrayaan-3 spacecraft successfully touched down near the South Pole, making it the first craft to land there. Russia also attempted to land on the Moon, but lost control of its craft which made a crash landing.

Separately, but in coordination with Artemis and CLPS, last year the US Defense Advanced Research Projects Agency (DARPA) launched its own initiative, LunA-10. This is focused on pulling together companies that previously were working in isolation to develop different parts of a lunar infrastructure. The end game is to develop a commercial lunar infrastructure by the mid 2030s. In December, 14 companies were awarded contracts to work together for seven months, in six different areas: communications and navigation, construction and robotics, market analysis, mining and in situ resource utilization (ISRU), power, and transit, mobility and logistics. These companies include three that are also part of the CLPS program, namely Blue Origin, Firefly Aerospace, and SpaceX. Other companies include Northrop Grumman, GITAI, Cislunar Industries and Sierra Space.

What is particularly interesting about the current race to the Moon, is that unlike the last Moon race, success in this one doesn’t just lie in the hands of governments, but in a myriad of commercial entities, some of which didn’t even exist a few years ago. Given the sheer numbers involved it would be impossible to mention them all in the confines of this article, so, given that the topic is “New Space,” I’m going to focus on just a few, all of them new entrants to the space industry: Firefly Aerospace, Green Launch, GITAI and SLI (Space Leasing International), a company that isn’t building anything, but has introduced an alternative way of financing assets, to the industry.

|

| Firefly Aerospace's Alpha rocket designed to lift ~1,000 kilograms to a low earth orbit. (image courtesy of Firefly Aerospace) |

Firefly Aerospace

Firefly raised the largest investment in Q4 2023, garnering US$300 million in Series C financing. The company was founded in 2017 and describes itself as an “end-to-end space transportation company, with launch, lunar and on-orbit services” and a “disruptor in space.” For such a young company, its achievements have been impressive. To date there have been four launches of its Alpha rocket, which is designed to lift ~1,000 kilograms to a low earth orbit. The third launch was for the US Space Force. The challenge was to demonstrate that private companies could meet launch deadlines in as little as 24 hours. The previous record was 21 days. Last September, Firefly met the deadline, completing all launch preparation in the 24 hours and successfully launching in the first available window. The fourth launch was not so successful, delivering its payload for Lockheed Martin outside of the intended orbit. A Mishap Investigation report has now been submitted to the FAA.

In addition to Alpha, Firefly’s product line includes MLV, a rocket capable of lifting 16,000 Kilograms to LEO. This was developed in conjunction with Northrop Grumman as a replacement for the Antares rocket. The first launch is scheduled for 2025.

Blue Ghost and Elytra complete the current product offering from Firefly. Blue Ghost is a small lunar lander (2 meters high and 3.5 meters diameter) and forms the basis of Firefly’s three CLPS contracts valued at US$230 million. Elytra is designed for on-orbit transfers, hosting, delivery and servicing to cislunar space and beyond. It can launch on both Alpha and MLV.

As well as the CLPS contracts, Firefly also has a contract with L3Harris for three launches to a LEO orbit in 2026.

Part of the reason for Firefly’s success is attributed to the fact that it uses common core avionics, power systems, propulsion components, and carbon composite structures across its launch vehicles, lunar landers, and orbital vehicles, to reduce costs and scale efficiencies.

Green Launch

Green Launch, an early-stage company, at the beginning of its funding cycle, has a totally different approach to accessing space and reducing the costs of doing so.

Green Launch uses hydrogen to launch. Hydrogen is the lightest and fastest gas and environmentally friendly as it produces no carbon dioxide. The rocket is ejected from a barrel, in a manner similar to a cannon, which is reusable. Whilst hydrogen is in plentiful supply, Green Launch intends to capture and reuse it, further reducing launch costs. Obviously, there is limited amount of control that can be applied to something launched in this manner, so there will be a rocket motor on top of the launcher for control, and to provide additional speed.

The company is looking at delivering small cargo such as cubesats and also packages up to 10 kilograms to the Moon. Eric Robinson, President, Green Launch, believes that ultimately it will be delivering these packages to the Moon in 24 hours.

Although it is an early-stage company, it has a contract with the National Science Foundation for Atmospheric Sampling. One of the issues with current methods of sampling is cost, according to Robinson, each sample costs around US$5 million. Using Green Launch, this can be reduced to US$175,000 which of course will enable far more samples to be taken and provide a more accurate picture of what is really happening in the atmosphere. The first sample is scheduled for Q3 this year.. Funding has been the issue limiting its progress, but it now has a new investor onboard, and is expecting to receive US$1-2 millions from this investor, which will also bring a new CEO to the company.

Green Launch, also has a contract with the US Space Force, but can’t reveal any details about this. Lack of funding is also hampering its ability in other ways. The highest altitude reached to date is 33 kilometers, a very long way from the Moon or even LEO, but Robinson is supremely confident that it will reach its goal to be the Fedex of Space.

GITAI

GITAI is another young company, founded in 2016 by Sho Nakanose who built his first robot at age seven, and has been passionate about them ever since. The company started in Japan, but moved its headquarters and many of its staff to Torrance, California, last year when Nakanose got his US “Green Card” in record time, and became a US permanent resident.

|

|

GITAI's 1.5-meter-long autonomous dual robotic arm system (S2) has successfully been deployed to the International Space Station (ISS) to conduct an external demonstration of in-space servicing, assembly, and manufacturing (ISAM). (image courtesy of GITAI). |

The company’s vision is to partner with launch companies, “To provide a safe and affordable means of labor in Space,” and reduce operational costs by 100 times. To this end it is developing robots to help build and maintain satellites, space stations, lunar bases and cities on Mars.

Although a much smaller company than Firefly, GITAI has also made impressive progress in just a few years. As already mentioned, it is one of the 14 companies selected to take part in DARPA’s LunA-10 project. The company’s proposal revolved around a concept for deploying modular, multi-purpose robots, known as Inchworm robots, for labor on the Moon’s surface. The Inchworm is a modular “arm” equipped with tool-changeable end effectors that can handle multiple tasks from construction to maintenance and adaptation. “We’re both humbled and thrilled to be chosen for DARPA’s LunA-10 program,” said Nakanose, Founder & CEO GITAI. “This mission goes well beyond robotics; it’s about forging a new era of lunar infrastructure. Our innovative approach, leveraging modular robotics, is a catalyst for reshaping how we envision the Moon.” The company is actively developing spacecraft that can assemble solar panels, antennas, habitation modules and fuel generators, in addition to performing exploration, resource extraction and maintenance and inspection tasks on the Moon.

Prior to being included in LunA-10, in 2021 GITAI successfully concluded a technology demonstration inside the ISS. Its autonomous robot, assembled both panels for in-space assembly (ISA) and operating switches and cables for intra-vehicular activity (IVA). However, as Nakanose is quick to point out, there is no point in doing this inside the ISS, the real test comes when this occurs outside the space station, in the harsh atmosphere of space. This is about to happen. In February of this year, its autonomous dual robotic arm system (S2) arrived at the ISS to conduct an external demonstration of in-space servicing, assembly and manufacturing (ISAM). At the conclusion of this demonstration GITAI aims to achieve Technology Readiness Level (TRL) 7 and establish its ISAM capabilities.

Looking further ahead, the company plans to operate a Robotics-as-a Service (RaaS) model, so that customers will not need upfront capex to utilize its products and can grow business in line with demand.

Unsurprisingly, given its achievements, GITAI has been successful in raising capital, garnering US$67.6 million in various funding rounds since 2019. It also has contracts with Toyota, the Japanese Aerospace Exploration Agency (JAXA) and the (Japanese) Ministry of Economy Trade and Industry (METI).

Space Leasing International

While these three new companies are driving down the costs of space projects, space nevertheless remains an expensive and capital-intensive business. One company intends to change that. SLI (Space Leasing International). SLI is part of the international Libra Group, which has been successfully providing leasing to the aviation industry, amongst others, for many years. SLI brings that expertise to the satellite and space industry, and works with both manufacturers and operators across the entire value chain. SLI was created only eight months ago, and already has a number of transactions closed and a strong pipeline.

One example is its relationship with RBC Signals. Last year SLI acquired a ground station in the Alaskan arc that RBC Signals is leasing from the firm. SLI is partnering with the company to acquire or build a total of 20 ground stations around the world and lease them back to RBC Signals. However, SLI has no intention of confining itself to the ground segment. It currently has an extensive pipeline of transactions related to assets both in the ground segment and on orbit. CEO Alex Kerschen, commented, “Leasing assets gives companies the opportunity to focus on what they’re good at: running their business, rather than raising capital, which can be a challenging and time-consuming practice, sometimes resulting in loss of control. Companies in the space sector are all too familiar with this scenario, and have been very receptive to the concept of leasing assets.”

Many times in the past, I’ve written about the speed of change and how exciting this industry is. I’m going to say it again! In only a few short years, these new entrants to the industry have succeeded in changing the dynamics, distances traveled and the financial structure. Doubtless with some casualties on the way, these companies and many others are likely to continue doing so, well into the future. What an exciting industry we work in!

--------------------------------------------

Elisabeth Tweedie has over 20 years experience at the cutting edge of new commmunications entertainment technologies. She is the founder and President of Definitive Direction (www.definitivedirection.com), a consultancy that focuses on researching and evaluating the long-term potential for new ventures, initiating their development, and identifying and developing appropriate alliances. During her 10 years at Hughes Electronics, she worked on every acquisition and new business that the company considered during her time there. She can be reached at etweedie@definitivedirection.com

Elisabeth Tweedie has over 20 years experience at the cutting edge of new commmunications entertainment technologies. She is the founder and President of Definitive Direction (www.definitivedirection.com), a consultancy that focuses on researching and evaluating the long-term potential for new ventures, initiating their development, and identifying and developing appropriate alliances. During her 10 years at Hughes Electronics, she worked on every acquisition and new business that the company considered during her time there. She can be reached at etweedie@definitivedirection.com