Executive Roundtable on the Small and Medium Satellite Launch Market

by Bernardo Schneiderman

Los Angeles, Calif., March 3, 2025--The small/medium satellite launch vehicle market reveals a significant rise in demand for smaller satellites, driving the development of more versatile and cost-effective launch vehicles, increased adoption of commercial off-the-shelf (COTS) technologies, growing focus on reusability, and new entrants entering the market with innovative launch solutions.

All these factors all contributing to a rapidly expanding market with diverse applications like Earth observation, communication, and scientific research.

The key trends in the Launch Servies for the Small and Medium Satellite Market are:

Increased demand for small satellites. The primary driver of the small/medium launch vehicle market is the surging demand for small satellites due to their affordability and flexibility for various applications, including constellations for internet access, Internet of Things (IoT), and high-resolution imaging among use for enterprise, government and defense applications.

Development of dedicated launch vehicles.Companies are designing and building launch vehicles specifically for small and medium-sized satellites, optimizing launch costs and increasing accessibility to space.

COTS technology adoption. To reduce development costs and accelerate innovation, manufacturers are increasingly incorporating commercially available components and technologies into their launch vehicles.

Focus on reusability. Similar to larger launch vehicles, there's a growing interest in developing reusable small launch vehicles to lower launch costs significantly.

New market entrants. The small launch vehicle market is seeing a wave of new players entering the scene, including startups, which are bringing fresh perspectives and competition to the industry.

Diverse launch site options. With the need for flexible launch capabilities, companies are exploring various launch sites at global level, including land-based, sea-based, and mobile platforms.

Government and commercial applications. Both government agencies and commercial companies are increasingly utilizing small/medium launch vehicles for various missions, including Earth observation, environmental monitoring, scientific research, communication and other government and defense applications.

Constellation development. The trend of building large satellite constellations for global connectivity is further driving the need for reliable and frequent small satellite launches.

Considering these scenario. we have the following potential challenges:

High development costs. Despite the growing market, developing new small launch vehicles can still be expensive, especially for smaller companies.

Regulatory complexities. Navigating the complex regulatory landscape of space launch operations can be challenging for new entrants at global level.

Competition in the market: With many new players entering the market, competition for launch contracts is intensifying among global players

BryceTech issued a report about Global Space Launch Activity in 2024 analyzed 259 orbital launches and nearly 2900 spacecraft deployed in 2024, tracking key trends in launch activity, providers, and satellite deployments. The report finding include:

- Nearly 60% of launches were conducted by U.S.A. providers

- Commercial providers accounted for about 70% of launches

- Small Satellites, primarily for communications, were the majority of all spacecraft launched at 97%

BryceTech reported that in 2024 the number of small satellites launched by application comprise the following: communications 79%, Remote Sensing 13%, Technology Development 7%, Scientific 1% and others 1%.

Another key item reported is the next generation satellites in constellations tend to be larger:

- Starlink v1 (~300 kg) vs v2-mini (~800 kg)

- Planet Skysat (~110 kg) vs Pelican (~150 kg)

- Capella Whitney (~100 kg) vs Acadia (~165 kg)

- Iridium (~670 kg) vs Iridium Next (~860 kg) This report reflects an increased threshold for smallsats from 600 kg to 1,200 kg

- Historical data shows 1,200 kg definition, resulting in the inclusion of 298 satellites from systems such as O3b, Galileo, and Iridium NEXT from 2014 – 2022

The key conclusions from the Brycetech report on Small Satellites are as follows:

Business Outcomes. Smallsat ventures continue efforts to prove their business models and generate revenue, with increasing attention on communications megaconstellations. Macroeconomic factors may have outsized impact on early-stage ventures and influence long-term smallsat market.

Communications Megaconstellations. Smallsat telecommunications operators dominated smallsat activity in 2023 and are continuing deployments in 2024. Launch of these large constellations will influence smallsat activity in the next few years as initial deployments finish and expanded constellations are authorized.

Smallsat Launch Options. Smallsats continue to primarily deploy on medium to heavy launch vehicles. Smallsat operators have other launch options including small launch and rideshare. In addition, dozens of companies continue to develop new small launch vehicles (many launch and rideshare. In addition, dozens of companies continue to develop new small launch vehicles (many < 500 Kg capacity).

Government Use of Smallsats. In 2023, the United States conducted the first deployments of national security proliferated architectures. Governments are increasingly seeking to leverage smallsats or include them in architecture planning to augment existing capabilities.

Smallsat Driven GEO/NGSO Integration.Organizations are likely to continue and expand Geostationary Orbit and Non-GEO (GEO/NGSO) integration, possibly through additional merger and acquisition activity, for optimal routing of traffic based on consumer speed, coverage needs, and unique remote sensing observations/data fusion.

The companies profiled in the article have been selected based in the stage they are in the market such as product portfolios, market penetration, research and development initiatives in the Small Launch Vehicle Market. : We invited the major players in the market and the companies that agreed to participate in a virtual executive roundtable include: Robert Sproles, CEO of Exolaunch; Christian Schmierer, CEO of Hyimpulse; and Morgan Connaughton, VP-Marketing Communications of Rocket Lab.

|

|

| Robert Sproles, CEO, Exolaunch |

Excerpts of the virtual roundtable follows:

Please provide a brief profile of your company and a current status of your launch service capabilities for the small and medium satellite market (LEO, MEO, Equatorial Orbit, and Lunar Orbit)?

Robert Sproles, Exolaunch: Exolaunch is a global leader in launch mission integration and satellite deployment technologies, with headquarters in Berlin, a fast-growing U.S. office in Denver, and expanding operations in Japan and France. With over a decade of flight heritage, we have successfully launched hundreds of satellites across 32 missions as of February 2025, supporting commercial, government, and institutional customers worldwide. Our multi-launch agreements with leading launch providers in the U.S. and internationally ensure frequent and flexible access to space. Exolaunch’s proprietary separation systems—including CarboNIX, EXOtube, Quadro, and EXOpod Nova—are trusted for their precision, seamless integration, and flight-proven reliability. We currently enable access to all Earth orbits (VLEO to GEO), with expansion into future lunar and deep space missions.

|

|

|

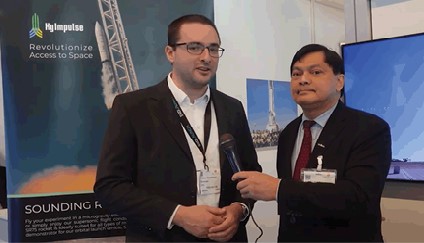

Christian Schmierer, CEO, Hyimpulse Technologies |

Christian Schmierer, Hyimpulse Technologies: HyImpulse is a German-based space transportation company founded in 2018, with a UK subsidiary. The company develops cost-effective, safe, and reliable launch services using proprietary hybrid propulsion technology, which reduces costs by 50 percent while improving safety and sustainability.

HyImpulse currently offers suborbital and orbital launch services, as well as in-space logistics solutions. The SR75 suborbital rocket became operational in May 2024, with its first launch in Australia. It supports microgravity research, hypersonic testing, and atmospheric studies. The SL1 small launcher, designed to carry payloads of up to 600 kilograms to low Earth orbit. The first SL1 flight is planned for end of 2026.

HyImpulse is also developing the HyMOVE Orbital Transfer Vehicle, an in-space logistics solution that enables last-mile payload delivery and hosted payload services. Commercial operations are expected to begin in 2027. The company is continuously expanding its capabilities to provide affordable, flexible, and sustainable access to space for the small and medium satellite market.

|

|

|

Morgan Connaughton VP-Marketing Communications Rocket Lab |

Morgan Connaughton, Rocket Lab: Rocket Lab is the global leader in small launch, and we are the second most prolific U.S. launch provider by number of rockets launched per year. Our Electron launch vehicle launches small satellites up to 300kg to LEO, MEO or Lunar orbits and has been in service since 2017. Our Neutron launch vehicle is designed for the medium lift market with a payload capacity of 13,000 kg and is tailored for large constellation deployments as well as national security and defense missions, plus exploration missions beyond Earth orbit. We also operate a variant of the Electron rocket called HASTE (Hypersonic Accelerator Suborbital Test Electron) which provides affordable and rapid hypersonic and suborbital test opportunities for the US DoD and its commercial partners.

Considering the rideshare market for launching small satellites, can you provide some information on how you are addressing the rideshare market at this time and in the future?

Exolaunch: Exolaunch is driving the evolution of the rideshare market by ensuring satellite operators have reliable, efficient, cost-effective, and flexible launch opportunities. Through our long-standing relationships with major launch providers, we secure dedicated rideshare capacity that allows customers to reach orbit on predictable schedules. Our mission management expertise and advanced deployment technologies optimize every aspect of rideshare integration, from payload accommodations to precise on-orbit deployment.

Additionally, as demand for rideshare launches accelerates, we are continuously innovating deployment solutions, expanding our integration capabilities, and reinforcing our global infrastructure to support the next generation of small satellite missions. For example, our latest innovation, EXOtube, is transforming rideshare missions by enabling modular, multi-level payload stacking. This universal adapter allows for maximum flexibility, accommodating a wide range of satellite sizes and configurations while maintaining seamless compatibility with all Exolaunch separation systems. Because EXOtube is fully launch vehicle-agnostic, it integrates effortlessly with small, medium, and heavy-lift rockets, unlocking new efficiencies for satellite operators.

Hyimpulse: The SL1 small launcher supports both dedicated small satellite launches and rideshare missions, allowing multiple payloads to share a single launch while benefiting from cost efficiencies.

|

|

| Rocket Lab's Electron Rocket. |

Beyond launch, HyImpulse is developing the HyMOVE Orbital Transfer Vehicle, which not only provides last-mile in-space transportation for satellites requiring custom orbital insertions but also serves as a platform for hosting multiple payloads. This capability enables extended mission operations, technology demonstrations, and hosted payload services for various customers.

RocketLab: Electron is sought after by customers seeking to deploy small satellite payloads to a precise orbit, on a tight or highly specific schedule, often with complex or tailored mission parameters such as orbit raising or multiple deployments to different orbits on the same mission. This level of flexibility is not possible on a large rideshare mission where you’re at the whim of the prime or simply being launched to a generic orbit on a schedule you don’t get to control. It’s why cost per kg is not an accurate measure on which to judge the competitiveness of Electron, as our customers are seeking a bespoke service, not necessarily the lowest cost ride.

Can you provide the number of launches that you have already done since you started the operations or when you are planning to start launch operations for the small and medium satellite market?

Exolaunch: Since our founding, Exolaunch has executed 32 missions, deploying nearly 500 satellites across multiple launch vehicles. With an increasing launch cadence, we are set to deliver a record number of missions over the next several years. As we scale operations, we are investing in expanded integration facilities, global logistics, and an accelerated U.S. hiring strategy to meet the growing demand for our services.

Hyimpulse: HyImpulse has successfully launched the SR75 suborbital rocket in May 2024, demonstrating its hybrid propulsion technology. The company is now advancing towards the first full-scale test flights of the SL1 small launcher, with commercial orbital launch operations planned to begin in 2026.

Rocket Lab: 60 Electron launches since the first launch in May 2017. Our medium lift Rocket, Neutron, is scheduled to make its debut later this year.

What differentiates your company and your offerings from your competitors?

|

|

| Exolaunch's EXOpod Nova. |

Exolaunch: Exolaunch stands out through our proven flight heritage, cutting-edge deployment technologies, global launch access, and unmatched mission expertise. Our industry-leading separation systems offer the highest levels of precision and reliability, making them the preferred choice for satellite operators worldwide. With our latest products like Quadro and EXOtube set to enter the market soon, we are even more capable of optimizing payload configurations for more efficient and adaptable rideshare launches.

Exolaunch handles every aspect of satellite integration in-house, including design, manufacturing and testing of our separation system hardware, ensuring mission success through a hands-on, end-to-end approach. Our deep expertise in mission planning, payload integration, and deployment logistics enables us to provide customers with seamless, customized launch solutions. Through multi-launch agreements with major providers, we secure regular and flexible launch access, giving customers a competitive advantage in reaching orbit on their terms.

Hyimpulse: HyImpulse differentiates itself through its hybrid propulsion technology, which is safer, more cost-effective, and environmentally friendly compared to traditional liquid and solid propulsion systems. Our paraffin-based hybrid engines simplify design, reduce infrastructure requirements, and eliminate many safety risks associated with conventional fuels. This allows us to offer launch prices at approximately half those of competitors, while maintaining financial sustainability.

A key advantage of HyImpulse is its pre-fueled, long-term storage capability, enabling rapid deployment without extensive ground support, allowing for a flexible and responsive launch solution.

While most companies continue to focus on incremental improvements to liquid propulsion, and competing with SpaceX, HyImpulse is taking a fundamentally different approach with hybrid propulsion, offering a disruptive and more efficient solution. This unique technology ensures our ability to compete effectively and sustainably. By focusing on innovation and leveraging the inherent strengths of hybrid propulsion, HyImpulse is positioned for long-term success as a leader in cost-effective and responsive launch services.

HyImpulse successfully launched their SR75 rocket from Southern Launch’s Koonibba Test Range in Australia on May 3, 2024.

HyImpulse has demonstrated exceptional capital efficiency by achieving the SR75 suborbital rocket launch in May 2024 with just €16 million in equity funding and a team of 55 employees. This achievement highlights our ability to develop and test advanced spaceflight technologies at a fraction of the cost compared to industry norms. While many competitors require hundreds of millions in investment to reach similar milestones, HyImpulse has proven that hybrid propulsion enables a faster, more cost-effective path to operational capability. This efficiency strengthens our ability to scale, innovate, and deliver competitive launch services while maintaining financial sustainability.

Rocket Lab: Electron has flown more than any other orbital small launch vehicle in history. It’s performance, cadence and reliability are unmatched. Electron also offers customers unmatched flexibility for launch location as we operate three launch pads across two hemispheres. Launch Complex 1 in New Zealand (2 pads) and Launch Complex 2 in Virginia (1 pad). Launch Complex 1 was the world’s first private orbital launch site, giving us exclusive use of it enabling us to avoid queues and delays at increasingly crowded shared launch sites used by multiple rockets and companies. Between the three pads we can support more than 130 launches per year. We have also demonstrated the ability to launch two missions within 24 hours from different pads in two hemispheres.

|

| You can also view a video interview by Satellite Markets and Research editor-in-Chief Virgil Labrador with Hyimpulse CEO Christian Schmeirer |

-----------------------------------------------

Bernardo Schneiderman is the Principal of Telematics Business Consultants. He can be reached at:

Bernardo Schneiderman is the Principal of Telematics Business Consultants. He can be reached at:

info@tbc-telematics.com