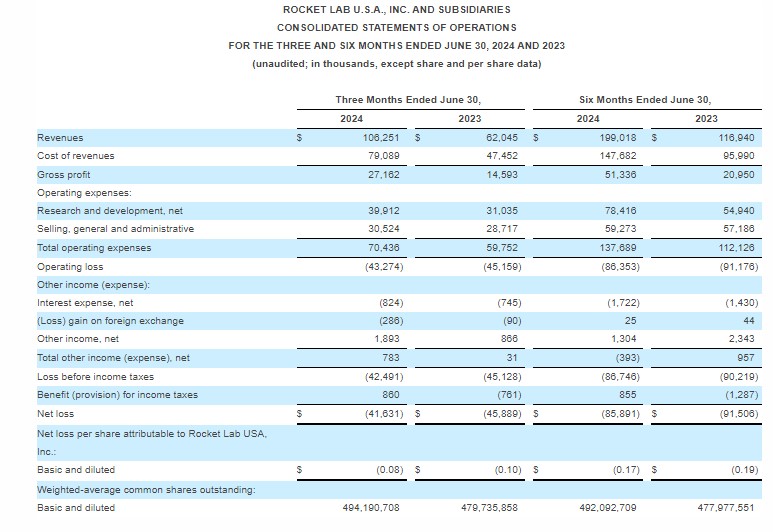

Rocket Lab Announces Second Quarter 2024 Financial Results, Posts Record Revenue on 71% Year-on-Year Growth

Long Beach, Calif., August 8, 2024 --Launch service provider Rocket Lab USA, Inc. (Nasdaq: RKLB) today released the financial results for fiscal second quarter, ended June 30, 2024.

Rocket Lab founder and CEO, Sir Peter Beck, said: “This year’s second quarter was Rocket Lab’s highest revenue quarter in Company history at $106 million. This 71% year-on-year revenue increase demonstrates the strong and growing demand for our launch services and space systems products, and importantly, our team’s ability to execute against it. Meanwhile, we reached a critical milestone in the development of our new medium lift rocket Neutron, with the successful completion of the first hot fire for the Archimedes engine. Over the same period, we made significant progress in Neutron production and launch infrastructure with the scaling of engine production facilities, installation of the automated fiber placement machine that will produce Neutron’s largest carbon fiber structures, and we furthered development of Launch Complex 3 and the integration and assembly facility on site in Wallops, Virginia. On the small launch front, Electron remains the leading small rocket globally with successful launches in the quarter for government and commercial customers, and demand for it continues to grow with 17 new launches signed so far this year. We also continue to reach development and production milestones across our space systems programs, in which we have more than $720 million in spacecraft under contract. Some significant achievements on this front include the completion of twin Rocket Lab-designed and built satellites for a NASA mission to Mars, as well as completing successful development reviews for the government and commercial constellations we have in work.”

Business Highlights for the Second Quarter 2024, plus updates since June 30, 2024:

- Achieved our highest revenue quarter in company history at $106 million.

- Successful Electron launches for NASA, commercial constellation operators Synspective, Kineis, and the Korea Advanced Institute of Science and Technology (KAIST). Electron remains the most frequently launched small rocket globally and Electron launches have accounted for 64% of all non-SpaceX orbital U.S. launches in 2024 to date.

- Successfully launched our 50th Electron mission, reaching 50 launches faster than any commercially developed rocket in history.

- Demonstrated pinpoint deployment accuracy by launching customer payload to within eight meters of target orbit (accepted industry tolerance is typically 15 kilometers).

- Signed 17 new launch contracts year-to-date, including multi-launch deals with commercial constellation operators, a HASTE (Hypersonic Accelerator Suborbital Test Electron) launch for a government customer, and two highly complex missions for the Department of Defense, including a responsive launch demonstration in which Rocket Lab will build a spacecraft, as well as launch and operate it as an end-to-end space service.

- Reached major development milestone with successful completion of first Archimedes engine hot fire. Now moving into full production for remaining flight engines.

- Significant progress made in development and flight hardware of Neutron structures, fairing, avionics, and flight software.

- Infrastructure development progressing to support first Neutron flight and operational launch cadence, including scaling Archimedes engine production line, arrival of long lead cryogenic systems at launch site, installation of automated fiber placement machine for Neutron production, and entering final construction phase of establishing final assembly facility at Wallops, Virginia.

- Completed production of two spacecraft for NASA’s ESCAPADE mission to Mars, scheduled to launch this year.

- Signed preliminary terms for $49.4m in state and federal funding, including a portion under the CHIPS Act, to expand production of solar cells in Albuquerque, New Mexico.

- Progressing development and production of spacecraft for Varda Space Industries, as well as constellations on contract for the Space Development Agency and MDA/Globalstar.

- Introduced a new satellite dispenser at the Small Satellite Conference in Utah to provide customers with more flexibility when designing spacecraft.

Third Quarter 2024 Guidance

For the third quarter of 2024, Rocket Lab expects:

- Revenue between $100 million and $105 million.

- Space Systems revenue between $79 million and $84 million.

- Launch Services revenue of approximately $21 million.

- GAAP Gross Margins between 25% and 27%.

- Non-GAAP Gross Margins between 30% and 32%.

- GAAP Operating Expenses between $80 million and $82 million.

- Non-GAAP Operating Expenses between $69 million and $71 million.

- Expected Interest Expense (Income), net $1 million.

- Adjusted EBITDA loss of $31 million to $33 million.

- Basic Shares Outstanding of 498 million.

*See “Use of Non-GAAP Financial Measures” below for an explanation of our use of Non-GAAP financial measures, and the reconciliation of historical Non-GAAP measures to the comparable GAAP measures in the tables attached to this press release. We have not provided a reconciliation for the forward-looking Non-GAAP Gross Margin, Non-GAAP Operating Expenses or Adjusted EBITDA expectations for Q3 2024 described above because, without unreasonable efforts, we are unable to predict with reasonable certainty the amount and timing of adjustments that are used to calculate these non-GAAP financial measures, particularly related to stock-based compensation and its related tax effects. Stock-based compensation is currently expected to range from $12 million to $14 million in Q3 2024.

About Rocket Lab

Founded in 2006, Rocket Lab is an end-to-end space company with an established track record of mission success. We deliver reliable launch services, satellite manufacture, spacecraft components, and on-orbit management solutions that make it faster, easier and more affordable to access space. Headquartered in Long Beach, California, Rocket Lab designs and manufactures the Electron small orbital launch vehicle, various satellite platforms, and is developing the Neutron launch vehicle for large spacecraft and constellation deployment. From its first orbital launch in January 2018 to date, Rocket Lab’s Electron launch vehicle has become the second most frequently launched U.S. rocket annually and has delivered 191 satellites to orbit for private and public sector organizations, enabling operations in national security, scientific research, space debris mitigation, Earth observation, climate monitoring, and communications. Rocket Lab’s Photon spacecraft platform has been selected to support NASA missions to the Moon and Mars, as well as the first private commercial mission to Venus. Rocket Lab has three launch pads at two launch sites, including two launch pads at a private orbital launch site located in New Zealand and a third launch site in Virginia, USA. To learn more, visit www.rocketlabusa.com.

*USE OF NON-GAAP FINANCIAL MEASURES

We supplement the reporting of our financial information determined under Generally Accepted Accounting Principles in the United States of America (“GAAP”) with certain non-GAAP financial information. The non-GAAP financial information presented excludes certain significant items that may not be indicative of, or are unrelated to, results from our ongoing business operations. We believe that these non-GAAP measures provide investors with additional insight into the company's ongoing business performance. These non-GAAP measures should not be considered in isolation or as a substitute for the related GAAP measures, and other companies may define such measures differently. We encourage investors to review our financial statements and publicly filed reports in their entirety and not to rely on any single financial measure. Reconciliation of the non-GAAP financial information to the corresponding GAAP measures for the historical periods disclosed are included at the end of the tables in this press release. We have not provided a reconciliation for forward-looking non-GAAP financial measures because, without unreasonable efforts, we are unable to predict with reasonable certainty the amount and timing of adjustments that are used to calculate these non-GAAP financial measures, particularly related to stock-based compensation and its related tax effects. The following definitions are provided:

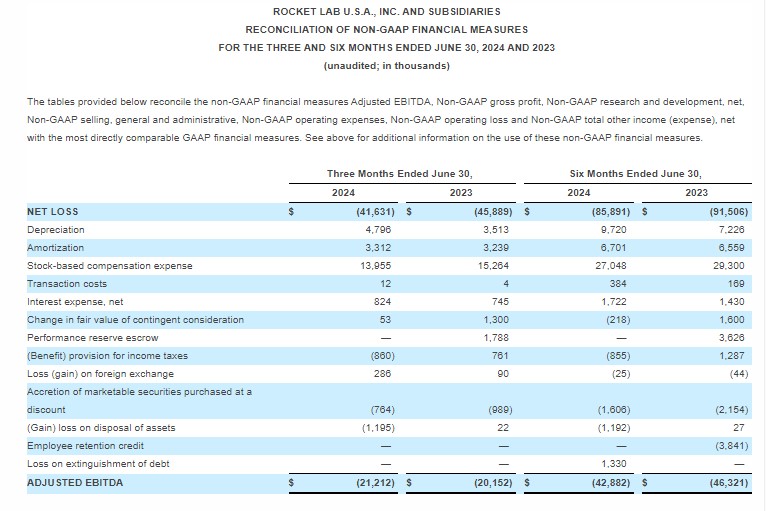

ADJUSTED EBITDA

EBITDA is defined as earnings before interest, taxes, depreciation and amortization. Adjusted EBITDA further excludes items of income or loss that we characterize as unrepresentative of our ongoing operations. Such items are excluded from net income or loss to determine Adjusted EBITDA. Management believes this measure provides investors meaningful insight into results from ongoing operations.

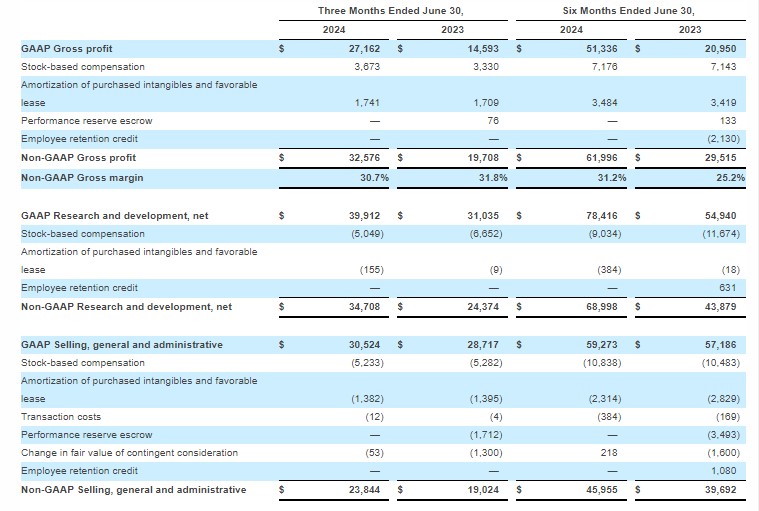

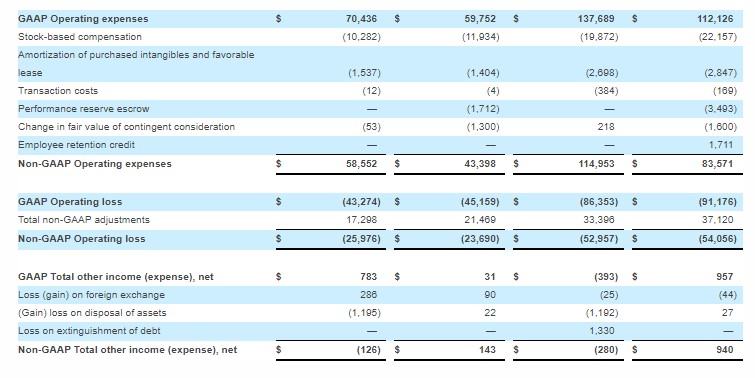

OTHER NON-GAAP FINANCIAL MEASURES

Non-GAAP gross profit, research and development, net, selling, general and administrative, operating expenses, operating loss and total other income (expense), net, further excludes items of income or loss that we characterize as unrepresentative of our ongoing operations. Such items are excluded from the applicable GAAP financial measure. Management believes these non-GAAP measures provide investors meaningful insight into results from ongoing operations.

|

|

|

|

|

|

|

|