Executive Roundtable on the Small to Medium Satellite Manufacturing Market

By Bernardo Schneiderman

Los Angeles, Calif., January 15, 2025 - BryceTech announced the new edition of its annual Smallsats by the Numbers report. In 2023, a record number of 2,680 smallsats (≤1200kg) were launched, an 18% increase from 2022 and a 61% increase from 2021. Smallsat broadband megaconstellation operators dominated smallsat activity in 2023 and are continuing deployments in 2024.

The launch of large constellations will continue to influence smallsat activity over the next few years

More highlights from the report:

- 97% of all spacecraft launched in 2023 were smallsats

- Starlink & OneWeb satellites make up 64% of all smallsats launched since 2019

- 64 launches in 2023 carried smallsats

- 5% of smallsats launched on small/micro launch vehicles in 2023

- Between 2014 and 2023, China has deployed three more government smallsats than the United States

For this year’s report, BryceTech adjusted the definition of smallsats to include spacecraft up to 1,200 kg. This adjustment was made to accommodate the increasing mass of next-generation satellites, including Starlink.

At the Small Satellite Conference held in Logan. Utah last year, some of the key trends trends in the small satellite market were identified, including:

- Cost-effectiveness. Small satellites are a more economical alternative to larger satellites, which can be more expensive to manufacture, launch, and operate. This cost-efficiency is attracting a wider range of users, including government agencies, commercial companies, and academic institutions.

- High-throughput communication payloads. These payloads allow minisatellites to provide high-speed data transmission, which supports applications like broadband internet and secure communications.

- Multi-satellite constellations. These constellations increase coverage and redundancy, which ensures that service is available continuously.

- Low-cost satellites. Companies like Spire Global offer a range of low-cost satellites, including nanosatellites, which are used for low-cost remote sensing.

- Robotics and autonomous solutions. Companies like Maxar use sophisticated robotics and autonomous solutions to design and manufacture satellites

Gabriel Deville, senior consultant at Novaspace in a presentation during the Small Satellite Conference, said his company was forecasting 14,500 smallsats would launch into the next decade. The number of smallsats forecasted to launch in the next decade is declining as some satellites get heavier. Novaspace, defines smallsats as those weighing no more than 500 kg. Starlink’s is moving to heavier Satellites that number is down from the 23,000 forecasted a year ago by Novaspace.

SpaceX is continuing to deploy Starlink satellites, but the “V2 mini” spacecraft is weighed about 750 kg, that increase in mass is part of industry trend as operators seek to increase performance of their spacecraft, particularly those moving into large constellations as the case of Starlink Constellation. Gabriel mentioned that the average mass of smallsats launched in 2017 was just 19 kg (cubesat models), during 2023, the mass of smallsats grew to 199 kg.

The exhibtion had a large number of small satellite manufacturer presenting a range of sizes from Cubesat to small and medium Satellites and application range from broadband communications, radar, imaging (earth observation) and other sensing technologies. We cover some of the companies attending the show highlight their website and some of them provided some feedback to our questions.

The Satellite Executive Briefing (SEB) invite companies to participate in this virtual executive roundtable to provide an inside view on the small satellite marke. Among the companies we received feedback are: Gordon Wasilewski, Business Development Manager, Creotech Instruments; Andrew Swain, Business Development Manager, NanoAvionics (A Kongsberg Company); Carol Craig–CEO and Founder, Sidus Space; Alex da Silva Curiel, Business Development Manager, Surrey Satellite Technology, Ltd..

The responses to our questions follows:

Satellite Executive Briefing (SEB): Please provide a brief profile of your company and the current status of your product line and availability.

|

|

|

Creotech: Creotech Instruments is the Poland’s leading designer and manufacturer of satellite systems, subsystems and components, as well as advanced electronics for quantum computer and communication control systems and other applications. The company was founded in 2012 and has been listed on the Warsaw Stock Exchange since 2021. Creotech is involved in the design and production of custom-made electronics based on ECSS quality standards and as such was involved in multiple large science missions, like ExoMars, JUICE & Comet Interceptor, as well as commercial missions, with over 40 electronics subsystems launched. Most importantly, since 2017, the company develops microsatellite platforms based on proprietary HyperSat architecture and avionics. In 2024, using Transporter-11 Creotech launched Poland's largest satellite - EagleEye, a 60 kg EO satellite based on HyperSat Eagle bus. Creotech is currently working on several national and ESA missions, such as PIAST constellation, Lunar Mapper orbiter, Plasma Observatory constellation, and combined optical and radar constellations.

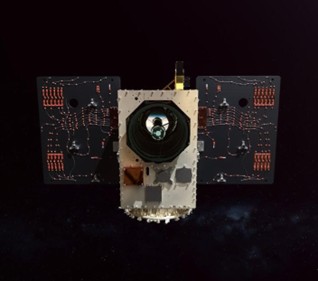

NanoAvionics: Kongsberg NanoAvionics is at the forefront of the New Space economy, specializing in the development and deployment of small satellite platforms. As a subsidiary of Kongsberg Defense and Aerospace, we leverage our extensive expertise to deliver robust, innovative, and reliable satellite solutions that accelerate our clients' missions.

Our product line centers around standardized small satellite platforms, including cubesats and microsatellites, which are designed for a variety of mission requirements and for payloads up to 100kg in mass. These platforms, with 21 ready-to-deploy configurations, are built for scalability, accommodating diverse payloads and mission objectives while ensuring cost efficiency, reduced mission risk, and faster production times. For our constellation customers, with specific mission requirements not matching any of the standard products, we provide custom-built satellites and serial manufacturing. In addition to our satellite platforms, we offer end-to-end mission services including payload integration, testing, launch support, and mission operations. This comprehensive approach allows our clients to focus on their core mission goals while we manage the complexities of satellite deployment and operation.

Our solutions are designed with flexibility in mind, offering clients the ability to start with smaller missions, such as In-Orbit Demonstrations (IOD), and scale up to full constellations as their needs evolve. This phased approach, combined with our global reach and robust support, enables us to cater to both emerging space startups and established industry leaders with equal efficiency.

|

|

|

Sidus Space: Sidus Space (NASDAQ: SIDU) is a multi-faceted Space Infrastructure as a Service satellite company based in Cape Canaveral, Florida, where it operates a 35,000-square-foot facility for manufacturing, assembly, integration, and testing. The company specializes in mission-critical hardware manufacturing, multi-disciplinary engineering services, satellite design, production, launch planning, mission operations, and in-orbit support. Sidus Space offers vertically integrated Space-as-a-Service solutions, including end-to-end satellite support.

Sidus Space's mission is "Bringing Space Down to Earth™" by enabling new technologies to gain space flight heritage status and delivering data and predictive analytics to customers worldwide. The company is more than just a Satellite-as-a-Service provider, with products and services offered through multiple business units:

- Space-as-a-Service: Comprehensive satellite services, including mission planning, launch, and operations.

- Space-Based Data Solutions: Providing analytics and data services for Earth observation and remote sensing.

- AI/ML Products and Services: Utilizing artificial intelligence and machine learning for enhanced data processing and analytics.

- Mission Planning and Management Operations: Expertise in planning and executing complex space missions.

- 3D Printing and Products/Services: Offering advanced manufacturing solutions for space and defense hardware.

- Satellite Manufacturing and Payload Integration: Full-service design, production, and integration for a range of satellite types and payloads.

- Space and Defense Hardware Manufacturing: Producing high-quality components for aerospace and defense industries.

SSTL: Surrey Satellite Technology Ltd. (“SSTL” or “Surrey”) was established in 1985 and is an experienced spacecraft manufacturer and operator based in Guildford. It specializes in small satellites, and has been wholly owned by Airbus Defense and Space since 2008. In today’s terminology it provides turn-key operational missions as “Spacecraft-as-a Service” and “Mission-as-a-Service” with its 400 skilled staff. It is vertically integrated, and manufactures entire spacecraft and small constellations, including the manufacture of the majority of sub-systems and payloads, and integrating and testing spacecraft. In addition, SSTL also has its own spacecraft operations center to bring spacecraft into operation. SSTL tends to serve all applications and customer types, and today SSTL it is building its 80th spacecraft.

SEB: Considering the market for small & medium satellites has can serve a wide variety of applications, what application are your main focus or the mix (ie. Communications, Imaging, Radar, etc.)

Creotech: In the space segment, Creotech is currently mainly involved in optical and radar Earth Observation (EO), as well as space weather applications and in orbit demonstrations.

|

|

|

NanoAvionics: Our company and satellite technology are payload-agnostic, meaning that we have hosted a wide variety of payloads since our inception and do not focus on a single application. We have launched nearly 50 missions covering communications, remote sensing, and fundamental research. However, we have observed increased interest and a growing customer base in the remote sensing category. This trend is partly due to advancements in our satellite buses, which are now capable of hosting more sophisticated instruments, as well as rapid developments in remote sensing technologies and the rising demand for Earth Observation (EO) data driven by geopolitical factors.

Our expertise particularly shines in remote sensing applications. The payloads our buses have hosted include meter-class resolution RGB imaging, UHD video livestreaming, multispectral and hyperspectral sensors, thermal infrared, SAR (Synthetic Aperture Radar), RF sensing, and more.

Sidus Space: Sidus Space is focused on several key satellite applications:

- Imaging: Utilizing state-of-the-art optical and infrared sensors for Earth observation, supporting sectors such as agriculture, urban planning, environmental monitoring, and disaster response.

- FeatherEdge™ Onboard Computing: Utilizes the FeatherEdge onboard computer, designed for real-time data processing and analytics in space.

- Custom Satellite Design and Manufacturing: Providing tailored satellite solutions to meet specific client needs, from initial design and payload integration to manufacturing and launch support.

- Other Applications: Supporting scientific research, technology demonstrations, and IoT connectivity to provide seamless data integration and insights.

SSTL: Although SSTL builds spacecraft for all applications using in-house payloads or hosted customer furnished payloads, we have strong in-house optical payload capability and many of our projects relate to Earth Observation missions including optical, hyperspectral, radar and infra-red imaging. SSTL is also building GNSS Reflectometry spacecraft for the European Space Agency to provide a science data service, built a Bringing into Use satellite for Telesat Lightspeed, and it is building a communications satellite as part of its own commercial initiative to provide lunar data relay services to a range of planned third party orbiters, landers and rovers. Recently demand for privately owned Earth Observation has increased significantly both with Enterprise and Government users around the world.

Demand for localized production or project specific batch production has also increased, and is something that we can also address well. For example, SSTL designed and built the first spacecraft for the TASA Formosat-7 spacecraft, with the remainder of the constellation being integrated and tested by the customer in their facility.

SEB: Describe what vertical application your satellite has more penetration (ie. Enterprise, Government or Defense) and can you provide some examples.

Creotech: Our current platform portfolio tackles both civilian, military and dual-use applications, with main customers located in Poland and Europe.

NanoAvionics: Currently, NanoAvionics has a customer split of approximately 80% commercial and 20% government, with the latter encompassing both civil and defense applications. However, a significant portion of our commercial customers deliver data or services to governments, which necessitates maintaining very high reliability standards.

While the smallsat demand from government and defense organizations is rapidly increasing, we anticipate a shift in this split over time. However, institutional programs tend to develop more slowly and do not translate into backlog as quickly as commercial ones.

We are an ideal partner for commercial constellation companies because we can guide them through the entire constellation development process—a service they highly value. This includes everything from demo missions to serial manufacturing and automated mission operations.

For defense customers, the highest security standards for sensitive information or classified missions are crucial, and we can meet these requirements by collaborating with our parent company, Kongsberg Defence and Aerospace.

|

|

| SSTL has teamed with SatVu in the UK to provide ground-breaking high-resolution thermal imaging capability in support of a range of applications. |

SSTL: was one of the first smallsat suppliers to support commercial Earth Observation missions such as RapidEye and ExactEarth, and pioneered novel models such as leased Earth Observation satellites and fractional ownership of small satellites and constellations. In the 2010-2020 period there was significant interest in Enterprise systems as commercial investment into space peaked, however more recently governments have also started taking note of the benefits of small satellite in providing affordable private and independent surveillance systems.

Hotsat-1 is a good example of a more recent Enterprise system where SSTL has teamed with SatVu in the UK to provide ground-breaking high-resolution thermal imaging capability in support of a range of applications.

Tyche is a good example of a Defense system for an SSTL satellite for operational service for UK Space Command, as small satellites provide the potential for private and priority service, and in groups can provide an affordable high-revisit satellite system.

In addition, SSTL also serves customers wanting to develop their own licenced satellite production. Examples of that include the Thai Space Agency GISTDA and Philippine space agency MULA with whom SSTL has developed the THEOS-2TS and MULA spacecraft, so that these organizations can use the technology for their own future science and technology and operational government missions.

------------------

Bernardo Schneiderman is the Principal of Telematics Business Consultants. He can be reached at:

Bernardo Schneiderman is the Principal of Telematics Business Consultants. He can be reached at: